Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Apr, 2021

|

North America's largest proton exchange membrane electrolyzer facility for green hydrogen production is a 20-MW unit in Quebec. Experts projected the electrolyzer market could hit 1 GW by 2023 and 100 GW by 2030. Source: CNW Group/Air Liquide |

The market for electrolyzers that produce green hydrogen could grow much faster than the solar panel market expanded, perhaps taking less than half the time to hit key mile markers, experts said at the BloombergNEF Summit in New York.

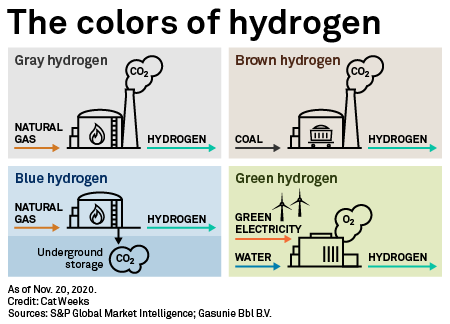

The world's ability to scale up the electrolyzer market is not the only key to making green hydrogen viable, but it is critical. Green hydrogen, which is produced by splitting water into hydrogen and oxygen using zero-carbon electric power, is increasingly viewed as a pathway for decarbonizing heavy transport, industrial processes, building heating and power generation.

In 2020, electrolyzer shipments reached 200 MW, according to Xiaoting Wang, a solar and hydrogen technology specialist at BloombergNEF, which provides research on the transition to a low-carbon economy. For context, annual shipments of solar photovoltaic modules stood at 200 MW in 1999, reached 1 GW in 2004 and hit 99 GW in 2017, Wang said during an April 13 panel. Wang quizzed panelists about when the electrolyzer market would cross these thresholds.

1 GW scale by 2023 achievable

Air Products & Chemicals Inc. Chairman, President and CEO Seifi Ghasemi said the electrolyzer market could pass the 1 GW threshold in as little as a year and a half, underpinned by purchases for a $5 billion green hydrogen export facility that his company is co-developing in Saudi Arabia. The facility is planned for Neom, a city envisioned by Crown Prince Mohammed bin Salman as an urban-scale technology incubator and a vehicle for his plans to overhaul Saudi Arabia's oil-dependent economy.

The Neom export facility will require 1.5 GW to 2 GW of electrolyzer capacity to produce 650 tons per day of green hydrogen, Seifi said. Air Products assessed locations around the world before deciding that the combination of daytime solar and overnight wind resources in Saudi Arabia could make the project viable.

Rich Voorberg, president of Siemens Energy AG's North America Hub, agreed that the hydrogen market will beat the solar industry's rate of market penetration. He noted that Siemens plans to offer a 1 GW electrolyzer unit by 2030. The company expects the market to reach 10 GW of annual shipments "well in advance of that," he added.

"The numbers are going to scale up very quickly, and once we can start scaling, that's when the prices will drop," Voorberg said. "We've got to get more experience under our belt, and I think we'll see that pricing drop to a much more economic opportunity."

Siemens and other hydrogen players are seeking to produce green hydrogen at $1.50 per kilogram by 2025, down from about $4/kg to $5/kg today. Green hydrogen is poised for an 85% cost decline to below $1/kg through 2050, driven by cheaper solar power, according to BloombergNEF. By 2050, it could become cheaper than natural gas in 15 of 28 markets analyzed by BloombergNEF.

The bull case: 100 GW by 2030

The most bullish outlook came from Mona Dajani, a partner at Pillsbury Winthrop Shaw Pittman LLP who heads the firm's renewable and hydrogen practice. In her view, the electrolyzer market will reach 100 GW of annual installations by 2030.

"I'm representing a number of companies that are in stealth mode right now," Dajani said. "They don't want others to know what is going on, and we're putting in a lot of R&D."

Dajani said her role in hydrogen dealmaking in Europe and the Middle East underpins her outlook. She acknowledged that there is currently no merchant market for hydrogen, and the capital-intensive nature of large-scale projects requires bankable offtake schemes. However, she said fossil fuel-based hydrogen consumers may present the first green hydrogen opportunities, because the offtake picture for these consumers is "very clear and easier to model."

"We're seeing it with oil majors," specifically big, early-stage projects at the majors' petroleum refineries, which are among today's largest hydrogen consumers, Dajani said. "This is something that we have worked on all around the world. It's really developing very nicely."

Keying off Dajani's comments, David Knight Legg, CEO of Canadian business organization Invest Alberta Corp., said one of the most interesting features of the hydrogen opportunity is the ability to retrofit existing LNG infrastructure to support hydrogen production with carbon capture and storage, or blue hydrogen. Knight Legg, who is involved in attracting hydrogen and CCS projects to Alberta, said the electrolyzer market can lean into an ecosystem comprised of an existing supply chain, highly trained engineering talent and intellectual property.

"The feedback we're getting from the major trucking [and] engineering firms, the major rail firms, is that this is ready to go for use cases in the next 24 to 36 months," he said. "So I think the demand side is going to pull adoption very, very quickly ... solar, wind and other things just didn't have those kinds of components in place."

Policy will play a role

All participants acknowledged that policy will play a role in scaling up the electrolyzer market. Nine countries and the European Union announced hydrogen strategies in 2020, boosting confidence among potential investors, according to BloombergNEF.

This group of investors includes Canada. Alberta is in discussions with the federal government on carbon capture, utilization and storage policy, which could appear in an upcoming budget, according to Knight Legg.

Dajani said she is working with the U.S. Department of Energy and the White House to develop hydrogen policies. She did not disclose the nature of the conversations, but she shared the policies that she thinks would most benefit the green hydrogen market. One is carbon pricing, a policy that Dajani noted has the backing of Treasury Secretary Janet Yellen. Subsidies and tax credits similar to those that supported the solar industry should also be on the table, Dajani said. These could complement carbon capture credits and combine with DOE loan guarantees for certain technology, she said.

"I think anywhere in the world right now, it's still very difficult to make a real economic business case," Voorberg said. "But the way we're going to progress this is by ... utilizing the government subsidies to get there."