Although projects and drillholes increased month-over-month in February, year-over-year metrics were down, with projects and drillholes down 14% and 8%, respectively, compared to February 2023. Drilling increased at late-stage and minesite projects in February, with late-stage increasing 1% to 122 projects and minesite projects up 33% to 65 projects, while early-stage projects dropped 1% to 109.

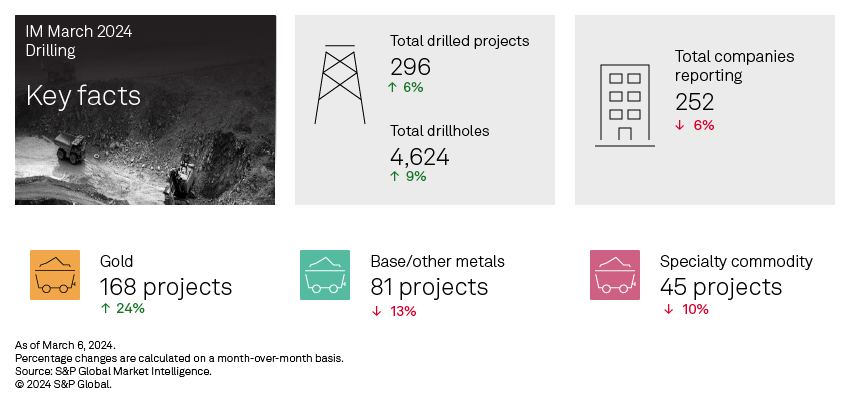

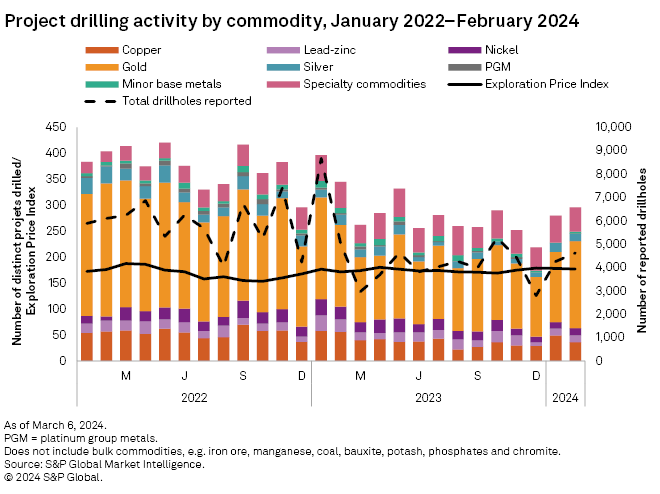

Projects reporting drilling rose for the second consecutive month, up 6% in February, mostly due to a 24% increase in gold projects. Nickel, platinum group metals and minor base metals increased slightly, lead-zinc projects stayed constant month-over-month, and copper, silver and specialty metals fell. Drillholes reported also increased in February, up 9% overall. Copper, gold, platinum group metals, specialty metals and minor base metals were all up, while silver, lead-zinc and nickel dropped.

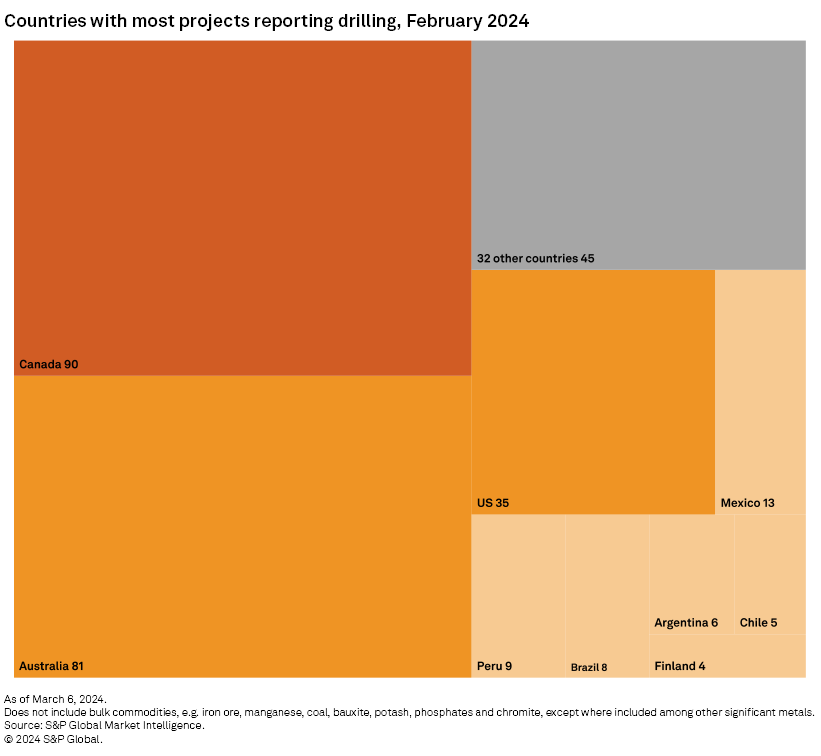

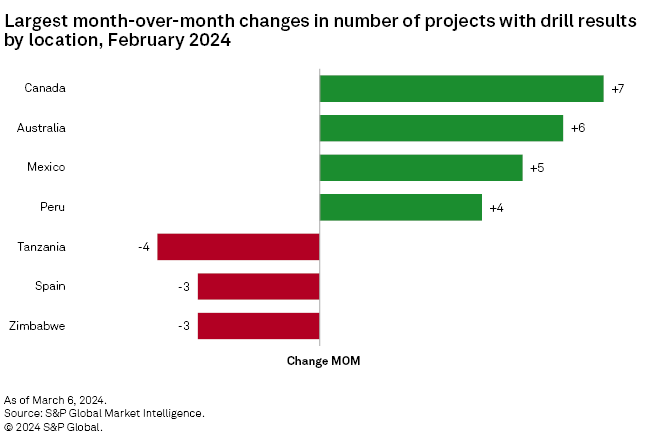

For the second month in a row, Canada held the top spot for countries drilling, increasing 8% to 90 projects. Australia also increased 8%, reaching 81 projects, but failed to retake the lead, and the US increased by just one project to 35 reporting in February.

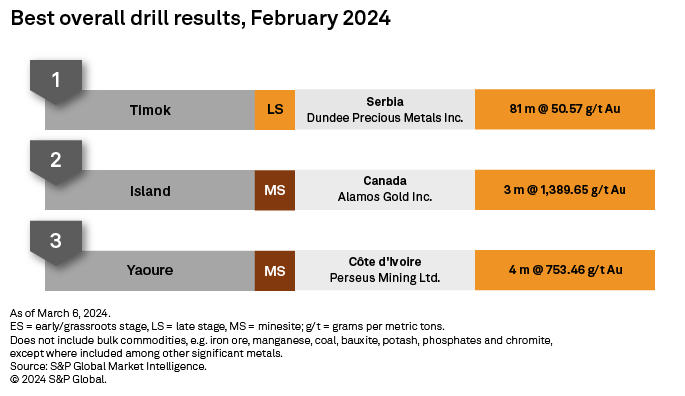

February's top result came from Toronto Stock Exchange-listed Dundee Precious Metals Inc.'s Timok gold project in Serbia, which reported an intersect of 81.0 meters grading 50.57 grams per metric ton of gold. The company recently announced an inferred mineral resource estimate of 1.8 million ounces of gold, as well as positive results from a scout drilling project at two prospects north of the main deposit of Timok.

TSX-listed Alamos Gold Inc.'s Island gold mine in Ontario turned in February's second-best result. The company reported an intersect of 2.90 meters grading 1,389.65 g/t Au from outside the existing Mineral Reserves & Resources. Several hanging wall and footwall structures adjacent to the known mineralization have been drilled, with results expected to extend the high-grade mineralization zone at the deposit and add near-mine R&R, which would be low-cost to develop.

Australian Securities Exchange-listed Perseus Mining Ltd.'s Yaoure gold mine in Côte d'Ivoire rounds out the top three results. The company announced an update from ongoing exploration activities at the mine, including a highlight of 4.0 m grading 753.46 g/t Au from Yaoure's open pit. The ongoing drilling aims to expand the open pit operations and add confidence to the deposit's underground mineral resource.

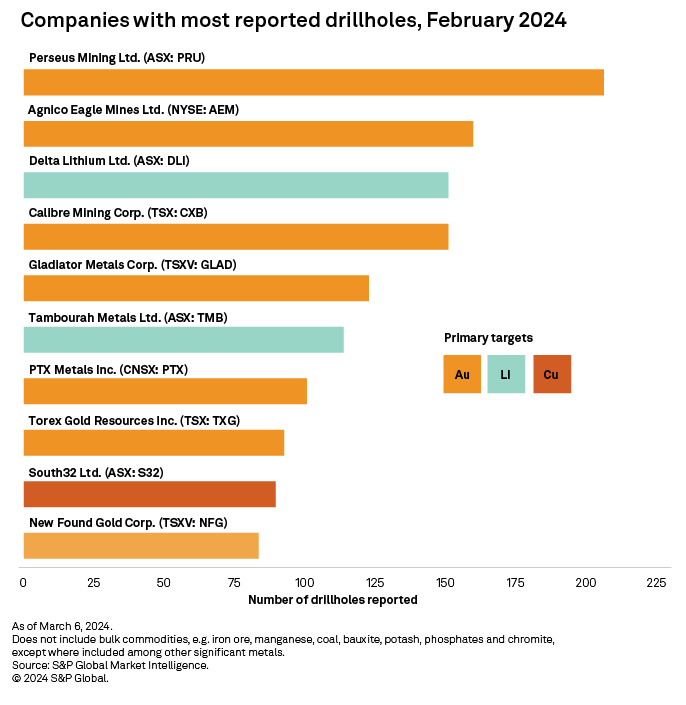

Perseus Mining Inc. also reported the most drillholes in February, with 205 holes between its two operating gold mines in Côte d'Ivoire, Yaoure and Sissingue. At Sissingue, the company's exploration program aims to identify mineral extensions that can extend mine life.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.