U.S. workers' compensation premiums fell 8.1% year over year to $24.84 billion in the first half of 2020, an S&P Global Market Intelligence analysis showed.

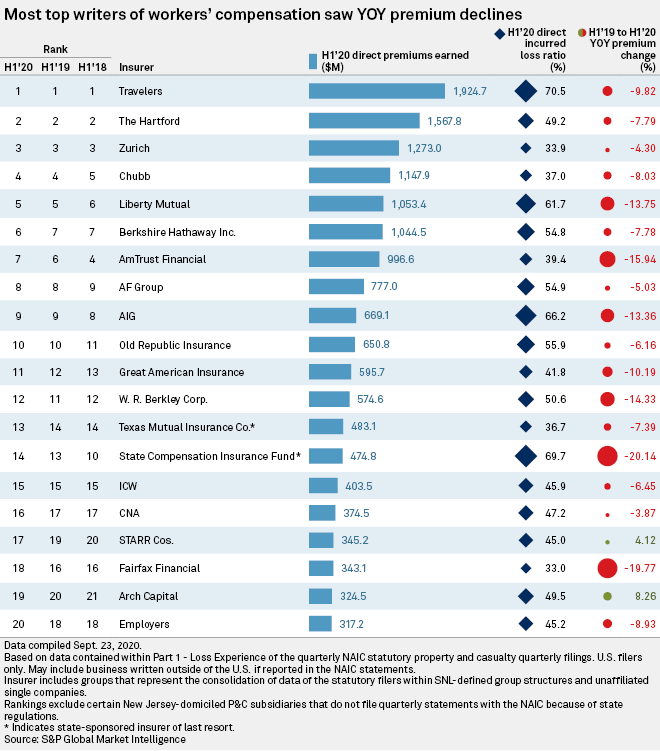

Of the top 20 U.S. workers' comp underwriters, only Starr International Co. Inc. and Arch Capital Group Ltd. recorded higher direct premiums earned during the half.

Liberty Mutual Holding Co. Inc. retained its spot as the fifth-largest writer of workers' comp policies but reported the sharpest decline in premiums earned among the top five insurers. Direct premiums earned tumbled 13.75% to $1.05 billion from $1.22 billion in the first half of 2019.

Despite a 9.82% dip in premiums earned, Travelers Cos. Inc. held on to its position as the top workers' comp insurer in the U.S. The company's premiums earned declined to $1.92 billion from $2.13 billion on a yearly basis, while the direct incurred loss ratio spiked to 70.5% from 46.55%.

Hartford Financial Services Group Inc., which sits in the No. 2 spot, saw its earned premiums decline 7.79% to $1.57 billion. Zurich Insurance Group AG rounded out the top three with $1.27 billion of earned premiums in the first half of the year, down 4.30% from $1.33 billion a year ago.

The industry's loss ratio improved year over year in the pandemic-depressed second quarter, declining to 45.6% from 49.3%, while premiums fell 13.5% over the same period.

Moody's warned that a sharp decline in payrolls, resulting mainly from COVID-19-related impacts to businesses, will drive written premiums lower for workers' comp writers in the coming quarters as companies return some premiums to policyholders.

Employers Holdings Inc. CEO Douglas Dirks said the pandemic is more likely to be a premium event than either a capital or claims event for workers' comp. During a second-quarter conference call, he said new business production and renewal premium will continue to be somewhat uneven as U.S. states either allow businesses to reopen or reinstate certain closures.

COO Stephen Festa said a decrease in average premium size on new business bound for the quarter was greater than seen in previous quarters, attributable mainly to lower-than-usual payroll.

The workers' comp line at Old Republic International Corp. experienced a 14.3% quarter-over-quarter decrease in net premiums earned, mainly due to a decrease in exposure base resulting from the economic downturn and was further exacerbated by the effect of rate decreases, President and CEO Craig Smiddy said during the company's second-quarter earnings call.