Deal activity in the information technology space just keeps ticking up, and so do the multiples being paid.

Across tech and telecommunications, there were 2,326 transactions announced in the first seven months of 2021, compared to 2,154 deals announced in the same period in 2019, according to 451 Research, an offering of S&P Global Market Intelligence. Transaction values have skyrocketed well above pre-pandemic levels, with the total deal value landing at $758.61 billion for the year through July 2021 compared to just $294.42 billion for the same period 2019, according to 451.

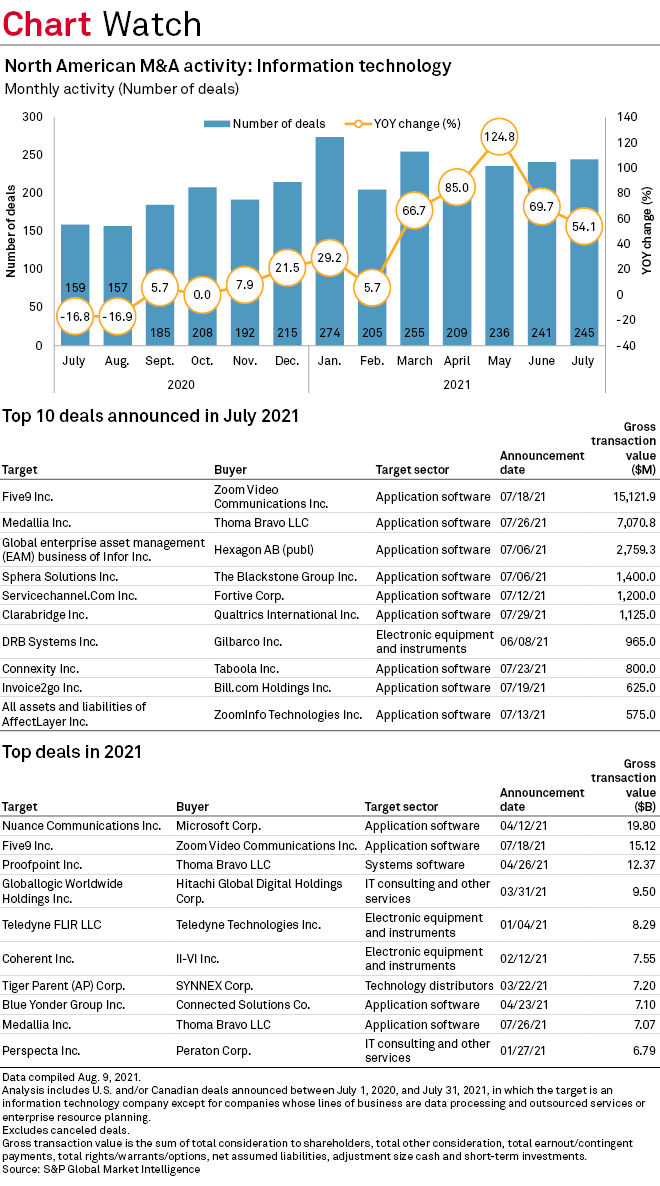

Looking at July in particular, deal volume in the information technology sector was up 54.1% year over year to 245 transactions. July 2020 saw 159 deals announced in the sector, down 16.8% from the same month in 2019, according to data from S&P Global Market Intelligence.

Zooming in further to look at specific deals driving the activity, Zoom Video Communications Inc.'s $15.12 billion planned purchase of Five9 Inc. gave July transaction values a big boost, coming in not only as the largest deal of the month but as the second-largest information technology transaction of the year.

The 11-figure deal comes after Zoom's reputation and equity value soared amid the pandemic. The company went from 10 million meeting participants to 300 million in just a few short months early in 2020, and the corresponding run-up in Zoom's market capital allowed the company to land its largest transaction ever. The transaction puts a whopping 30x enterprise value-to-trailing revenue multiple on Five9, above Zoom's own public market valuation.

Even though Zoom has grown its trailing revenue much faster than Five9, the company is looking to the future at a time when demand for videoconferencing is leveling off as workers return to offices and consumers meet friends and family in person. Five9 provides cloud-based software for contact centers that use artificial intelligence to help companies interact with customers. The deal is "a logical move" for a post-pandemic Zoom, according to a note from a team of 451 analysts.

Only one other software transaction over $10 billion has carried a higher deal multiple: salesforce.com inc.'s $29.35 billion acquisition of Slack Technologies Inc. That transaction, which was announced in December 2020, carried a trailing revenue multiple of 36x.

In that massive deal, Slack took The Goldman Sachs Group Inc. as a financial adviser, and Goldman will put its M&A expertise to work again in the Zoom transaction. Fee's were not disclosed for Goldman's work with Zoom, but by way of comparison, Goldman charged Slack $38.9 million in its combination with Salesforce.

Five9 will hire Qatalyst Partners LP as its financial adviser. Fees were not disclosed, but Evercore Inc. advised Nuance Communications Inc. on a similar transaction with Microsoft Corp. Evercore charged $63.0 million in fees and $7.0 million for a fairness opinion for its work on that $19.80 billion acquisition, which marks the largest information technology transaction of the year.

In the second-largest transaction of the month, private equity firm Thoma Bravo LLC continued its voracious consolidation of the application software sector with a $7.07 billion agreement to acquire enterprise data and tools firm Medallia Inc. The private equity firm announced 32 transactions in the broader technology industry in 2021 through July, according to 451, with a total announced transaction value of $41.83 billion and an average multiple of 9.8x enterprise value to trailing 12 months revenue.

The Medallia deal will only expand that multiple as Thoma Bravo is looking to plunk down 12.3x the company's trailing revenue, according to 451 analyst Scott Denne.

"At today's valuation, Medallia garners a higher multiple than any other US-listed software provider to go private in a 10-figure deal — a surprising record for a company whose shares lost 9% over a two-year stretch where the S&P 500 gained 48%," Denne said in a note on the transaction.

Advisers on the megadeal include Morgan Stanley, which will provide Medallia financial consultation and a fairness opinion.

While Morgan Stanley will consult the seller on the July deal, Morgan Stanley is a favorite of Thoma Bravo. The two have worked together on 73 transactions for a total of $113.06 billion in disclosed transaction values, according to S&P Global Market Intelligence.

Fees for its work on the Medallia transaction were not disclosed, but Morgan Stanley advised Thoma Bravo on its acquisition of Proofpoint Inc., the third largest information technology transaction of 2021 and the largest in the private equity firm's history at $12.37 billion. In that April transaction, Morgan Stanley charged $62.0 million in fees and $16.0 million for a fairness opinion.

Medallia will also take Bank of America Corp. and Wells Fargo & Co. as advisers, while no advisers were listed for Thoma Bravo.