Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 26 Apr, 2023

By Zuhaib Gull and Gaby Villaluz

This article is a part of the worldwide bank ranking series. The world's largest 100 banks, 2023 Asia-Pacific's 50 largest banks by assets, 2023 Latin America and the Caribbean's 50 largest banks by assets, 2023 The Middle East and Africa's 30 largest banks by assets, 2023 |

Click here to view the latest 2024 edition of this article.

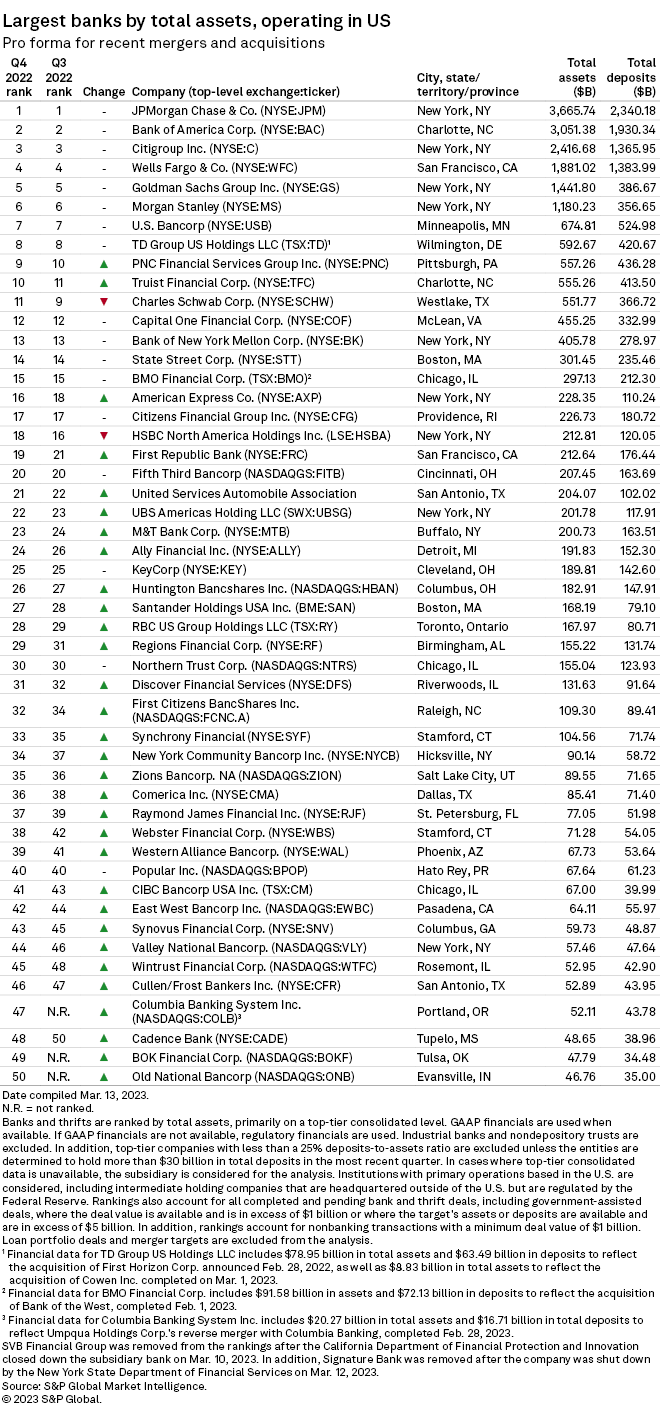

The majority of the largest U.S. banks and thrifts reported asset growth in the fourth quarter of 2022 despite expectations for a recession, slower loan growth and tightening underwriting standards.

Of the 50 largest U.S. banks and thrifts, 32 reported a sequential increase in total assets, according to S&P Global Market Intelligence data.

About this analysis

To conduct this analysis, S&P Global Market Intelligence examined the largest U.S. banks and thrifts by assets with a deposits-to-assets ratio of at least 25% or at least $30 billion in deposits as of quarter-end.

To compile a pro forma ranking, S&P Global Market Intelligence calculates pro forma assets after accounting for pending M&A transactions as well as transactions that closed after quarter-end. To be included in pro forma adjustments, the deal value must be over $1 billion or involve assets or deposits in excess of $5 billion. Loan portfolio deals are not included because of a general lack of data on both deal consideration and the impact on total assets.

Combined assets of 'Big 4' drop

Aggregate assets of the "Big 4" U.S. banks declined by a total $90.84 billion, or 0.8%, in the fourth quarter of 2022, led by a 2.9% drop at JPMorgan Chase & Co. and a 0.7% drop at Bank of America Corp.

Collectively, the country's top 10 banks shed $240.55 billion in assets during the period.

Majority of banks with assets of $50 billion to $500 billion report growth

Of the 36 banks with assets between $50 billion and $500 billion, 25 reported asset growth during the fourth quarter of 2022.

BOK Financial Corp. recorded the highest growth rate among the top 50 banks, with assets having gone up 9.5% from the previous quarter, while Discover Financial Services posted the second-highest rate of increase at 8.0%.

HSBC North America Holdings Inc. reported the largest percentage decrease at 7.9%, falling down from 16th spot last quarter to No. 18 at the end of 2022.

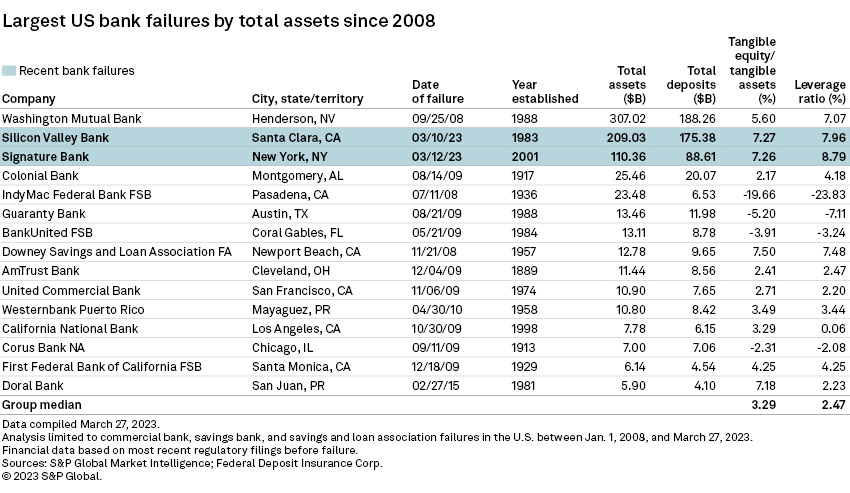

Largest US bank failures

SVB Financial Group, which took the 19th spot last quarter, was kicked off the list after California's financial regulator, the Department of Financial Protection and Innovation, took possession of its bank unit, Santa Clara, Calif.-based Silicon Valley Bank, on March 10, citing inadequate liquidity and insolvency. Silicon Valley Bank had total assets of roughly $209.03 billion at the end of 2022, making it the second-largest U.S. bank failure ever.

In addition, Signature Bank, which was No. 33 in the previous quarter, was also removed from the list after the New York Department of Financial Services took possession of the New York-based bank two days after SVB's failure. Signature bank had total assets of roughly $110.36 billion as of Dec. 31, 2022, which makes it the third-largest bank failure in U.S. history.

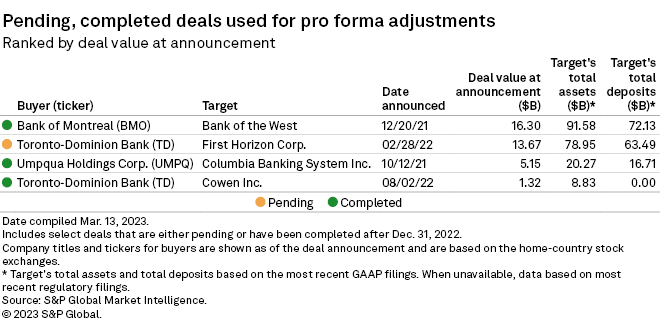

Bank of Montreal, Umpqua Holdings, Toronto-Dominion Bank close deals

On Feb. 1, Chicago-based BMO Harris Bank NA, a subsidiary of Bank of Montreal, completed its acquisition of San Francisco-based Bank of the West from BNP Paribas SA. BMO Financial Corp.'s assets were adjusted $91.58 billion higher to reflect the acquisition.

The assets of Tacoma, Wash.-based Columbia Banking System Inc. were adjusted higher by $20.27 billion to account for its merger with Portland, Ore.-based Umpqua Holdings Corp. The merger closed Feb. 28.

Assets of Toronto-Dominion Bank's subsidiary, TD Group US Holdings LLC, were adjusted higher by $8.83 billion to reflect the acquisition of Cowen Inc., which closed March 1, and by $78.95 billion to account for the pending acquisition of First Horizon Corp.

M&A outlook

According to S&P Global Market Intelligence's 2023 U.S. Bank Outlook Survey, some U.S. banking executives are still bullish on M&A, even as rising interest rates push unrealized losses in banks' securities portfolios higher and heightened regulatory scrutiny dampens the attractiveness of large deals.