Mortgages held by US life insurers continued to climb to new heights through the first three months of 2024, aided by the largest single loan acquired by any domestic carrier in at least the last 15 years.

➤ US life insurers acquired $22.87 billion of mortgage loans in the first quarter of 2024, according to S&P Global Market Intelligence. While that marked a year-over-year increase of 49.8% from a particularly sluggish first three months of 2023, it was generally in line with the aggregate dollar value of industry acquisitions during the comparable periods from 2019 through 2021.

➤ The rate of increase would have been 8 percentage points lower in the absence of a landmark loan purchase by Security Benefit Life Insurance Co. According to the company's quarterly statement, it invested in a mezzanine loan with an affiliate in the amount of $1.22 billion, bearing interest at 13.32%. Due to the unusual size of the Security Benefit Life loan — it is by far the largest single loan acquired by a US life insurer in at least 15 years — and the associated interest rate, the weighted average rate on the mortgages acquired by US life insurers rose by 34 basis points to 7.31% from what otherwise would have been a level in line with the result for the year-earlier period.

➤ Aside from the one-time spike in mezzanine loans, the first quarter brought the continuation of emerging trends in the mix of mortgages acquired by US life insurers. Uninsured residential mortgages, which have served as a rapidly increasing area of focus for some US life insurers' investments, accounted for 35.6% of the aggregate dollar amount of acquisitions during the quarter, or 37.6% when excluding the impact of the outsized mezzanine loan. These results compare favorably to the 33.6% share recorded in full year 2023 and are well above historical levels, which had been in the single digits before 2020.

➤ While acquisitions of uninsured commercial mortgages soared by 42.3% year over year, that growth rate came off of what was the slowest period for activity within that category in any quarter in 12 years. Loans on office properties remained out of favor as the industry continued to focus on multifamily as well as industrial properties, which include warehouses and other logistics facilities. The Mortgage Bankers of Association's Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations shows that the life industry's strength helped to partially offset sluggish activity among depositories.

Acquisitions surge but allocation holds steady

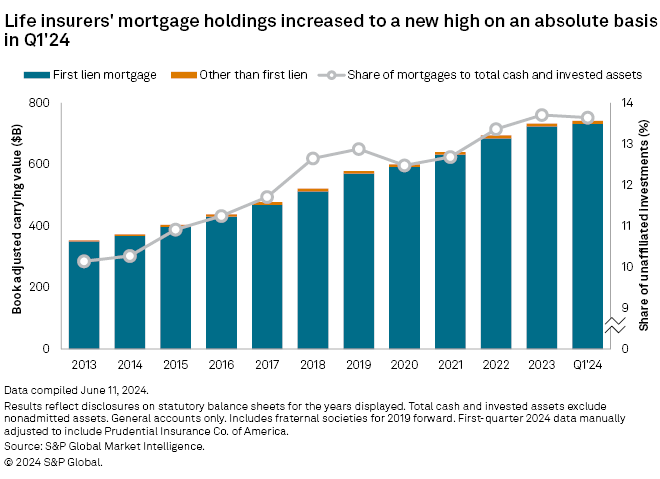

Mortgage loans held by US life insurers hit a new high of $741.51 billion as of March 31, up from $732.94 billion at year-end 2023, reflecting the impact of higher loan acquisitions and additional investments netted against an increase in amounts received from loan disposals. While the March 31 tally represented a new high on an absolute dollar basis, the ratio of mortgages to net admitted cash and invested assets slipped slightly to 13.64% from 13.70% during that three-month period, reflecting more rapid growth in select other asset classes.

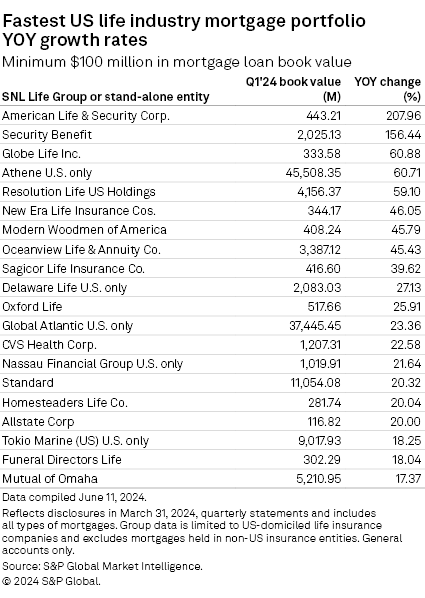

The sharp year-over-year growth in the US life industry's mortgage acquisitions reflected broad-based increases by various insurers. Among the 25 US life groups with the largest amount of first-quarter 2024 mortgage acquisitions as measured by aggregate actual cost (excluding Prudential Financial Inc.), 20 showed higher levels of activity on a year-over-year basis, with 11 more than doubling their purchases.

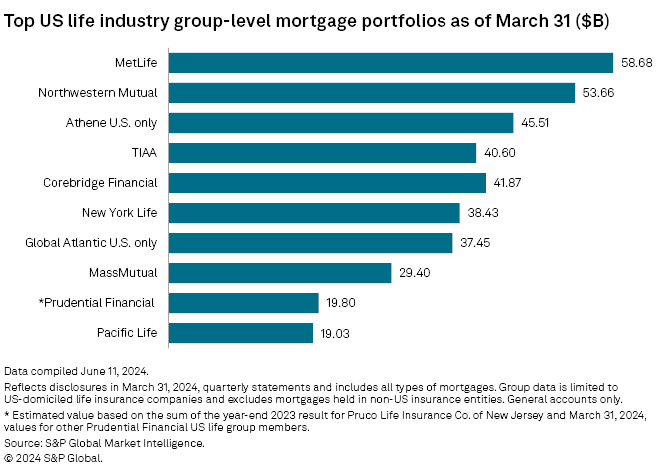

The US life units of the Apollo Global Management Inc.-backed Athene Holding Ltd. led the industry with mortgage acquisitions totaling $4.77 billion, an increase of 101.3% from the first quarter of 2023. The KKR & Co. Inc.-backed Global Atlantic Financial Group Ltd. placed second as its $2.39 billion of mortgage acquisitions marked an expansion of 88.6%. These two groups also were largely responsible for the industry's mix shift as residential mortgages accounted for 61.7% of their combined acquisitions relative to 23.3% for the rest of the industry. However, like the industry as a whole, the relative size of both Athene's and Global Atlantic's mortgage portfolios within their respective US subsidiaries was incrementally smaller as of March 31 than on Dec. 31, 2023.

Athene Annuity and Life Co. accounted for five of the US life industry's seven largest loan acquisitions during the first quarter with mortgages ranging in size from $146.0 million to $210.2 million on a range of commercial property types. Based on a proprietary cross-referencing of information provided in the insurer's quarterly statement with S&P Capital IQ Pro's Commercial Prospecting dataset, the acquisitions appear to include a $153.5 million mortgage backed by various SROA Capital LLC self-storage facilities, such as a location in Newburgh, Ind.

Beverly Hills, that's where I want to be

The combined value of Athene Annuity and Life's five-largest first-quarter loans still fell well short of the Security Benefit Life mezzanine loan purchase, a transaction that had a significant impact on the company's relative allocations across asset classes.

The absolute value of the company's mortgage holdings surged by 156.2% sequentially, and mortgages accounted for 4.2% of its net admitted cash and invested assets as of March 31 versus 1.7% three months prior. Security Benefit Life's year-end 2023 Supplemental Investment Risks Interrogatories section of its annual statement showed that the company's largest exposure to a single issuer, borrower or investment was a Cain Re LLC bond valued at $801.2 million, or 1.7% of its total general account assets.

Cain Re and Cain International LP are indirect parents of OBH Holdco LLC, the affiliated entity with which Security Benefit Life entered the $1.22 billion mezzanine loan. Cain International is an investment firm focused on real estate credit, equity and experiential businesses. All of the entities are ultimately controlled by Eldridge Industries LLC Chairman and CEO Todd Boehly.

The insurer's quarterly statement did not provide details about the property underlying the loan. However, a review of Beverly Hills, Calif., city records finds that OBH Holdco subsidiary BH Luxury Residences LLC and affiliate Oasis West Realty LLC are developing in partnership with a site currently containing the Beverly Hilton Hotel and the Waldorf-Astoria Beverly Hills into a residential and commercial mixed-use property called One Beverly Hills.

The nature and size of the loan are without recent precedent in the US life industry. It ranks as the largest single mortgage loan acquired by a US life insurer since at least the start of 2009, easily surpassing Massachusetts Mutual Life Insurance Co.'s August 2013 $761.8 million addition of the majority of an $832 million loan on a Chicago office property. It will stand as the largest single mortgage currently held by a US life insurer at well over 2x the value of the loan that held that mantle at year-end 2023: a $550 million Teachers Insurance & Annuity Association of America (TIAA) mortgage on a Washington, D.C., apartment building. The S&P Capital IQ Pro commercial prospecting data suggests the loan is backed by a 13-story property now known as Insignia on M.

Further, it would have been 6.4x greater in value than the largest single mezzanine loan held as of year-end 2023 by a US life insurer: a $191.3 million TIAA investment. Security Benefit Life's total mezzanine loan holdings of $1.58 billion, assuming the combination of the $1.22 billion loan and preexisting holdings, would rank second only to TIAA on an absolute dollar value basis. Relative to total general account assets, Security Benefit Life's pro forma mezzanine loan position of 3.2% would surpass year-end 2023 leader Tokio Marine Holdings Inc.'s Reliance Standard Life Insurance Co. That company joined the primary subsidiary of Jackson Financial Inc. as the lone US life entity with mezzanine loan holdings of more than 1% of total general account assets.

Efforts to obtain additional background from Security Benefit were not successful.

Incremental deterioration in asset quality

First-quarter data did not assuage continued concerns about commercial real estate valuations and prospects nor did it provide cause for alarm. As of March 31, based on disclosures on the general interrogatories section of quarterly statements, more than 99.5% of the uninsured commercial mortgages held by US life insurers were classified as being in good standing, which is broadly defined as being current, past due by less than 90 days or not in the process of foreclosure.

Reliance Standard accounted for 26.3% of the industry's $1.84 billion of commercial mortgage loans 90-plus days past due but not in the process of foreclosure. TIAA ranked second on that basis, with 22.2% of the industry total. Reliance Standard also showed $95.8 million in commercial mortgages in the process of foreclosure and reported that it had transferred a $41.6 million commercial mortgage on a Houston property to real estate-owned after foreclosing on it during the first quarter.

Note 5 of quarterly statements provides more granular mortgage loan asset quality data, and Reliance Standard was one of the more than five dozen individual life insurers that populated that section of their March 31 filings. On that basis, 98.1% of filers' uninsured commercial mortgages were reported as current, with the remaining 1.9% 30-plus days past due. The most significant increases in delinquencies occurred in the later stages of 90 to 179 days and 180 days or more when comparing Note 5 disclosures for the current and prior years.

Across all loan types, the mortgage valuation allowance rose to $1.66 billion, or 0.22% of the sum of total mortgage book value and the allowance, from $1.42 billion, or 0.19% at year-end 2023. The relative size of the allowance peaked during the global financial crisis at year-end 2009 at 0.42%.

There was a negative change in unrealized valuations of $140.1 million, compared with a negative change of $120.2 million in the first quarter of 2023.

Methodology

This report relies on the combination of consolidated disclosures on the balance sheets and Schedule B - Verification pages of US life insurers' annual and quarterly statements as filed with the National Association of Insurance Commissioners, as well as loan-level disclosures on Schedule B.

Aggregates reflect data obtained through June 11, including the manual addition of data for Prudential Financial Inc.'s The Prudential Insurance Company of America, except where noted.

Loan acquisitions reflect disclosures by individual life entities and reflect legal ownership of the underlying assets, gross of the impact of any applicable modified coinsurance relationships. In some cases, participation in the acquired loans may be spread among group members. Acquisitions include but are not limited to newly originated loans.

Aggregates and percentages will change as additional information is received, though we do not anticipate they will deviate materially from the values contained in this article. Due to the adjustments discussed above, they will not match the US Life Industry aggregates displayed on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.