Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 19 Jul, 2023

Publicis Groupe SA took the lead among the big four advertising groups in revenue terms, reporting a 7.1% organic net revenue growth in the first quarter of 2023. WPP PLC's net revenue growth hit 2.9%, while The Interpublic Group of Cos. Inc. (IPG) saw organic net revenues decline for the first time since 2020 by 0.2%. Omnicom Group Inc., which reports gross revenues, experienced a 5.2% growth. Following a strong year in 2022, with cyclical events such as the World Cup boosting ad spend, 2023 will see revenues slow down due to continued economic uncertainty and the lack of headline events.

➤ Publicis exceeded expectations in terms of organic net revenue growth, while IPG's rate was negative for the first time since 2020.

➤ Agencies were negatively impacted by technology clients decreasing ad spend in light of uncertainty in the industry and cost cuts.

➤ The rise of generative AI creates new opportunities for ad companies to develop ideas and provide a faster starting point for brainstorming, pitches and new campaigns. There are still concerns over accuracy, data privacy, copyright and legislation, as well as the fear of personnel replacement.

➤ The big four ad agencies have already established partnerships with major AI platforms, which, integrated with their own data, provide faster creation of high-value content in line with each client's brand image.

Yet, Publicis managed to exceed expectations in the first quarter of the year, recording a 7.1% organic net revenue growth, following an even stronger first quarter in 2022 with 10.5%. The company experienced double-digit growth in both Europe and Latin America, while organic growth in North America stood at 5.7%, and Asia-Pacific was almost flat. The company benefited from past investments in data and tech capabilities, as Epsilon and Publicis Sapient continue to be key growth drivers, recording 10% and 11% organic revenue growth, respectively. Europe's 12.3% organic net revenue growth is attributed to the 24% rise in the UK and 10.4% in Germany, accounting for 9% and 3%, respectively, of the group's total revenues. The company was not immune to certain budget declines. Like its peers, it saw revenues from the tech, media and telecom sector fall 7% year over year as the tech industry faces its own turmoil, focusing on cost-cutting and improving efficiencies. While overall performance was stronger than expected, Publicis maintained its full-year forecast at 3% to 5%, expecting a slowdown in the second half of the year.

WPP's organic revenues rose 2.9% year over year. It also performed strongly in the UK and Europe, accounting for a third of the company's total revenues. In the UK, revenues increased 7.4% organically and 3.4% in Western Europe. In North America, organic revenues rose 1.9%, a slowdown from the 8.7% seen a year ago and equal to the rate in the rest of the world. The slowdown was partly due to a 0.6% decrease in spending by tech and digital services clients and a 5.8% drop in retail clients. The company similarly expects 3% to 5% organic growth for the full year.

IPG had forecast its 0.2% negative organic growth for the first quarter during its 2022 earnings call due to its strong performance in the first quarter of 2022, with net revenue growth of 19.8%, the strongest among the four quarters of that year. As a result, the company has kept its full-year forecast of 2% to 4% for 2023. Beyond high comps, IPG was impacted by weak performance in the tech industry, which is the second-largest client sector, accounting for 15% of the company's billable revenues. Current uncertainty in the tech sector has made major advertisers reduce ad budgets for the foreseeable future. The negative growth stemmed from negative performance in the US, which accounts for 67.6% of total revenues, as well as Continental Europe and Asia-Pacific. Asia-Pacific had organic revenues decline 2.6% in the first quarter, driven down by the performance in the major markets of India, China and Japan, but partially offset by positive results in Australia and New Zealand. In continental Europe, organic revenues fell 4.0% due to weak performance in Spain and Portugal, despite stronger performances in Germany and France.

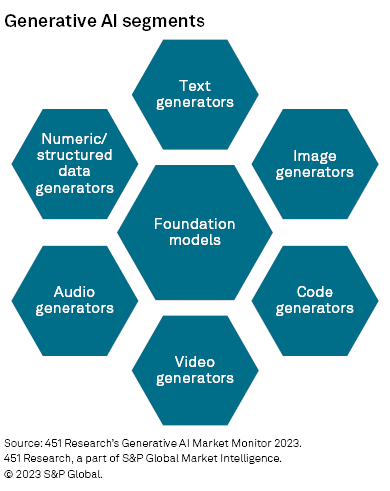

The focus during the earnings calls for the major ad companies this quarter was highlighting AI's role in the industry and the companies themselves. While AI has been used in the advertising industry for a while, generative AI tools such as ChatGPT and Dall-E have brought new opportunities to the industry that the big four, among others, are already heavily investing in. Generative AI — AI models that generate new content — include the automated creation of media content such as text, image and video.

The commercial launch of the technology has unlocked new revenue sources. For advertisers, this creates new opportunities for faster, more adaptive and creative responses to current market trends and fast-changing consumer demands. Ad companies advocate that these platforms create a new opportunity to develop ideas and provide a faster starting point for brainstorming, pitches and new campaigns, and continue to explore potential use cases.

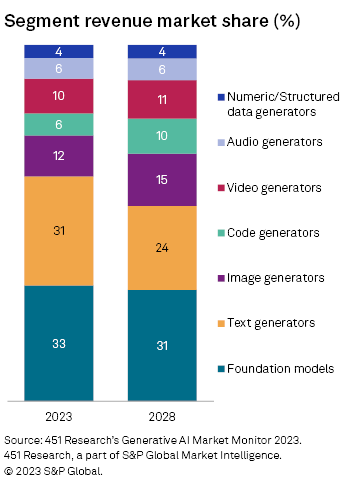

According to 451 Research's model, generative AI is forecast to generate $3.7 billion in 2023 and reach $36.36 billion in 2028. Of that, the majority continues to be text generators, while image, video and audio generators are set to take a larger share over time. This type of media content has drawn the attention of the ad industry looking into how to get a piece of the pie.

Concerns remain that new generative AI platforms ultimately rely on the available data. Content is generated based on a database that can be influenced by fake news or is not based on real-time information and promote stereotypes such as those based on gender, for example. Sam Altman, CEO of OpenAI LLC, founding company of ChatGPT, has warned of the potential risks of generative AI, stating, "I'm particularly worried that these models could be used for large-scale disinformation." When ChatGPT was integrated into Bing search in February, responses were influenced by third-party sources that were not vetted, generating false responses. In addition, paywalls were bypassed from certain sites when pulling information, leading to copyright issues and, consequently, the suspension of the service July 4.

Copyright and plagiarism also remain a real concern to advertisers considering the lack of control over content creation. Any product of generative AI is based on the information it has available, drawing from existing text and images that could come from a competitor or a single artist. Generative AI is expected to raise new concerns on data privacy, aggregation and storage. Both the US and the EU are reviewing a regulatory framework around the technology, which could restrict generative AI for the industry in a similar way that General Data Protection Regulation impacted addressable advertising and social media.

Much fear surrounds generative AI's future role and the possibility it could replace people. For now, the human element remains essential. Many companies, including WPP and IPG, have already started training employees to use generative AI for the development of personalized campaigns and launched new departments focusing solely on the technology. With a shortage of a skilled workforce due to the sudden boom of this technology, reskilling workers has become a priority across companies and industries.

New opportunities will also emerge from the content platform side, such as Meta, Google and TikTok, which have already announced work on proprietary AI ad creation tools. While this can help deliver faster and more personalized advertising, it also threatens the role ad agencies play.

The Big Four have already launched anecdotal ad campaigns using generative AI, and all have units focused solely on that. Publicis, via its subsidiary Publicist Sapient, was one of the early investors in AI. In 2020, it launched a joint venture called Publicist Sapient AI Labs, now fully owned. The company's focus is the R&D and incorporation of AI solutions for its clients.

More recently, WPP announced its partnership with tech company NVIDIA to develop a new generative AI platform for its customers. With tools powered by partners such as Adobe, WPP aims to enable the faster creation of high-value content, in line with each client's brand image.

In the last few months alone, Omnicom has partnered with Google Cloud, Amazon Web Services and Adobe. With Google Cloud, Omnicom will be able to integrate AI models from the Vertex AI platform into its operating system Omni, allowing the company to benefit from models such as the text-to-image model Imagen, and integrate them with their Omni audience to create customized campaigns.

Omnicom's recent investment in AI came from its partnership with Adobe to get access to Adobe’s generative AI tools, including Adobe Firefly and Adobe Sensei GenAI. Similarly, Omnicom plans to integrate AWS generative AI and machine learning services such as Amazon Bedrock and Amazon Elastic Compute Cloud (EC2) to build foundational models of its own for the automation of media plans, ad creative, audience segmentation and performance measurement. With Adobe, Omnicom intends to use Adobe Firefly for content creation.

451 Research is part of S&P Global Market Intelligence.

Economics of Advertising is a regular feature from Kagan, a part of S&P Global Market Intelligence.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.