Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 20 Apr, 2022

Deal-making to continue apace in 2022

For the fifth consecutive year, S&P Global Market Intelligence conducted an annual survey among PE and VC practitioners to measure industry outlooks for the upcoming 12 months.[1] The study centered mostly on General Partners’ (GP) expectations around deal-making, fundraising, investment strategy, threats to the growth of portfolio companies, and the approach to Environmental, Social and Governance (ESG) factors. This year we also included a question on investors’ advances on their digitization and automation journey.

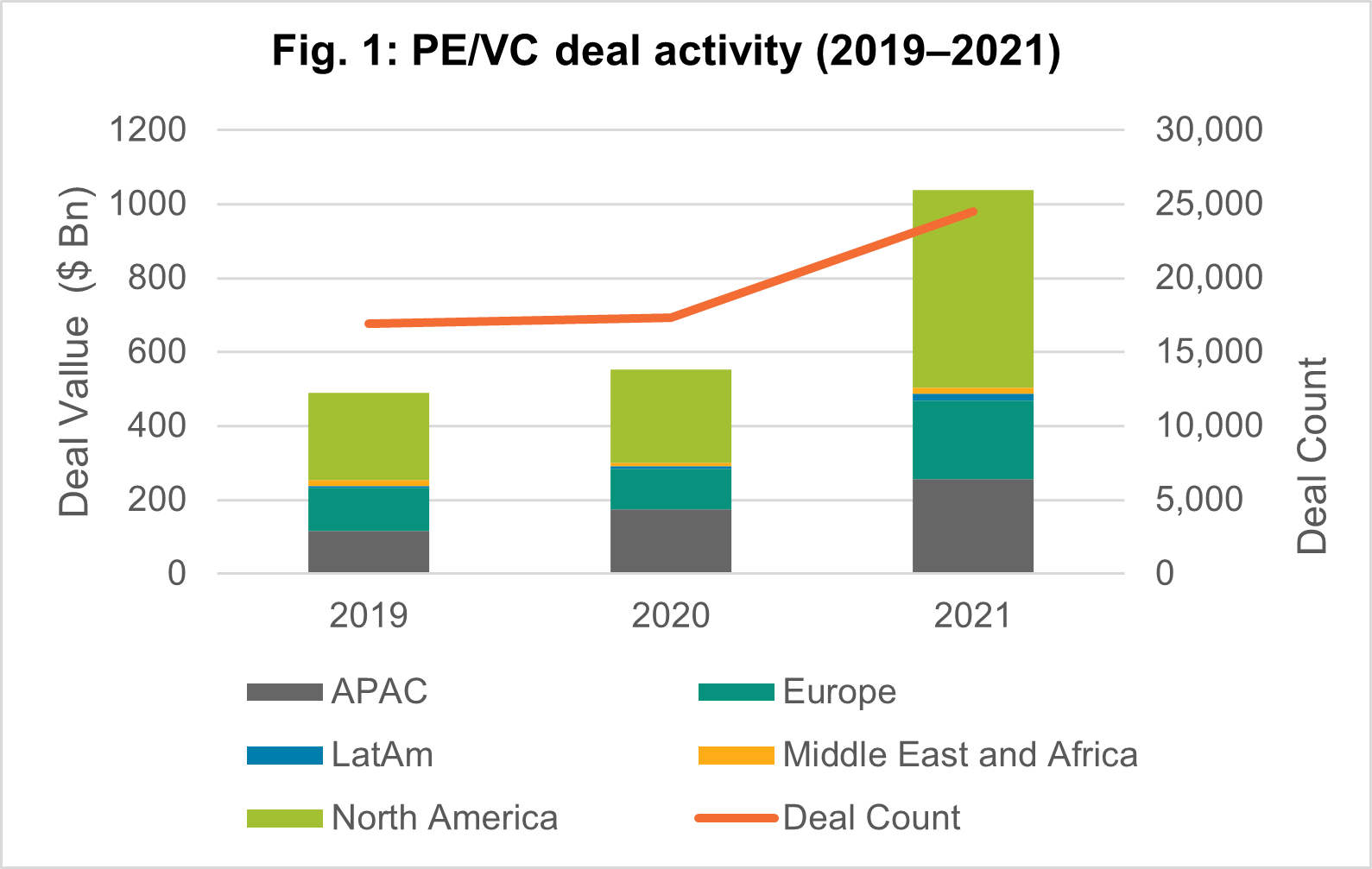

2021 was a record year for the PE industry as investment activity surpassed the trillion-dollar mark for the first time. In total, 24,520 deals were closed, with an aggregate deal value worth $1.04 trillion, nearly double the amount from the year before. At the same time, deal volume grew by 41.6% over 2020, proving that investors’ predictions of improved deal-making in 2021 came to fruition. Each region benefited from an investment spree, with Latin America (LatAm) and North America (NA) witnessing the highest uptick in aggregate deal value year-on-year. Indeed, LatAm grew by an outstanding 225%, to $19.5 billion in 2021 from almost $6 billion in 2020, with the top 12 deals accounting for a third of the total deal value in the region. North America registered a 111% increase in aggregate deal value on the previous year and accounted for half of the total transaction value ($534 billion).

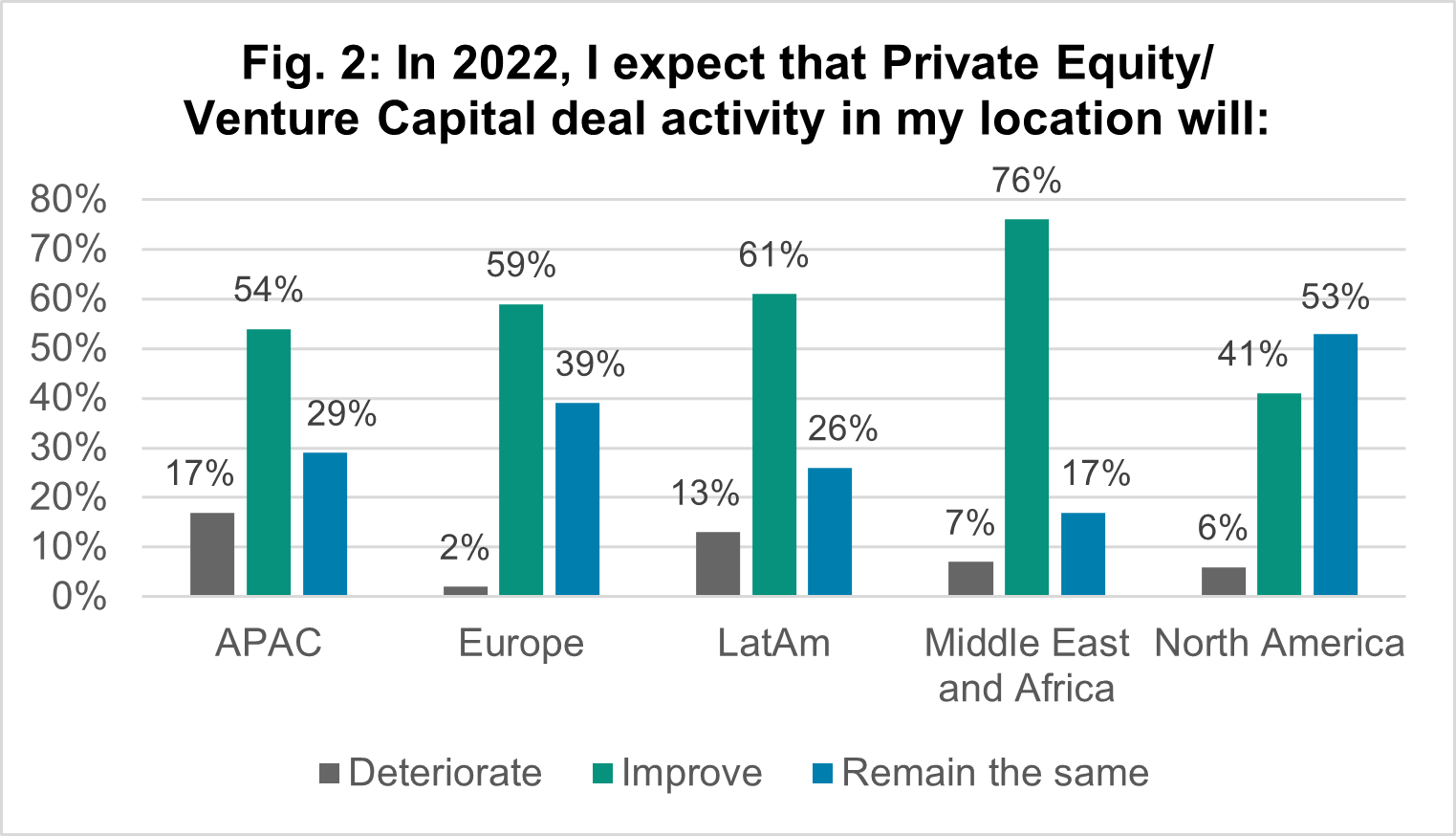

Going into 2022, PE investors remain largely bullish on the investment activity outlook. On average, 56% of respondents believe deal activity will improve in the next 12 months. 37% think it will remain the same, a slight increase over 2021 when only 27% of investors expected deal activity to remain flat. In the context of elevated investment levels, this likely suggests that investors are growing wary of risks such as inflation, rising interest rates and high valuations that could put the brakes on this unprecedented pace of transactions.[2]

European investors appear to have the most confidence about the industry’s outlook, with 98% predicting that deal-making activity will either improve or remain the same. By contrast, Asia-Pacific (APAC) respondents maintain the most cautious view. Almost 17% of PE professionals from that region anticipate the investment landscape will deteriorate in 2022.

Source: S&P Global Market Intelligence. For illustrative purposes only.

Fundraising hit a new record in 2021 with established fund managers riding the wave

Like deal-making, fundraising also saw an upward growth trajectory in 2021 as money flew abundantly into private markets. In total, 2,543 funds held a final close, a 14% increase on the previous year’s tally. On aggregate those funds raised $845.5 billion capital across various strategies, with growth capital funds seeing the largest upsurge. According to Preqin data,[3] aggregate capital raised by growth funds hit a new record of $136 billion, up by 60% on the previous year and exceeding the 5-year average of $114 billion. VC fundraising also saw an increased level of activity, with an aggregate capital raised up 23% on the previous year.

Out of those PE firms that have been fundraising in the last 12 months, a quarter indicated that convincing Limited Partners (LPs) about the investment strategy and source of competitive advantage is the biggest challenge faced during the process. This is of particular concern for LatAm investors: 38% of respondents from the region say that convincing LPs about the right strategy and ability to deploy capital effectively is the biggest fundraising challenge their firm is facing. Conversely, only 18% of North American respondents see it as a hindrance, the smallest percentage across all regions. 20% of all survey participants think that large LPs pouring capital into fewer funds with established LP-GP relationships is the second most common challenge, a sentiment felt most by European investors (23%). Notably, 40% of respondents from North America and 26% from Europe claim that they don’t face any major challenges, while only 11% of LatAm investors and 13% of Middle East investors feel the same. 18% of APAC investors say that LPs demanding diversification and fierce competition against larger firms pose other significant fundraising challenges.

When it comes to the fundraising outlook, half of the respondents expect fundraising conditions to remain the same and another 36% believe it will improve; among Middle East and Africa investors the percentage is as high as 52%, which indicates a very positive outlook for 2022. Only 13% of respondents anticipate fundraising conditions to deteriorate.

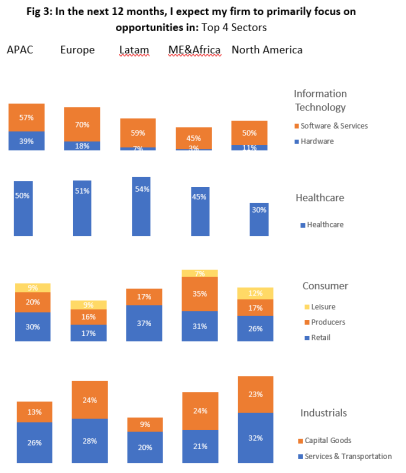

Looking at the investment strategy from the sector perspective, Information Technology (IT) remains the top industry of choice, with 63% of investors planning to deploy capital in this sector. This is up from 51% in 2021, indicating that its attractiveness continues to grow year-on-year. Investor strategy is backed by robust numbers: in 2021, IT accounted for nearly half of total deals completed (46%) and a third of total deal value (37%).[4] The most favored industry group within the sector across regions, according to our respondents, is by far Software & Services (61%), while only 17% plan to invest in Hardware.

Healthcare follows IT as the second top industry, up to 47% from 43% in 2021, attracting more investors as the sector continues to offer opportunities, especially in the Healthcare Technology industry.[5] In 2021, deal activity in Healthcare continued gaining momentum, not only in terms of deal count but also deal value, which reached $340 billion; Healthcare Technology deal counts contributed the most to the sector’s dynamism.[6]

Contenders for the third sector of choice are the Consumer (35%) and Industrials (34%) sectors. Both sectors’ attractiveness has increased from last year (30% and 26% respectively). However, in 2021, the Consumer sector saw the sharpest rise in deal value of all sectors, tripling $180.8 billion in 2021 from $63.3 billion in 2020 to[7]. PE/VC firms considering investment in the Consumer sector plan to focus on the Consumer Retail (24%) and Consumer Producers sub-sectors (18%), while taking rather a cautious approach to Consumer Leisure (8%).

Source: S&P Global Market Intelligence. For illustrative purposes only.[8]

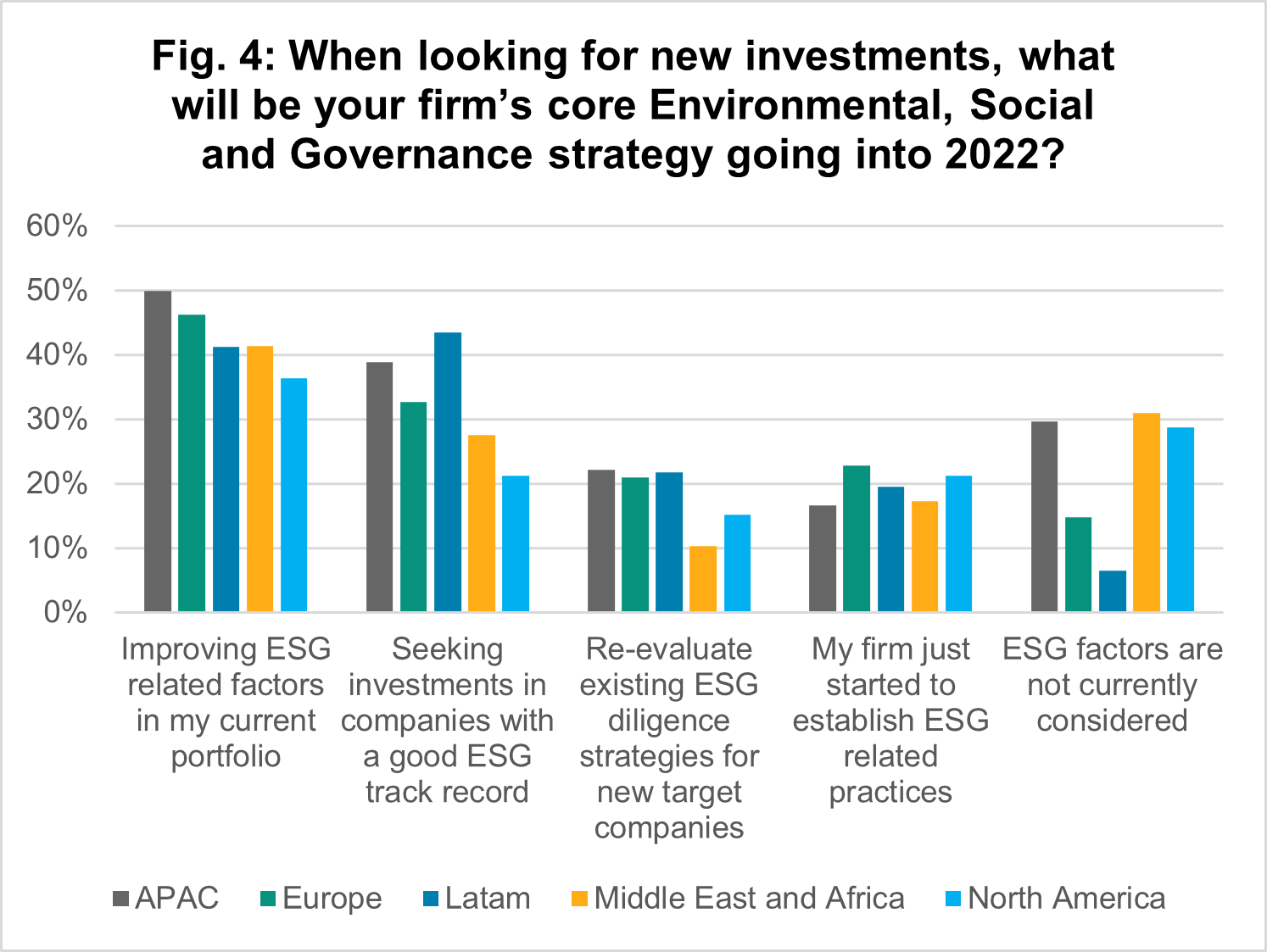

It has been a positive year for ESG with a broad recognition of ESG’s importance from all stakeholders and acknowledgement of its role in value creation.[9] Many PE investors now consider ESG factors when building and managing their portfolio. 44% of respondents indicated they are planning to focus on improving ESG related factors in their portfolio companies this year, and 32% are seeking investments with a good ESG track record, up from 29% in 2021. Globally, the number of companies that are beginning to implement ESG-related practices has decreased since the previous year, indicating that many companies are already well into their ESG journey. LatAm investors especially seem to have accelerated the adoption of ESG principles: the number seeking investments in companies with a good ESG track record has nearly doubled from last year, to 43% from 25%, while the number of firms that are not considering ESG factors has decreased considerably, to only 7% from 19% in 2021. However, the overall number of firms not considering ESG factors when looking for new investments remained unchanged from last year at approximately 20%. ESG still clearly faces challenges in its implementation, such as the lack of standardized performance reporting, and will certainly require time before all companies can be on board. Despite this, stakeholders are expecting 2022 to be a year of action on ESG issues, not just for climate change as expected but also for rising concerns over social issues[10].

Source: S&P Global Market Intelligence. For illustrative purposes only.

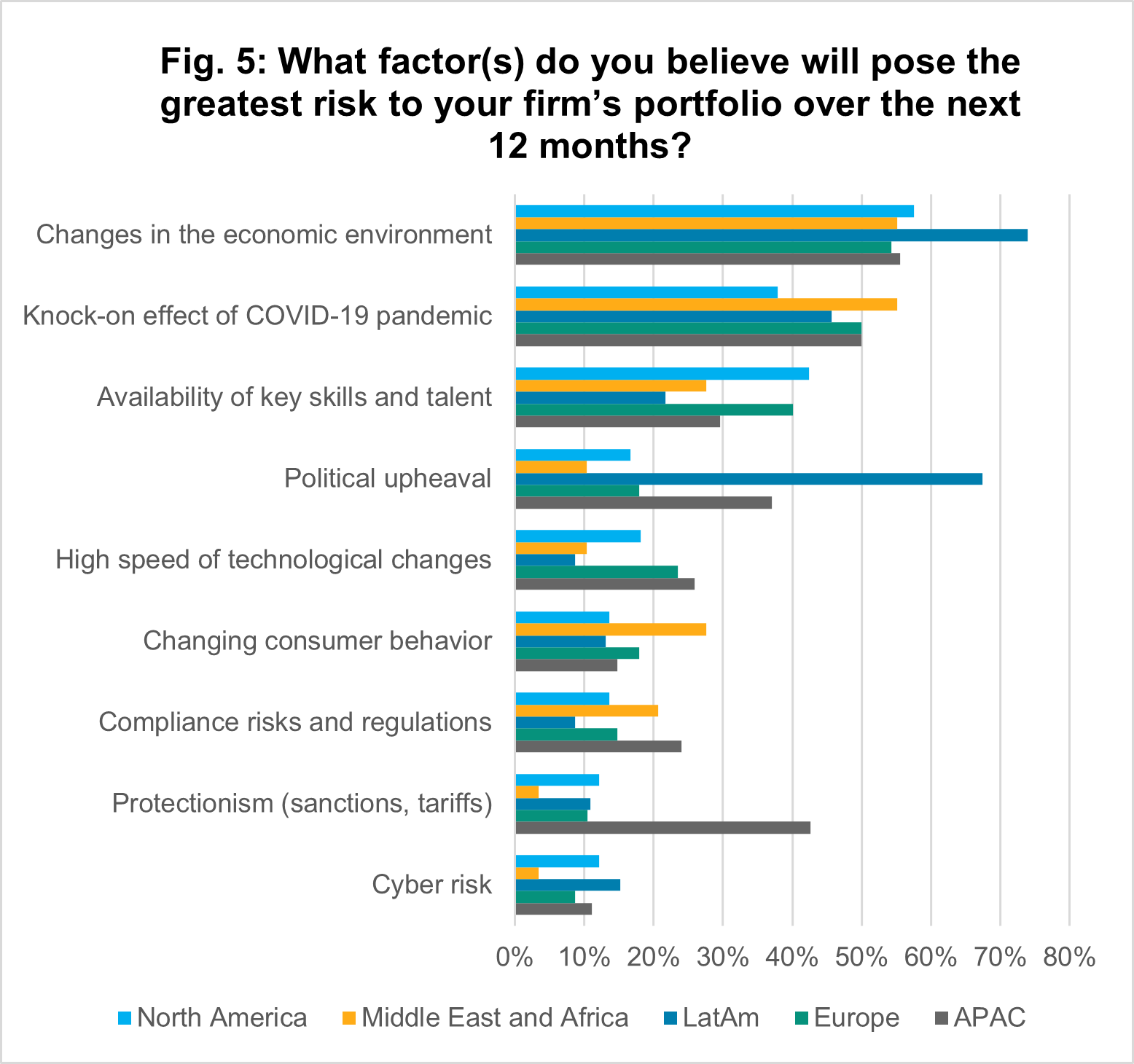

Economic environment at the forefront of risk concerns

Going into 2022, PE/VC investors are mainly concerned about the changes to the economic environment. More than half of respondents (58%) highlighted it as the top risk factor to their portfolio. The economic effects of the pandemic continue to linger; however, as PE/VC firms have gained more experience with its impact, it has become less of a concern, dropping to second place this year (48%). The third risk factor concerning PE/VC firms this year has changed considerably from last year. Concerns about the availability of skills and talent as a threat to the growth of portfolio companies have doubled from last year, climbing to 36% from only 17% in 2021. More than 40% of both European and North American investors are concerned about the availability of key skills and talent, the highest number across all regions. Labor shortages in the wake of the pandemic are undoubtedly playing a role in the overall picture. Political upheaval (26 %) and the high speed of technological changes (20%) round off the top five risk factors. Environmental issues and regulations, lack of financing and raw materials, logistics and high valuations are other topics of concern on investors’ minds. Changes in consumer behavior is no longer one of the top five factors of concern, decreasing to 17% this year from 26% in 2021%) as firms now have a better gauge of consumer reactions to the pandemic and have adjusted their strategies accordingly.

Source: S&P Global Market Intelligence. For illustrative purposes only.

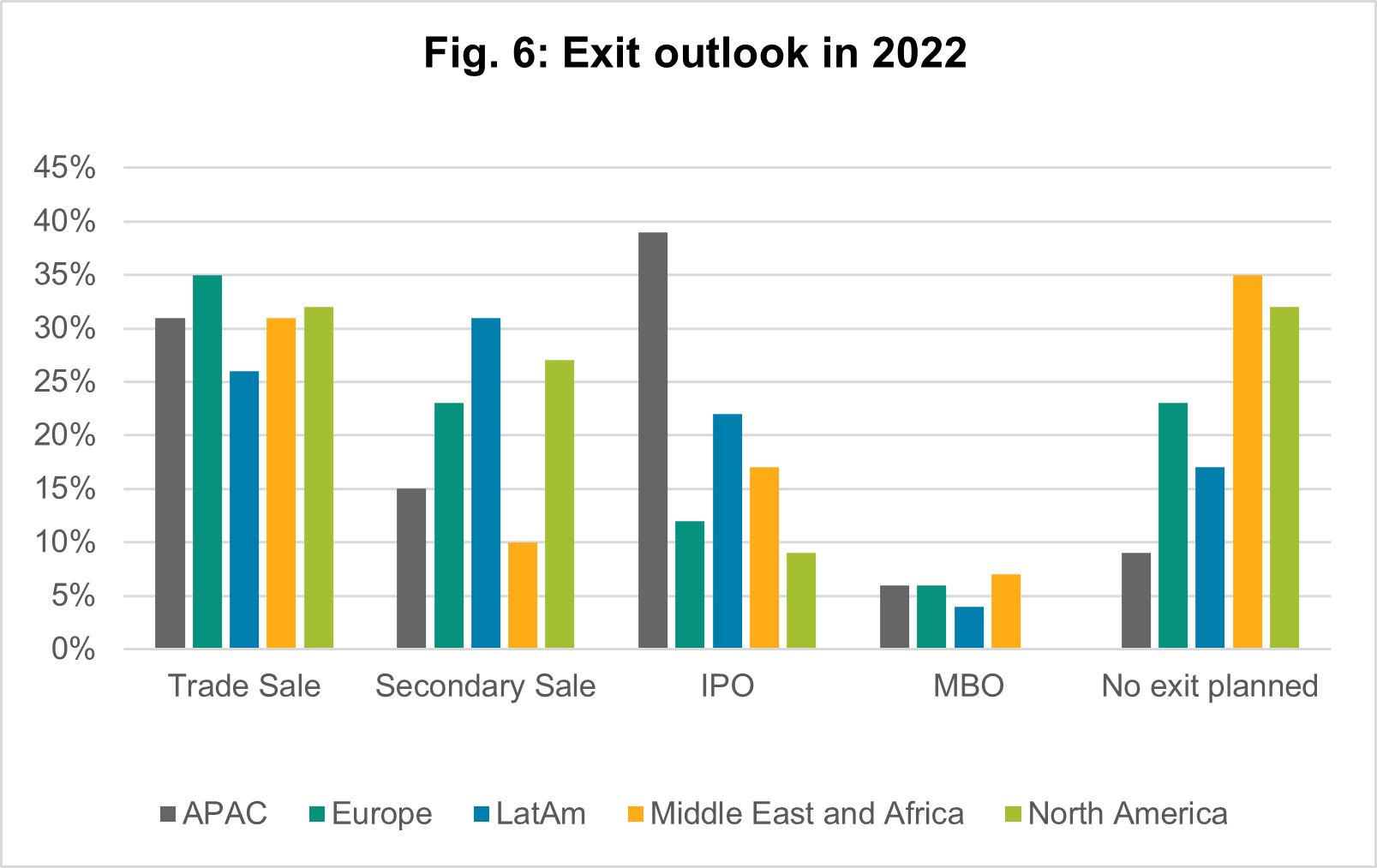

Exit activity bounces back and set for another active year

More than three-quarters of firms (77%) say they are planning to exit their portfolio companies, marking an increase from last year (66%). APAC investors are the most enthusiastic at 91%. 2021 was an exceptional year for exits: not only did the number of exits increase by 34% from 2020, but exit value also increased by 57%.

North America largely led this increase, accounting for 76% of the total deal value.[11] Another active year is anticipated[12] as sponsors continue to take advantage of favorable exit conditions and new dynamics such as the rise of Special Purpose Acquisition Companies (SPACs).[13] In terms of exit methods, trade sale will still be the most preferable route, attracting a third of respondents (32%) versus a quarter last year. IPOs remain the first choice of exit methods among APAC investors (39%), and it is also increasingly attractive to LatAm investors, rising to 22% from only 4% last year. The number of IPOs in LatAm in 2021 was on par with 2020, a levelling out of the steep increases seen in 2019, with most of them taking place in Brazil.[14]

Source: S&P Global Market Intelligence. For illustrative purposes only.

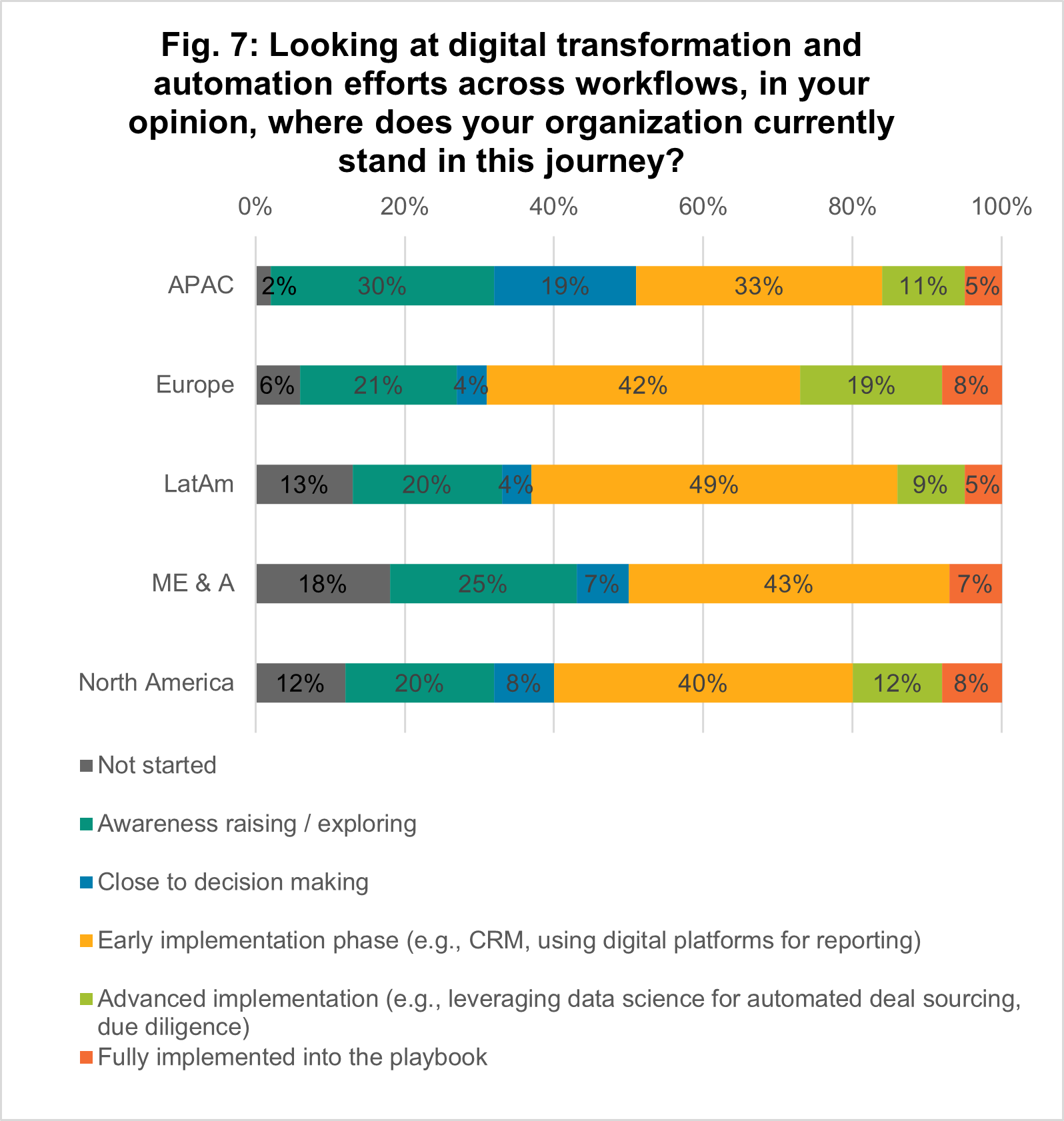

Private Equity firms gradually catching the digitalization train

Digital innovation and transformation across existing workflows are imperative for PE firms wishing to maintain a competitive edge among peers. Going into 2022, all regions are clearly at different stages of digital technology adoption. Overall, 41% of respondents say that their firms are in the early implementation stage, mainly focusing on using Customer Relationship Management (CRM) and digital platforms for reporting. In terms of advanced digitization, 14% declare their organizations have advanced to the point of leveraging data science for automated deal sourcing and due diligence, while only 7% of respondents said that digital technologies have been fully implemented into their playbook.

European firms seem to lead the pack, with 27% saying they have either fully implemented digital technologies or are in the advance stages; by comparison, only 20% of North American investors are in the same stage. Across all regions, digitalization is high up on PE agendas and awareness has risen significantly. 22% of respondents say their firms are exploring digital technologies while 7% say their firms are close to making the final decision. Changes is slowest in the Middle East and Africa where 18% of investors have yet to embark on digital revolution at all.

Conclusion

PE/VC investors are optimistic about 2022, with a majority betting on the current rapid pace of investment and fundraising to continue given the huge amount of available dry powder and the strong interest in the asset class.

However, many are cautious of the growing inflation and rate hikes that may impede the unprecedented rate of investment activity. IT and Healthcare sectors will continue to be in high demand, with ESG considerations taking an increasingly central role in the investment decision process and beyond. Another prevailing theme for the upcoming months to grow in significance will be digitalization. Although PE firms have been slow to join the digital technology revolution, many are catching up and implementing advanced data and analytics tools to identify new growth opportunities and remain competitive.

2022 is likely to be an active year for private equity exits, and many investors are preparing to divest their portfolio companies. SPACs are playing a new role in the market dynamics, particularly in the U.S. But whether the exit activity will be on par with that of 2021 remains to be seen, and may hinge on looming economic risks.

Source: S&P Global Market Intelligence. For illustrative purposes only.

[1] The survey was conducted over the period of 15 weeks between October 4, 2021, and January 16, 2022. In total we received 357 responses from PE and VC investors globally. 48% of respondents were senior level professionals. 43% were Private Equity Firms, 29% were Venture Capital firms and 28% were firms doing both Private Equity and Venture Capital investments. Geographically, 45% of respondents were from Europe, 19% were from North America, 15% were from APAC, 8% were from the Middle East & Africa and 13% were from Latin America.

[2] Private equity managers expect another boom year in 2022. (As of 13/01/2022). S&P Global Market Intelligence Retrieved from: https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/private-equity-managers-expect-another-boom-year-in-2022-68394243

[3] Preqin Pro, (as of 07/02/2022). www.preqin.com

[4] S&P Capital IQ Pro Platform (as of 27/01/2022). www.capitaliq.spglobal.com

[5] Investing in the next generation of healthcare opportunities. (As of 7/10/2021). FT Adviser. Retrieved from: https://www.ftadviser.com/investments/2021/10/07/investing-in-the-next-generation-of-healthcare-opportunities/

[6] M&A Year in Review 2021. S&P Global Market intelligence. Retrieved from: https://pages.marketintelligence.spglobal.com/2021-Year-in-Review-Investment-Banking-Infographic.htm

[7] S&P Capital IQ Pro Platform (as of 27/01/2022).

[8] Multiple selections were allowed. Example: 70% of all Europe-based investors responded that they are planning of making investments in Software & Services.

[9] PE Pulse: Five takeaways from 4Q 2021. (As of 20/01/2022). EY. Retrieved from: https://www.ey.com/en_us/private-equity/pulse

[10] Key Trends that will drive the ESG agenda in 2022. (As of 31/01/2022). S&P Global. Retrieved from: https://www.spglobal.com/esg/insights/key-esg-trends-in-2022

[11] S&P Capital IQ Pro Platform (as of 25/01/2022). Screening results include only M&A Exits not IPOs.

[12] Robust private equity exits may set record year. (As of 16/11/2021). S&P Capital IQ Pro. Retrieved from: https://www.capitaliq.spglobal.com/web/client?auth=inherit#news/article?KeyProductLinkType=2&id=67618330

[13] PE-backed SPACs in 2021 soar past last year's tally. (As of 09/09/2021). S&P Global Market Intelligence. Retrieved from: https://www.capitaliq.spglobal.com/web/client?auth=inherit#news/article?id=66494139

[14] S&P Capital IQ Pro Platform (as of 14/02/2022).

Research

Research