Many of Europe's major banks went into the coronavirus crisis with their liquidity positions worsening, according to research by S&P Global Market Intelligence, even as the European Central Bank resorted to paying banks to keep liquidity flowing.

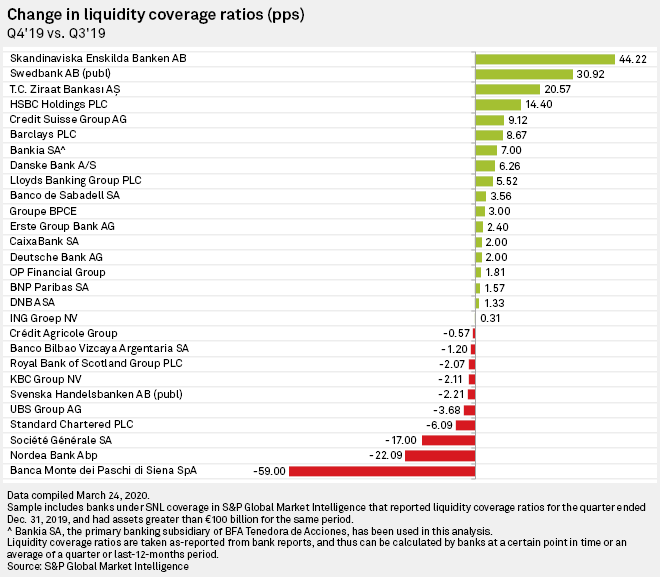

Italy's Banca Monte dei Paschi di Siena SpA, the U.K.'s Standard Chartered PLC and France's Société Générale SA were among banks that saw their liquidity coverage ratios decline in the final quarter of 2019, compared with the previous three months. The ratio measures banks' ability to withstand cash outflows and is calculated by dividing a bank's stock of high-quality liquid assets by total net cash outflows over a 30-day period.

S&P Global Market Intelligence's sample includes 33 leading financial institutions in Europe. Of these, 10 reported a quarter-over-quarter decline in the ratio or no change, while 17 reported an increase. For six companies, data was not available.

Leading banks like StanChart, HSBC Holdings PLC, Danske Bank A/S and Raiffeisen Bank International AG have already said they will miss profitability targets this year in the face of what HSBC termed "a challenging environment."

Banks are likely to see clients drawing down on revolving credit facilities as sales and profits dry up across Europe. An array of firms have seen their financial targets obliterated — airlines British Airways and Lufthansa have warned of drastic cuts to scheduling, and consumer, travel and technology companies such as sportswear firm Adidas, cruise company Carnival and Netherlands-based NXP Semiconductors have all warned of a coronavirus-related impact.

Emergency measures

Both the ECB and the Bank of England have taken emergency steps to ensure banks continue to lend to corporate clients in trouble.

Christine Lagarde, president of the ECB, unveiled a series of measures designed to bolster banks and keep liquidity flowing last week.

They included offering cheap auctions of central bank cash in which the ECB effectively pays banks to borrow money. It would pay banks 0.75% interest to take money on offer as long as they keep credit lines to businesses open.

The ECB's deposit rate is minus 0.5%, although Lagarde did not cut it further last week despite market expectations that she would, so the banks will receive 0.25% interest on the ECB loans. The ECB also raised the amount banks can borrow under the auctions, called targeted longer-term refinancing operations, or TLTROs, to 50% from 30% of their stock of eligible loans — the amount banks can borrow is reduced by the amount they have previously borrowed under similar operations by the ECB.

The bank also added €120 billion to its existing asset purchase program while its supervisory arm will let banks fall short of some key capital and cash requirements to keep credit flowing.

Countries across Europe are taking their own measures to keep credit flowing: Denmark, for instance, has eased monetary policy by releasing banks' emergency buffer and has also offered cheap loans to banks.

Bank of England

The Bank of England has taken similar steps while also cutting its interest rate to 0.25% from 0.75%. It has reintroduced a term-funding scheme providing loans to bank as it did during the 2008 global financial crisis.

This time its scheme is aimed at small and medium-sized enterprises and, based on the take-up of its term funding scheme from 2016, it estimates that this new scheme could provide funding in excess of £100 billion. Over the next 12 months the TFSME scheme will offer four-year funding of at least 5% of banks' stock of real economy lending at interest rates at or very close to the Bank Rate.

The U.K. government has also announced measures to bolster the effectiveness the country's response to the virus crisis, including a package of government-backed and guaranteed loans worth £330 billion to support businesses. It has offered to cover most losses on business bank loans, in order that banks can "lend with confidence" so that funding does not dry up.

According to S&P Global Market Intelligence data, Sweden's Skandinaviska Enskilda Banken AB has the strongest liquidity ratio at 218.3%, up 44.2 percentage points over the fourth quarter of 2019, while Spain's Bankia SA was in second place with a ratio of 204.0%.

Meanwhile French bank Société Générale SA was at the bottom of the list, with a ratio of 119%.