Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 22 Apr, 2021

The recently concluded Auction 107 (C-Band) in the U.S. raked in over $81.11 billion or 94 cents per MHz/pop, shattering records for being the most expensive mid-band 5G spectrum auction locally and worldwide.

Click here to view the list of completed spectrum auctions (clients only). For upcoming spectrum auctions, click here.

Mobile industry experts worldwide have long advocated for a multi-band spectrum strategy for 5G deployment, ranging from traditional low- and mid-frequency bands to relatively newer high-capacity, high-frequency bands often called millimeter wave. Most pioneer 5G markets focused on mid-band spectrum, particularly the 3.5 GHz band, due to its good balance between coverage and capacity, but the U.S. took a different route and invested heavily in mmWave spectrum.

Years after the U.S. launched its first commercial 5G network using mmWave spectrum in October 2018, it has become clear that the world prefers mid-band spectrum for 5G for now. Only 10 out of 64 markets worldwide with commercial 5G services actively use mmWave spectrum as of January 2021. In contrast, at least 58 markets worldwide use mid-band spectrum, while 14 use low-band spectrum.

The U.S.'s insistence on using mmWave spectrum for 5G has left it isolated from the rest of the world, especially after 5G pioneers China, Europe and South Korea championed the use of mid-band spectrum.

The Federal Communications Commission and U.S. operators, however, seemed to have already warmed up to the idea of using mid-band spectrum after Auction 107 generated intense bidding and high prices.

"This auction reflects a shift in our nation's approach to 5G toward mid-band spectrum that can support fast, reliable and ubiquitous service that is competitive with our global peers," said Acting FCC Chairwoman Jessica Rosenworcel on Feb. 24, hinting at the geopolitical significance of the auction.

Mid-band spectrum (between 1 GHz and 6 GHz)

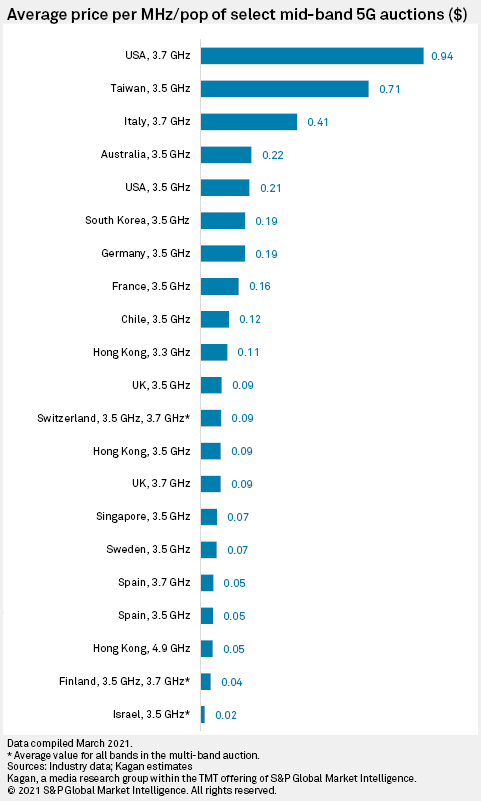

The U.S.'s Auction 107 (C-Band 3.7 GHz) emerged as the world's most expensive mid-band 5G spectrum auction in February 2021 at 94 cents per MHz/pop, inching above Taiwan's 71 cents per MHz/pop 3.5 GHz auction a year earlier.

Earning a total of $81.11 billion, Auction 107 is also the largest auction ever in the U.S. Verizon Communications Inc.'s Cellco Partnership was the biggest spender, shelling out $45.45 billion, followed by AT&T Inc. spending $23.41 billion and T-Mobile US Inc. spending $9.34 billion.

The importance of this auction is underscored by the fact that Verizon and AT&T had to take on significant debt for their bids. Aside from the desire to join the global mid-band 5G trend, low interest rates from the Federal Reserve's expansionary monetary policy in response to the ongoing pandemic-induced recession could have encouraged bidders to spend more.

Auction 105 (CBRS 3.5 GHz) earlier in August 2020 generated 21 cents per MHz/pop for a total auction value of $4.54 billion. This does not veer far away from the price of 3.5 GHz auctions in other markets such as Australia in December 2018 (22 cents MHz/pop), South Korea in June 2018 (19 cents MHz/pop) and Germany in June 2019 (19 cents MHz/pop).

The U.S. has two more planned mid-band auctions: Auction 108 (2.5 GHz) and Auction 110 (3.45 GHz).

The adoption of Dynamic Spectrum Sharing, or DSS, as a band-aid solution to canceled 5G auctions due to the pandemic also heightened interest in mid-band spectrum. The Netherlands, for example, tagged the 1.4 GHz and 2.1 GHz auction in July 2020 for 5G but local operators still look forward to using 3.5 GHz since it is the European standard band.

High-band spectrum (millimeter-wave bands above 24 GHz)

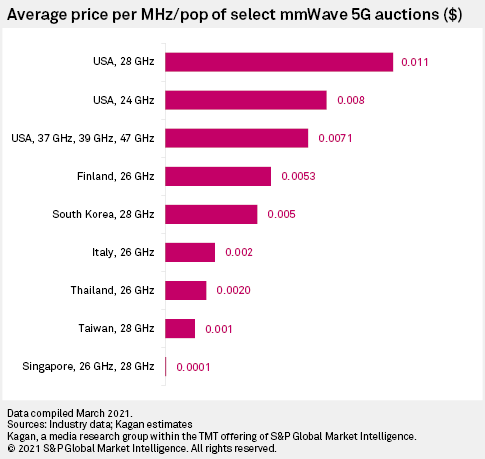

Interest in mmWave 5G spectrum remains thin compared to mid-band in the past year. In fact, several markets have opted to cancel mmWave auctions or simply award mmWave licenses for free due to little interest from operators, such as Brazil, Chile, Cyprus, Hong Kong, Poland and Russia.

Only two markets successfully auctioned mmWave spectrum in the past year: Finland with 26 GHz and Singapore with 26 GHz and 28 GHz, both in June 2020. In terms of price, however, the U.S.'s three recent mmWave auctions remain the priciest: Auction 101 (28 GHz) in January 2019 at 1.13 cents per MHz/pop, Auction 102 (24 GHz) in May 2019 at 0.80 cents and Auction 103 (37 GHz, 39 GHz, 47 GHz) in March 2020 at 0.71 cents.

Although mmWave spectrum could deliver ultrafast 5G throughput, its deployment entails the use of densely packed small cells, which is quite costly. For instance, South Korea auctioned 28 GHz spectrum way back in June 2018, yet operators only turned on their mmWave 5G network in December 2020, mainly due to concerns with power consumption. China, the world's largest 5G market, also has similar concerns and has not yet adopted mmWave 5G.

In our opinion, several prerequisites have to be established first before mmWave 5G becomes widespread, namely: high demand for mmWave-specific use cases, cost-effective deployment solutions and a mature global equipment and device ecosystem.

Low-band spectrum (below 1 GHz)

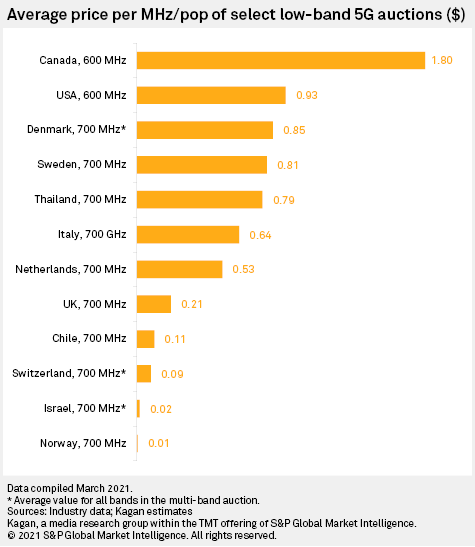

There was not much activity for low-band 5G spectrum due to canceled auctions last year. 700 MHz is still the most popular band due to its flexibility for use in both 5G and 4G. New additions since our last update include the Netherlands in July 2020, Chile in February 2021 and the United Kingdom in March 2021. Israel also auctioned 700 MHz in its multi-band auction in August 2020.

India tried to sell the 700 MHz in its multi-band 4G auction in March 2021, but operators placed no bids due to the expensive reserve price. This is the second time the 700 MHz went unsold in India.

Canada's 600 MHz auction in April 2019 remains the most expensive low-band 5G auction at $1.80 per MHz/pop, roughly double the U.S.'s Auction 1002 (600 MHz) in March 2017 at 93 cents per MHz/pop.

Wireless Investor is a regular feature from Kagan, a media market research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Research Article

Research Article