S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 27 Jul, 2022

By Neil Barbour

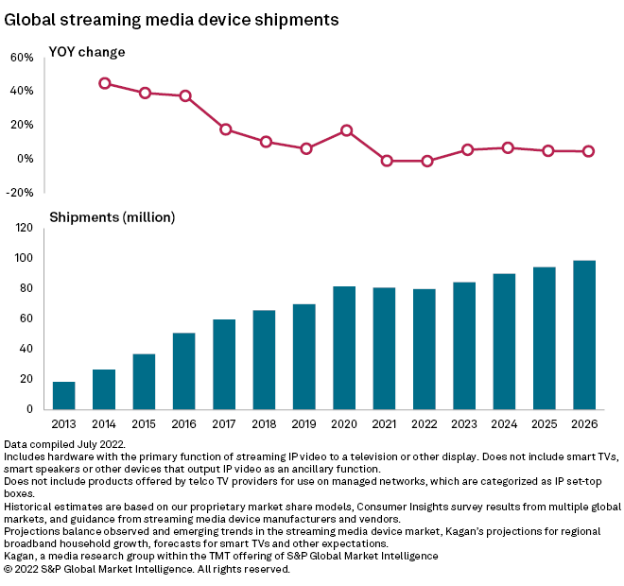

Global streaming media device shipments are expected to fall 1.2% to an estimated 80.0 million units in 2022 as inflationary pressures keep many consumers on the sidelines, according to Kagan, a media research group within S&P Global Market Intelligence.

Key highlights from the analysis include:

* This analysis includes streaming media players, such as Apple TV, and streaming media sticks, such as Amazon’s Fire TV. This analysis does not include smart TVs, smart speakers, game consoles or other devices with ancillary video streaming functions.

Campaign

Blog

Research