Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 17 Apr, 2024

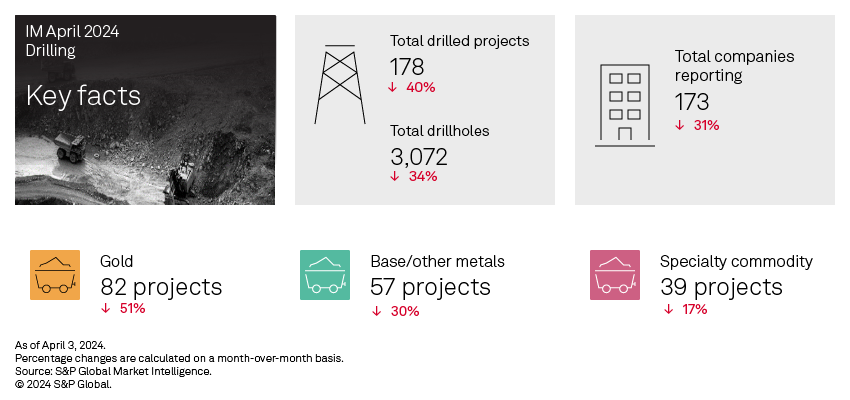

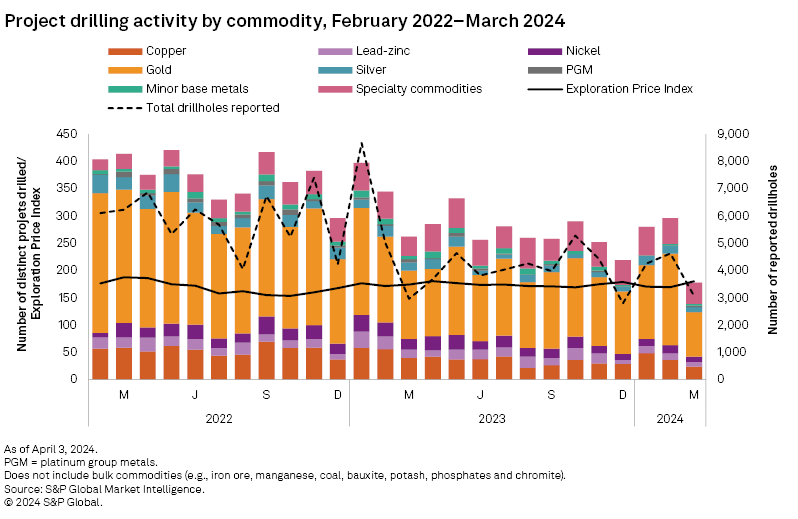

With a strong start to 2024 drilling in January and February, the slump in all drilling metrics in March is a disappointment. Projects drilled were down 40% to 178, the lowest since May 2020, while drillholes were down 34% compared to February. Drilling decreased at all project stages, with late-stage falling 44% to 68, minesite dropping 43% to 37 and early-stage drilling dropping 33% to 73 projects.

Access March drill results data in the accompanying Excel spreadsheet.

After seeing a 24% increase in gold projects drilling in February, the metal took a nosedive in March, plummeting 51% month over month to 82 projects, the lowest reported since May 2016. With this in mind, it is easy to see why projects drilled dropped 40% month over month. The only metals group with an increase in projects was platinum group metals, which increased by two projects, and minor base metals remained constant with three projects, while all other metals decreased. Drillholes reported also decreased in March across all metals except PGM and specialty metals, with silver drillholes remaining unchanged month over month.

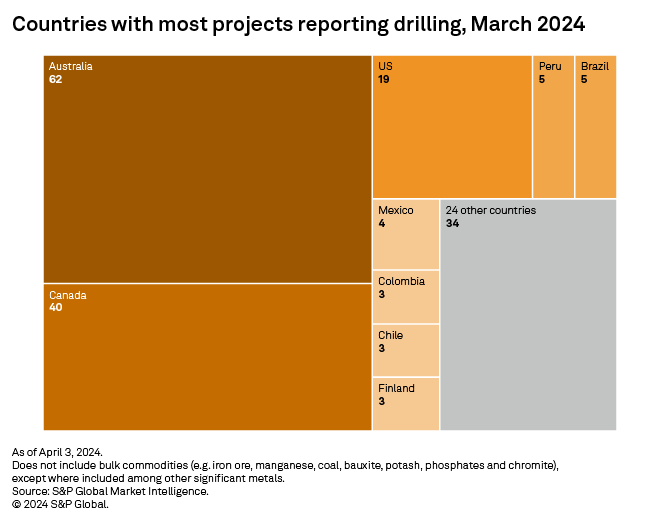

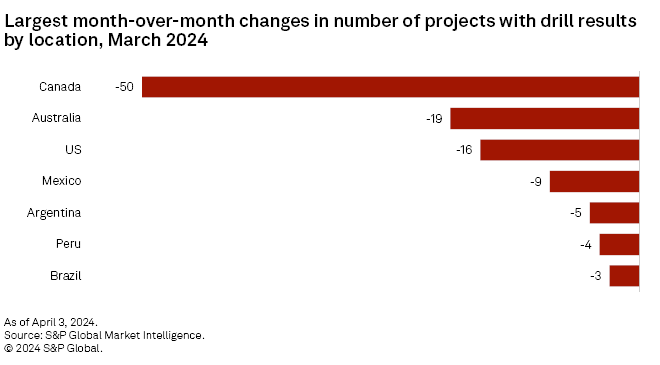

The top three countries for drilling also saw the largest month-over-month decreases in March, all reaching lows not seen since 2020. Australian projects dropped 24% to 62, while Canadian projects dropped 56% to 40 projects reporting drilling. The US also saw a substantial decrease, down 46% to 19 projects reporting drilling in March.

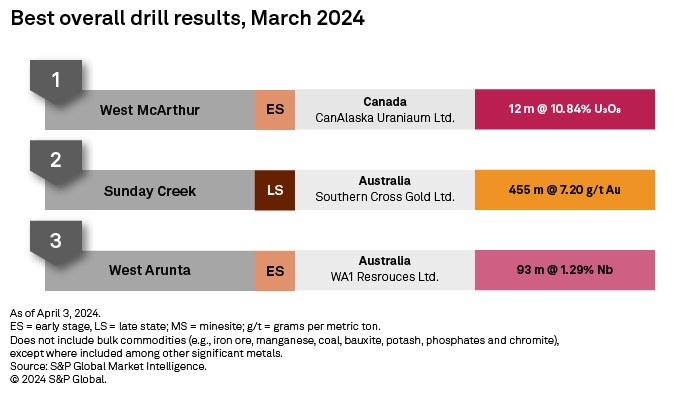

March's top result came from Toronto Stock Exchange-listed CanAlaska Uranium Ltd.'s West McArthur uranium project in Saskatchewan, which reported an intersect of 11.5 meters grading 10.84% uranium. Encouraging results from the winter drill program indicate that the high-grade mineralization zone continues, and the company hopes to expand it when drilling resumes in June. The project is a joint venture with Cameco Corp.; CanAlaska holds 83.35% ownership and solely funds the 2024 drill program.

Australian Securities Exchange-listed Southern Cross Gold Ltd.'s Sunday Creek gold project in Victoria turned in March's second-best result. The company reported its best hole drilled to date at the project, with an intersect of 455.3 meters grading 7.20 grams per metric ton of gold. The intersect contains a high-grade section of gold-antimony mineralization of 1.0 meters grading 2,318 g/t Au. The company hopes to expand the footprint of the mineralized system as the drill program continues.

ASX-listed WA1 Resources Ltd.'s West Arunta multi-metal project in Western Australia rounds out the top three results, with a 93-meter intersect grading 1.29% niobium. Drilling continues at the Luni prospect within West Arunta, and the company is expected to release an initial Mineral Resource estimate in the June quarter.

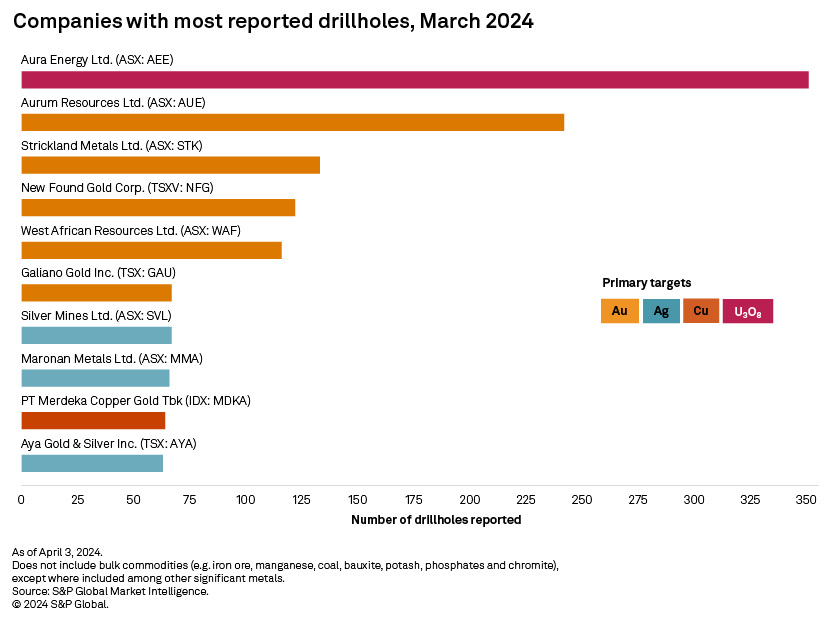

ASX-listed Aura Energy Ltd. reported the most drillholes in March, with 351 holes drilled at its Tiris uranium project in Mauritania. In March, the company announced it had received commitments of A$16.2 million from investors to advance the Tiris project. The company also reports that it will release an updated Mineral Resource estimate in the June quarter.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.