S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 23 Aug, 2023

By Ruilin Wang

In the monthly Commodity Briefing Service (CBS) report, S&P Global Commodity Insights discusses the copper market within the broader macroeconomic environment and provides rolling five-year supply, demand and price forecasts.

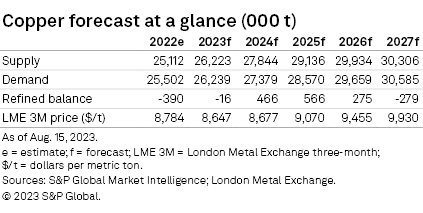

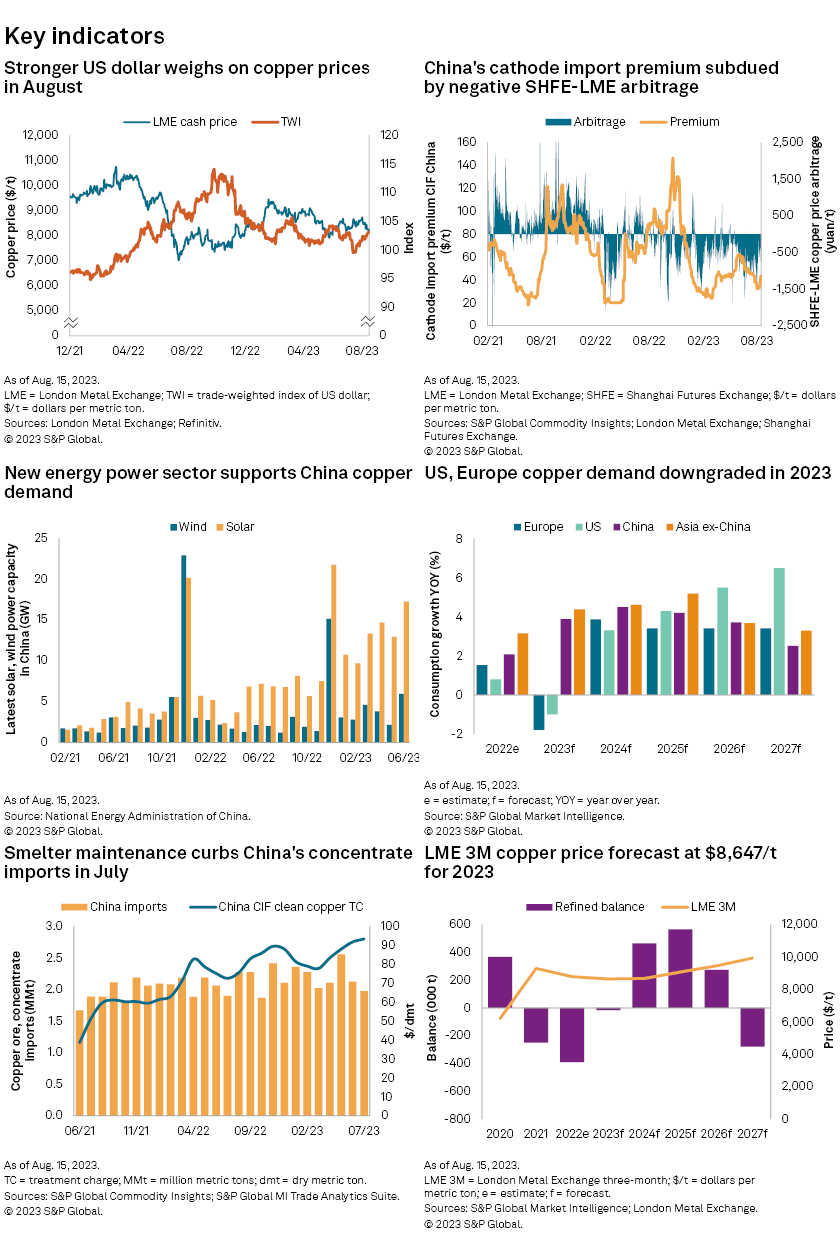

➤ The London Metal Exchange three-month (LME 3M) copper price climbed from $8,449 per metric ton July 21 to $8,768/t Aug. 1, buoyed by the prospect of further stimulus for China's beleaguered property sector. Prices fell over the first half of August, however, to $8,182/t Aug. 15, weighed by weak Chinese economic data and a stronger US dollar.

➤ The past month has witnessed several large copper mining companies cut their 2023 full-year production guidance due to operational challenges and project delays. This has prompted us to reduce our 2023 forecast for annual copper mine production by 359,601 metric tons to 22.97 million metric tons. Downgrades are mostly for mines in Chile and Zambia.

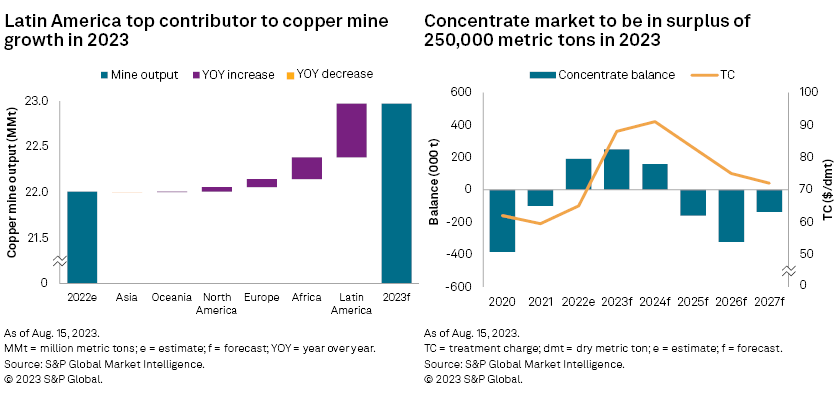

➤ There has been no significant change to our forecast of the copper concentrate market balance in 2023, however. A projected market surplus of 250,000 metric tons is only 29,000 metric tons down from our July forecast, and stems from lower forecast smelter production notably in Chile and Zambia, and several other countries including Bulgaria and the US.

➤ A heavy period of maintenance activity for Chinese smelters ended in late July, resulting in higher copper cathode production in August. Domestic copper demand was resilient despite seasonal weakness, however, which has prevented stocks in China from increasing to date.

➤ Outside China, copper cathode stocks accumulated sharply over the past month under pressure from weakening demand. We have downgraded our 2023 forecast copper consumption in the US and Europe to year-over-year falls of 1.0% and 1.8%, respectively.

➤ We have also downgraded our LME 3M average copper price forecast for the December quarter to $8,616/t from $8,850/t previously, taking into consideration the possibility of a large amount of cathode inflows into the Chinese market. It might prove difficult for China's downstream sectors to fully digest these inflows despite seasonally strong copper consumption being expected.

Analyst comment

The LME 3M copper price climbed from $8,449/t July 21 to $8,768/t Aug. 1, with sentiment buoyed by the removal of the phrase "Housing is for living, not for speculation" for the first time in five years in the statement released after China's Politburo meeting 24 July, raising the prospect of further measures to boost property sales. The price then fell 5.1% to $8,325/t Aug. 8, however, weighed by weak inflation and trade data in China, and a firmer US dollar. The sharp decline in the copper price attracted a pickup in cathode purchases, lifting the LME 3M copper price to $8,465/t Aug. 10, but the release of weaker-than-expected data for new bank loans in July added to concerns about China's deflationary pressure, driving prices down to $8,182/t Aug. 15.

The past month has witnessed several large copper mining companies cutting their 2023 full-year production guidance due to operational challenges and project delays. This has prompted us to reduce our 2023 forecast for annual copper mine production by 359,601 metric tons to 22.97 million metric tons. The biggest downgrade is in Chile, with copper production forecast at 5.4 MMt this year, down from 5.6 MMt predicted previously and similar to the 10-year low in 2022, according to data from the Chilean Copper Commission. Teck Resources Ltd.'s Quebrada Blanca mine produced less than 5,000 metric tons in the first half of 2023 because of bad weather leading to construction and commissioning delays of its QB2 project. Its annual output is now forecast at 80,000–100,000 metric tons of copper, down from a previous guidance of 150,000–180,000 metric tons. Due to strong increases in Peru and Brazil in the year to date, Latin America remains the top contributor to copper mine growth in 2023.

We have also substantially cut back our copper mine production estimate in Zambia, partly due to persistently low mining activity at the Mufulira, Nkana and Konkola copper mines, with properties hampered by financial difficulties because of dwindling capital injection.

The supply downgrades have not changed our forecast copper concentrate market balance in 2023 significantly, however. Our projected concentrate surplus of 250,000 metric tons is only 29,000 metric tons below our previous estimate in July, as our forecast smelter production is also lowered in Chile and Zambia, and several other countries. In the US, the Garfield smelter rebuild is expected to be completed in September, one month later than expected. In Bulgaria, we have factored in a production loss of around 40,000 metric tons due to a planned 40-day maintenance shutdown at Aurubis AG's Pirdop (MDK) smelter during the June quarter.

A heavy period of maintenance activity for Chinese smelters ended in late July, resulting in higher copper cathode production in China in August. Increasing demand for copper concentrate has lowered the spot market concentrate treatment charge from $95.10 per dry metric ton 31 July to $92.2/dmt Aug. 15, as assessed by Platts. Meanwhile, a recent rise in Collahuasi's arsenic content has led to concerns over lower supply of clean concentrate from the mine, which also put downward pressure on spot treatment charges. That said, further decreases are likely to be limited in impact in an already well-supplied global concentrate market. Additionally, concentrate exports from Indonesia have resumed, as PT Freeport Indonesia and PT Amman Mineral Nusa Tenggara secured their new export licenses, valid from July 24, 2023, through to May 31, 2024.

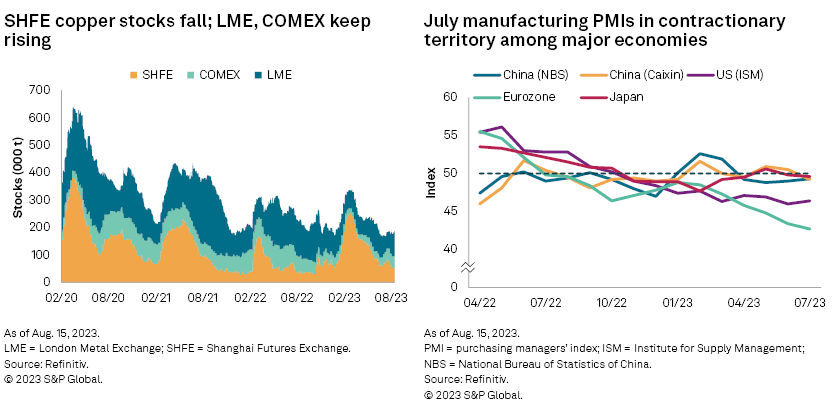

High domestic cathode supply pressure has been partly relieved by continued exports from several Chinese smelters, and lower-than-expected cathode imports in a negative import arbitrage. Meanwhile, cathode deliveries from Democratic Republic of Congo have been lower than anticipated, caused by disruptions to transportation within Africa. Most importantly, robust Chinese domestic copper demand — in traditionally a weak season — has prevented stocks in China from increasing to date. Copper wire rod production has remained higher than the corresponding period in 2022, thanks to robust demand from the solar power generation, power grid, infrastructure and electric vehicle sectors. In July, both the State Grid and China Southern Power Grid put in new orders, contributing to strengthening operating rates at wire and cable plants in August.

Outside China, however, copper cathode stocks have accumulated sharply over the past month under pressure from weakening demand. Inventories in LME warehouses have increased 52.3% month over month to 90,150 metric tons Aug. 14, while COMEX copper stocks are up 5.8%. Manufacturing purchasing managers' indexes (PMIs) in Europe slumped further to 42.7, with copper semifabricators experiencing strong operating contraction and a sharp fall in new orders. The absence of cathode output from Boliden AB (publ)'s Ronnskar refinery in Sweden failed to push up spot premiums in an oversupplied market. In the US, the Institute for Supply Management manufacturing PMI stayed in contractionary territory despite inching up to 46.4 in July. US copper plants had a moderate decrease in orders, which could result in weaker operating conditions in August.

Outlook

We have downgraded our forecast 2023 copper consumption in the US and Europe to year-over-year falls of 1.0% and 1.8%, respectively. US copper consumption is likely to weaken in the reminder of the year under high interest rates. In Europe, manufacturing activity could bottom out in September or October but then remain sluggish in the December quarter. This is expected to result in a further buildup of cathode stocks outside China, putting increasing downward pressure on copper prices.

We expect the September quarter average LME 3M copper price to stay firm at $8,531/t as the Chinese market still has low copper inventory and is going to enter a peak demand season in September. In addition, there is the potential for China's government to release further economic support measures to perk up growth following a recent flurry of weak data signifying a faltering economic recovery.

We have become bearish about copper prices in the December quarter, however, on the expectation of a large amount of cathode inflows into the Chinese market. Chinese copper consumption is usually strong in the quarter — supported by intensive orders from the grid sector for annual target fulfillment, and higher copper tube consumption for manufacturing air-conditioning units. It will be difficult for Chinese copper demand to be strong enough to absorb higher imports, however. Hence although an expected weaker US dollar could support prices, we have still downgraded our forecast LME 3M average copper price for the December quarter to $8,616/t from $8,850/t previously.

Platts Clean Copper Concentrate CIF China Treatment Charge $/mt is an offering of S&P Global Commodity Insights. S&P Global Commodity Insights is a division of S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

RESEARCH

RESEARCH