S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 31 Aug, 2022

By Ronald Cecil

Highlights

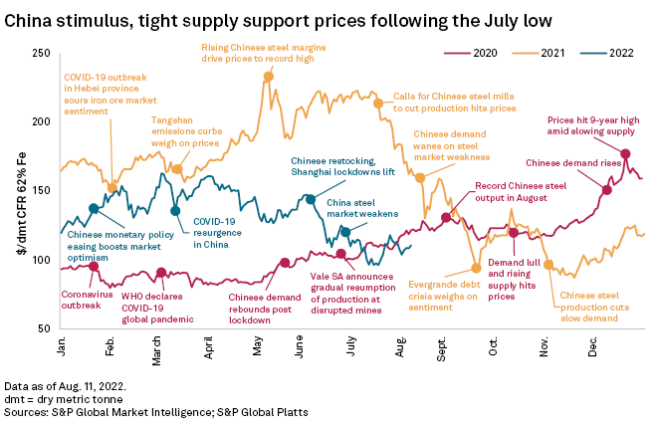

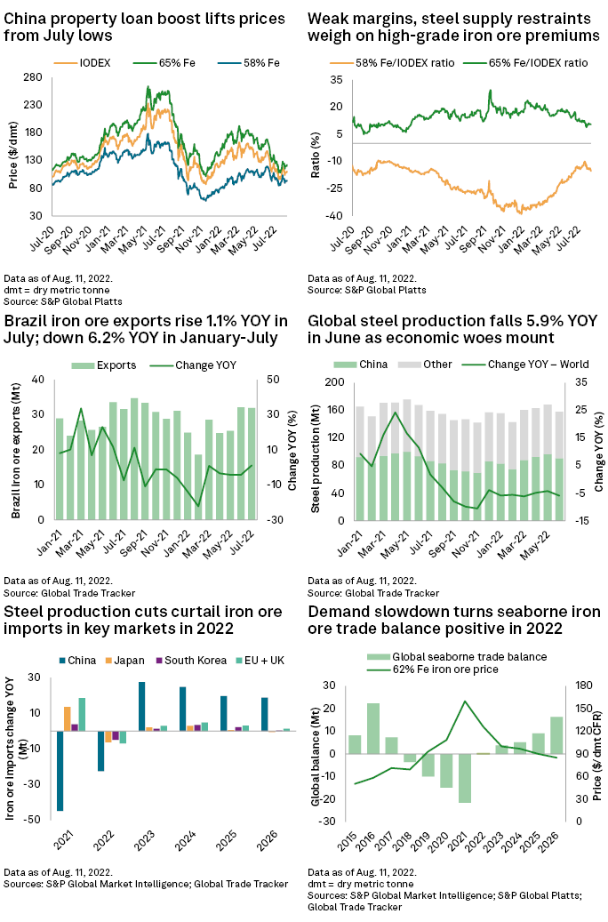

The S&P Global Platts IODEX 62% Fe iron ore price tumbled to an eight-month low of $96.40 per tonne July 21 on sluggish demand, before climbing to $117.95/t July 28 on potential financial support for China's ailing property sector. The price recovery proved fleeting, however, with the index falling to $108.85/t on Aug. 12 as sentiment soured as a result of the slowing global economy.

The beleaguered property sector in China remains a major cause for concern, with new housing project starts and land sales plunging in June. The government is reportedly planning to launch a 300 billion yuan, or about $44.5 billion, real estate fund to resolve the debt crisis affecting domestic property developers.

S&P Global Commodity Insights discusses the iron ore market within the broader macroeconomic environment and provides supply, demand and price forecasts for a rolling five-year period.

Key Findings

* The S&P Global Platts IODEX 62% Fe iron ore price tumbled to an eight-month low of $96.40 per tonne July 21 on sluggish demand, before climbing to $117.95/t July 28 on potential financial support for China's ailing property sector. The price recovery proved fleeting, however, with the index falling to $108.85/t on Aug. 12 as sentiment soured as a result of the slowing global economy.

* The beleaguered property sector in China remains a major cause for concern, with new housing project starts and land sales plunging in June. The government is reportedly planning to launch a 300 billion yuan, or about $44.5 billion, real estate fund to resolve the debt crisis affecting domestic property developers.

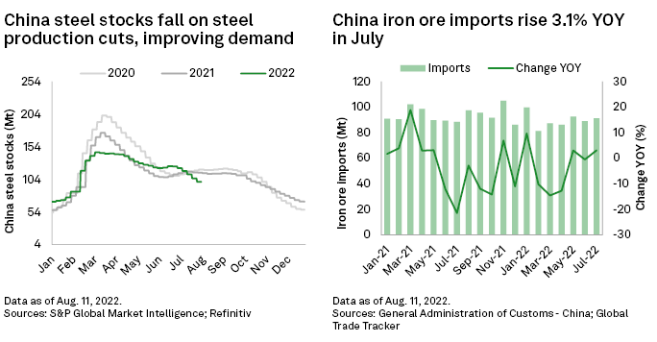

* China's steel market is showing signs of recovery. Domestic mill margins turned positive from late July and steel inventories fell to 100.1 million tonnes in early August. But these improvements have been largely due to continued restraints in domestic steel production; demand has remained lackluster overall.

* Chinese steel production dropped by 36 Mt year over year in the January-June period to 526.8 Mt. On the other hand, iron ore imports rose 3.1% year over year in July, edging up month over month to 91.2 Mt. A slowdown in off-take, however, resulted in portside iron ore stocks climbing to 135.0 Mt in early August.

* Brazil's iron ore exports continued to labor, slipping to 31.9 Mt in July, with January-July shipments down 12.2 Mt year over year at 186.2 Mt. Vale SA downgraded production guidance for 2022 to between 310 Mt and 320 Mt. Australia's iron ore exports ticked 1.0% higher year over year to 430.1 Mt in the January-June period.

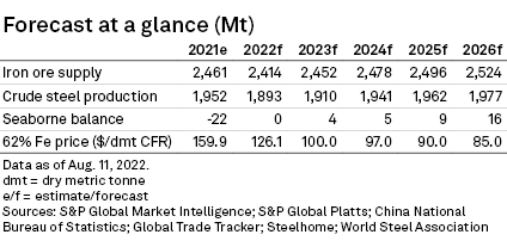

* The slowing global economy is expected to subdue ex-China iron ore demand in the second half, although we expect Chinese iron ore imports to rally on the back of recent stimulus incentives for the economy. Despite downgrades to our forecast growth for seaborne iron ore exports, we now expect a modest surplus in the global trade balance in 2022. We have maintained our forecast price to average $110.0/t and $115.0/t in the September and December quarters, respectively, but have lowered our projected 2023 annual average to $100.0/t.

For S&P Capital IQ Pro Metals & Mining users only, access the Iron Ore Commodity Briefing Service August 2022 Databook.

After dropping to an eight-month low in July, iron ore prices have headed back above $100.0/t in August, spurred by news of possible financial support for China's indebted property sector and a modest improvement in Chinese steel mill profitability. The upside for prices has been tempered, however, by market concerns around the slowing global economy and continued Chinese steel production restraints. Year-to-date data has prompted us to downgrade our forecasts for steel output and iron ore imports. Yet the promise of a multibillion-dollar, infrastructure-focused stimulus from the Chinese government should have positive implications for domestic iron ore and steel demand in the months ahead. Tightness in global iron ore supply is expected to provide support for prices. Recent indications from key miners are that they are mindful of the weakening demand trend and are likely to keep a tight rein on supply. Despite forecasting a looser seaborne iron ore trade balance, we have nevertheless maintained our price forecast for the second half; we reduced the 2023 price forecast to $100.0/t.

Analyst comment

Iron ore prices have been volatile, with the IODEX 62% Fe iron ore benchmark dropping to an eight-month low of $96.40/t July 21 on weak demand, before rallying to $117.95/t July 28 on improved steel mill profitability and proposed support for China's ailing property sector. Optimism soon waned, however, pulling prices back to $108.85/t on Aug. 12 as the global economic slowdown threatens to weigh on iron ore demand in the coming months.

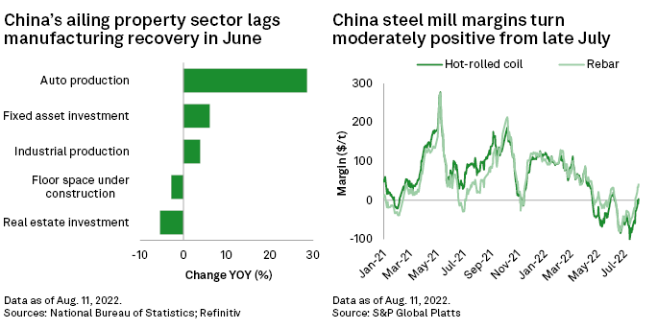

There are mixed signals regarding the health of China's economy. A depressed property sector continues to subdue domestic steel demand, with negative growth trends accelerating for both real estate investment and floor space under construction in June, which fell 5.4% and 2.8% year over year, respectively. Property developers have slowed construction, with land sales and new housing project starts in June plunging 65.0% and 45.0% year over year, respectively. Recent government initiatives to alleviate the stressed sector include further loans to beleaguered property developers, along with plans to launch a 300 billion yuan real estate fund to resolve the debt crisis.

China's manufacturing sector shows signs of improvement, benefiting from the loosening of COVID-19-related lockdown restrictions. Auto sales rose 20.1% in July from a year ago, while industrial production in June grew 3.9% year over year, the highest rate in three months. Steel mill profit margins turned positive toward the end of July, largely due to restraints in domestic steel production. Daily production dropped to 1.89 Mt in late July, 7.3% lower than mid-July, according to the China Iron and Steel Association. This follows a 6.5%, or 36.6 Mt, year-over-year decline in domestic steel output in the first half of 2022. The supply curbs have reduced steel inventories, which dropped to 100.1 Mt in early August.

China's iron ore imports edged higher month over month to 91.2 Mt in July, marking a 3.1% rise from a year ago. Higher imports and sluggish off-take helped lift iron ore portside stocks to 135.5 Mt in early August, from 128.3 Mt in mid-July. However, with Chinese imports falling by 22.7 Mt year over year in the January-July period, we downgraded our forecast for 2022 to 1,103.1 Mt, 2.0% lower than for 2021. The slowing global economy and cuts to steel output have also prompted downward revisions to our 2022 forecasts for iron ore imports in Europe, Japan and South Korea, with a combined 17.9 Mt year-over-year fall expected.

Tight supply has helped support iron ore prices. Brazil's iron ore exports declined 6.2%, or 12.2 Mt, year over year in the first seven months of this year, hampered by wet weather and persisting constraints at Vale's Northern System mines. As a result, the company lowered its 2022 production guidance to between 310 Mt and 320 Mt, compared with a previous target of between 320 Mt and 335 Mt. In response, we reduced our forecast for Brazilian exports to 350.1 Mt, from the previously expected 365.1 Mt. Australia's iron ore shipments edged 1.0% higher year over year in the first half, reaching 430.1 Mt. Prompted by the deteriorating global demand outlook, we moderately reduced our forecast for Australian exports to 881.8 Mt in 2022. In contrast, we slightly upgraded our 2022 export forecasts for India and Ukraine to 24.0 Mt and 30.2 Mt, respectively, based on stronger first-half shipments, albeit these estimates are still down 32.0% and 32.7% year over year, respectively.

Outlook

The deteriorating global economy, along with expectations for further interest-rate hikes in the U.S. and Europe to combat inflation have impacted global steel production, which fell 3.5% year over year in May and was 6.3%, or 52.9 Mt, lower year over year in January-May. The steel production downturn is weighing on ex-China iron ore imports, which we forecast to fall 2.1% in 2022, with Japan and Europe dropping 3.4 Mt and 4.9 Mt year over year, respectively.

In response to the gloomy economic outlook and its impact on global iron ore imports, we reduced our forecast for the global seaborne trade deficit to 5 Mt in 2022, from a previously expected 10 Mt. The loosening trade balance also reflects expectations for stronger growth in seaborne iron ore supply in the second half. Following the recent price correction, we downgraded our iron ore price forecast to average $110.00/t in the September quarter and $115.00/t in the December quarter. Iron ore prices will receive some support from stronger Chinese demand in the second half, aided by a multibillion-dollar infrastructure support program.

Key Indicators

S&P Global Platts is an offering of S&P Global Commodity Insights. S&P Global Commodity Insights is owned by S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Campaign

Webinar

Blog

Location

Products & Offerings