European banks are heading toward second-quarter earnings results having suffered near-universal falls in key capital levels, threatening their ability to lend, while most also saw their liquidity capacity to meet financial obligations weakened.

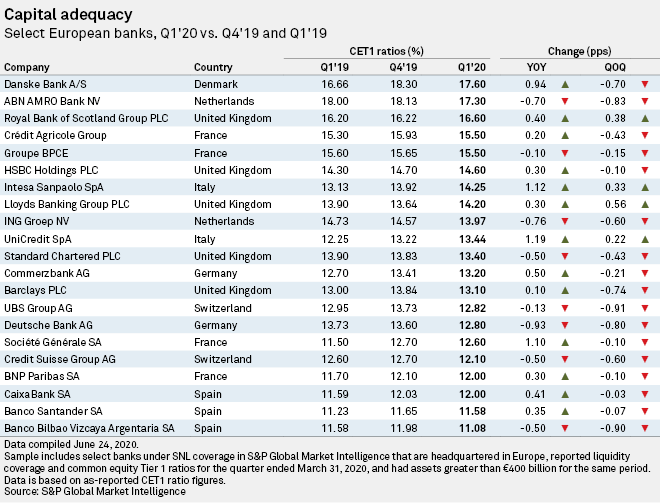

Research by S&P Global Market Intelligence looked at the common equity Tier 1 and liquidity coverage ratios at 21 leading banks across major European economies, to gauge how they have coped as the pandemic took hold. CET1 measures the amount of capital banks retain compared to risk-weighted credit exposures, while the LCR is a measure of banks' ability to meet short-term financial obligations.

Regulatory support

European countries were affected by the pandemic to varying degrees in the first three months of 2020 — with Italy, for instance, imposing the first national quarantine March 9. Since then, all major European countries have imposed some form of lockdown in an attempt to mitigate the worst effects of the coronavirus.

The Bank of England and the European Central Bank have relaxed regulatory capital requirements to aid lending — for instance, the BoE cut the countercyclical buffer to zero percent. However, such moves may not always work as intended, Sam Theodore, managing director at Scope Insights, told S&P Global Market Intelligence.

"A problem would be the stigma attached to a bank using its buffers — especially the liquidity one — given possible market reaction, at least for the first one or two banks daring enough to do it," he said.

The emerging supervisory leeway is "very positive" in that it allows banks to lend more and help with rebuilding economies, but supervisors need to state more clearly that there should be no stigma attached to the usage of buffers, and that this would indeed be considered positive, he said. This would be similar to how the ECB offered a no-stigma message when the first longer-term refinancing operation was made available to eurozone banks during the euro sovereign crisis.

Both central banks have made cheap loans available to banks to aid lending to corporate customers. The ECB also offers cheap auctions of central bank cash in which the central bank effectively pays banks to borrow money, via a negative interest rate on deposits, as long as they keep credit lines to business open.

The ECB and BoE both expect banks to use liquidity and capital buffers if provisions on exposure to affected sectors such as tourism, hospitality, airlines, transport, energy or automobiles increase considerably, "which is a distinct possibility," Theodore said.

The banking sector entered the COVID-19 crisis in a relatively strong prudential position in terms of capital and especially liquidity, thanks to a new system built up after the global financial crisis, Theodore said.

But there are key differences between the two situations, John Wright, a credit analyst at S&P Global Ratings, told S&P Global Market Intelligence.

The unprecedented speed and scale of fiscal and monetary policy support in 2020 has not only underwritten bank liquidity but also led to a rapid recovery in risk appetite in capital markets, he said.

"The latter has resulted in a far swifter return to normalized market access for bank capital — in months not years," the analyst said. "Many European banks have been prudent in wasting no time in raising capital against this backdrop — over $9.5 billion equivalent of Additional Tier 1 supply has been successfully issued since mid-May."

He noted however, that there was considerable uncertainty surrounding the unwinding of asset quality issues expected to arise due to various payment holiday and furlough schemes that have been implemented.

"I fully expect sanitary emergency scenarios to be part of future bank stress tests, probably no later than 2021 when the next European Banking Authority stress test is scheduled, after it was rightly postponed from 2020," Theodore said.

Capital concerns

Most banks saw a fall in capital in the first quarter as they took loan loss provisions in anticipation of coronavirus-related impairments. For banks already burdened with low capital levels, such provisions had a significant effect.

Among the banks in the sample, Spain's Banco Bilbao Vizcaya Argentaria SA, Banco Santander SA and CaixaBank SA had the lowest common equity Tier 1 ratios in the first quarter. All three set aside significant amounts of money for estimated losses related to the pandemic after the country was badly hit by the virus.

BBVA said at its first-quarter results presentation that it had taken a conservative approach to front-loading loan loss provisions in the first quarter, and that provisions for future quarters would be significantly lower.

Impairments at the bank rose to €2.58 billion in the first quarter, compared with €966 million in the same period of 2019. The bank decided not to retain its CET1 target ratio of between 11% and 12%.

CaixaBank's first-quarter loan loss provisions totaled €515 million, €400 million of which was related to the pandemic. Santander did not forecast how the pandemic might impact future earnings at its first-quarter results, but said it would reassess its midterm goals once the situation stabilized.

Denmark's Danske Bank A/S, Dutch bank ABN AMRO Bank NV, and U.K.-based Royal Bank of Scotland Group PLC recorded the highest first-quarter capital ratios in the first quarter.

Danske took a big hit upfront from coronavirus-linked loan impairment charges, with loan impairment provisions standing at 4.34 billion kroner, up from 618 million kroner in the first quarter of 2019.

ABN Amro reported €1.11 billion in impairment provisions, as the pandemic and the oil price crash put the bank under strain.

RBS is still state-owned after being bailed out by the government in the financial crisis. It reported a sharp jump in loan loss provisions in the first quarter, with a near ten-fold increase on the previous figure to £802 million from £86 million. Its pretax profits halved to £519 million.

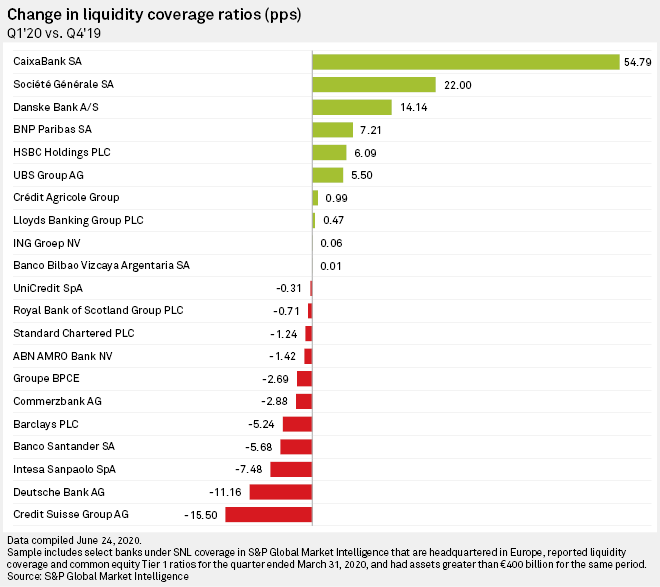

Liquidity

Dutch bank ING Groep NV, BBVA and Germany's Commerzbank AG had the lowest liquidity coverage ratios among the sample.

ING booked €661 million in additional loan loss provisions for the first quarter, more than triple the €207 million it booked a year before.

Commerzbank's CEO Bettina Orlopp warned that the "bulk of the problems" associated with the pandemic would materialize during the second and third quarter. The bank expects losses to total about €1.1 billion for the year.

At the top of the table were CaixaBank, Switzerland-based Credit Suisse Group AG, and U.K.-based HSBC Holdings PLC.

Credit Suisse increased its credit loss provisions in the first quarter to CHF568 million from CHF81 million a year ago. The bank has adapted its investment banking arm to focus on wealth management in recent years and still expects to reach a return on tangible equity of 10% this year.

HSBC reported sharply lower first-quarter profits and set aside $3.03 billion to cover bad loans, up from $585 million a year earlier. CEO Noel Quinn said he expected the bank's CET1 ratio to fall below 14% in the second quarter but said he believed regulators were comfortable with this as long as the bank supported lending in the U.K. and Hong Kong.