Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 26 Apr, 2023

By Zia Khan, Harry Terris, Ben Meggeson, and Mohammad Taqi

This article is a part of the worldwide bank ranking series. Europe's 50 largest banks by assets, 2023 Asia-Pacific's 50 largest banks by assets, 2023 Latin America and the Caribbean's 50 largest banks by assets, 2023 The Middle East and Africa's 30 largest banks by assets, 2023 |

Click here to view the latest 2024 edition of this article.

Chinese banks extended their dominance as the world's largest lenders in 2022, bucking declines in balance sheets among global peers amid rate hikes and slowing economic growth.

The number of Chinese banks in S&P Global Market Intelligence's ranking of the world's 100 largest banks by assets rose to 20, from 19 in 2021, after Bank of Ningbo Co. Ltd. joined the list at No. 89. The country's largest banks continued to hold the top four slots.

Aggregate assets rose 2.4% at the 19 Chinese banks that appeared on both years' lists. The four largest Chinese banks expanded their assets 4.1% to $19.871 trillion from $19.081 trillion in the 12 months ended Dec. 31, 2022. Agricultural Bank of China Ltd. led the big four's gains with a 7.5% increase.

Total assets at the eight Japanese lenders on the list shrank 8.8% in 2022, while assets at the 11 ranked US banks fell 0.4%, Market Intelligence data shows.

Last year was "a tumultuous year of shocks and growing uncertainty," according to McKinsey's Global Banking Annual Review published in December 2022. "Banks rebounded from the pandemic with strong revenue growth, but the context has changed dramatically. Now a series of interrelated shocks — some geopolitical and others lingering economic and social effects of the pandemic — are exacerbating fragilities."

About this analysis

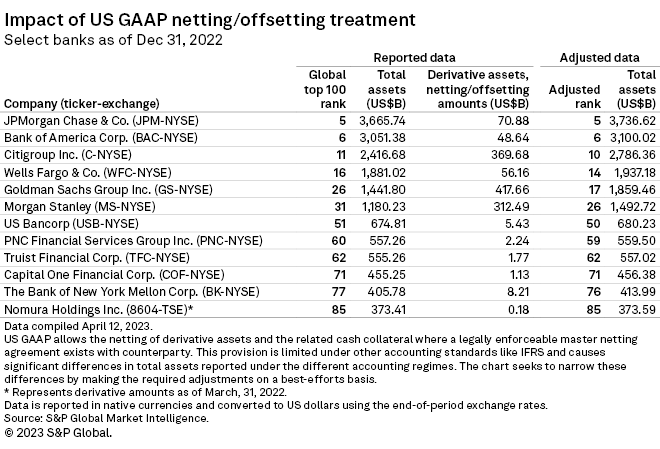

For the latest ranking, company assets were adjusted on a best-effort basis for pending mergers, acquisitions and divestitures, as well as M&A deals that closed after the end of the reporting period through March 31. Assets reported by non-US dollar filers were converted to dollars using period-end exchange rates. Total assets were taken on an "as-reported" basis, and no adjustments were made to account for differing accounting standards. The majority of the banks were ranked by total assets as of Dec. 31, 2022. In the previous ranking published April 12, 2022, most company assets were as of Dec. 31, 2021, and were adjusted for pending and completed M&A as of March 31, 2022.

Inflation, war

High inflation, interest rate hikes and the Russia-Ukraine war damped global economic growth and investor sentiment in 2022. Assets held by the 100 largest banks as of the end of 2022 totaled $111.965 trillion, down 1.5% from $113.674 trillion a year earlier.

Chinese lenders were not immune to these pressures as aggregate lending growth eased to 11.1% in 2022 from 11.6% in 2021, according to data from the nation's central bank. Still, that pace was far stronger than in most parts of the world as the People's Bank of China maintained an easing bias while most major central banks, led by the US Federal Reserve, raised rates sharply to counter decades-high inflation. The biggest climber on the list was UBS Group AG, which surged to 20th place from 34th in 2021. Its $1.608 trillion asset size has been adjusted to incorporate troubled Credit Suisse Group AG, which UBS agreed to take over in an emergency deal orchestrated by the Swiss authorities in March. UBS expects to wind down noncore activities over the coming three to four years, including parts of Credit Suisse's investment bank.

The tie-up put UBS ahead of French banks Groupe BPCE and Société Générale SA, which both fell one place to 21st and 22nd. Deutsche Bank AG dropped to 27th place from 22nd. The German lender's risk-weighted assets decreased 13% in 2022 as it worked through a long-running restructuring and de-risking process.

Eurozone banks may face constrained asset growth this year, as European Central Bank Vice President Luis de Guindos said March 26 that recent concerns about bank liquidity are likely to prompt a tightening of credit standards.

Asia-Pacific on the rise

The total number of Asia-Pacific lenders on the list rose to 43 from 41 with Macquarie Group Ltd. joining Bank of Ningbo as a new entrant. The Australian lender ranked 97th, claiming one of the slots vacated by US and European banks.

In total, 22 Asia-Pacific banks' rankings rose in 2022, 14 fell and seven were unchanged. Ten Chinese banks posted increases, the highest number in the region. There were declines for seven of the eight Japanese banks.

Deposit outflows shrink US banks

US banks generally suffered asset declines in 2022 as tighter monetary policy prompted customers to withdraw deposits built up during the pandemic. The decline in cash and securities outweighed strong loan growth, which was fueled by high inflation and a healthy economy.

The trends applied to the 11 US banks among the world's 100 largest and to the nation's lenders as a whole.

The 2022 deposit outflows proved to be a prelude to a liquidity crunch that emerged in March and risks restraining lending. US banks were already reporting tightening loan standards over recession fears at the end of last year.

U.S. Bancorp was a notable riser in the rankings, jumping nine spots to 51st place. Its assets increased 17.7%, helped by the acquisition of much of Mitsubishi UFJ Financial Group Inc.'s US operations. The purchase is part of a string of large cross-border deals including overseas lenders selling US businesses and Canadian banks expanding in the US.