Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 29 Mar, 2023

By Seth Shafer and Michael Nocerino

Top U.S. wireless operators have bundled free access to streaming services on select plans for years, with some options including AT&T Inc., (HBO Max), T-Mobile US Inc. (Apple TV+, Netflix Inc., and Paramount+) and Verizon Communications Inc. (Discovery+, Disney+, ESPN+ and Hulu). While bundles can potentially help with new customer acquisition and retention on the wireless side, the pacts are likewise an important source of subscribers for streaming service partners in an increasingly competitive landscape.

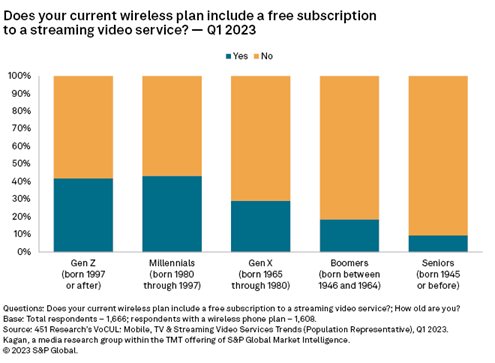

* 451 Research's VoCUL: Mobile, TV & Streaming Video Services Trends, first-quarter 2023 survey of 1,666 U.S. online adults shows that about 30% of respondents report having a wireless plan that includes a free streaming service subscription.

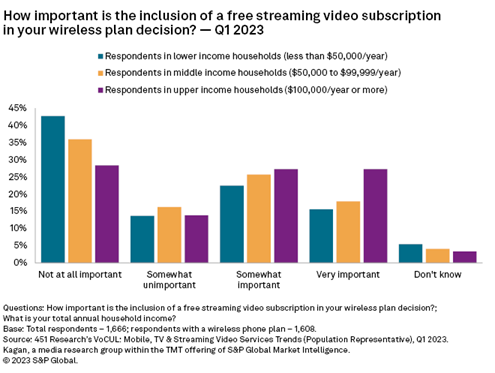

* Of respondents with a wireless phone plan, 42% say that access to a free streaming service is somewhat important (24%) or very important (18%) in their decision when selecting a phone plan.

* Younger demographics (Gen Z at 46% and millennials at 43%) were far more likely than older generations (Gen X at 29% and boomers/seniors at 28%) to have a free streaming service bundled with their wireless services and also more likely to say that the bundle is important when deciding on a phone plan.

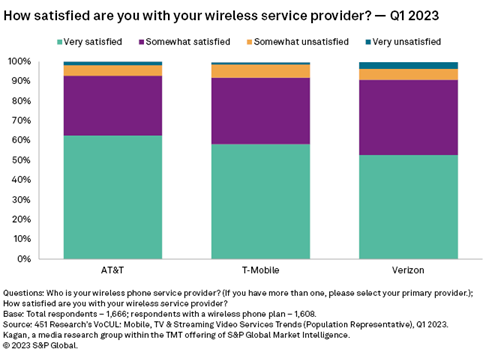

Overall satisfaction among wireless users of each of the Big Three operators AT&T, T-Mobile and Verizon was north of 90%, paced by AT&T, which also had the highest percentage of very satisfied users at 63%.

Bundling streaming services with wireless data plans has become a common practice, but how much does it help with acquiring and retaining subscribers? Survey data shows that AT&T (40%) and T-Mobile (38%) have the highest percentage of subscribers among operators surveyed who say their wireless data plans come with a bundled streaming service, well ahead of Verizon Communications Inc. (26%).

Additionally, 52% of AT&T subscribers and 47% of T-Mobile subscribers say having the bundled streaming service is very or somewhat important to them. Verizon also lags here, with 34% saying it is important.

Millennials (43%) and Gen Zers (42%) are more likely to have a wireless data plan that includes a bundled streaming service compared with other age groups. Millennials (58%), in particular, feel bundling is important when choosing a wireless data plan, followed by Gen Zers (51%) and Gen Xers (48%). While almost half of Gen X respondents say a bundled service is important, only 29% have a bundled streaming service with their wireless plan.

Although there are some exceptions, wireless operators have primarily bundled free streaming services as part of their more expensive plans. Among respondents that have a free streaming service bundled into their wireless service, 44% report living in a household with total income of $100,000 or more, versus 32% in middle-income households and 24% in households making less than $50,000 per year.

Of respondents in higher-income households making $100,000 or more per year, 55% say that the free streaming service is very important or somewhat important when selecting a wireless service. On the opposite end of the spectrum, 43% of respondents in lower-income homes say that the inclusion of a free streaming service was not important at all, likely driven in part by the fact that lower-income homes tilt toward using services such as Tracfone, Straight Talk and Boost Mobile, which do not bundle in free streaming video services.

Users of individual streaming services are all more likely than total respondents to say that the inclusion of a free streaming service in their wireless plan is somewhat or very important when choosing a plan. Sixty-nine percent of Apple TV+ users say a bundle is important, followed by Discovery+ users (66%) and Disney+ users (60%).

Walt Disney Co.'s partnership with Verizon was an important driver in the rapid rise in usage of Disney+ when the service launched in late 2019 while more recent launches such as Warner Bros. Discovery Inc.'s Discovery+ and Paramount Global's Paramount+ were also accompanied by a bundle deal with a wireless partner.

Combining 451 Research's industry-leading analysis with our Leading Indicator and Population Representative panels provides an accurate view of key trends and perspectives from consumers about mobile, TV and streaming video services, including current usage, viewership trends and satisfaction. Additionally, the surveys look at bundling and cancellation trends.

The U.S. Consumer Population Representative Survey was fielded online from Jan. 13 to Jan. 31, with approximately 1,670 United States consumers. Sampling is representative of the U.S. online population aged 18 and over across multiple demographics including age, gender, household income, ethnicity and geographic region.

Podcast

Research