|

A haul truck moves across Peabody Energy's North Antelope Rochelle coal mine in the Powder River Basin. |

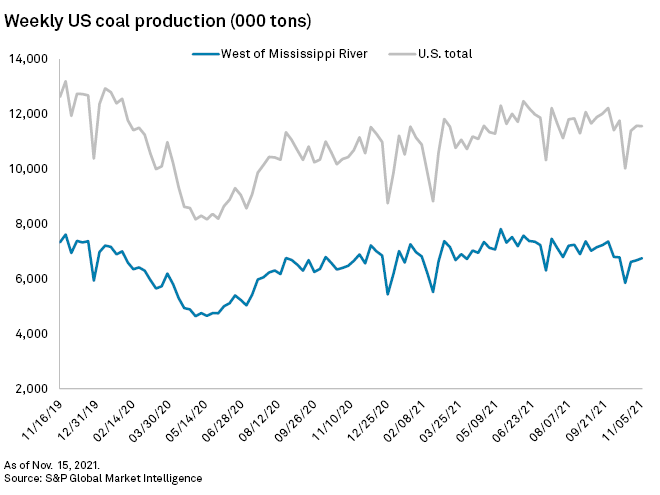

U.S. coal producers west of the Mississippi River rapidly scaled production in the third quarter as tight U.S. coal supplies and high natural gas prices spurred demand.

Led by Western U.S. coal producers, particularly those in the Powder River Basin, mining volumes have surged off of 2020's pandemic-driven lows. While ongoing coal-fired power plant retirements and a dearth of new coal plants on the drawing board points toward a long-term secular decline, the scramble for coal in recent weeks boosted the bottom line for many U.S. coal companies ready to meet demand.

Miners in the Powder River Basin, the largest coal mining region in the U.S., ramped up production in the third quarter to 10.3% over second-quarter production and more than 16.0% compared to the same period a year ago. Meanwhile, in the less prolific Uinta Basin, coal producers mined 17.2% more coal quarter to quarter and 14.0% more volume than the same mines generated in the third quarter of 2021.

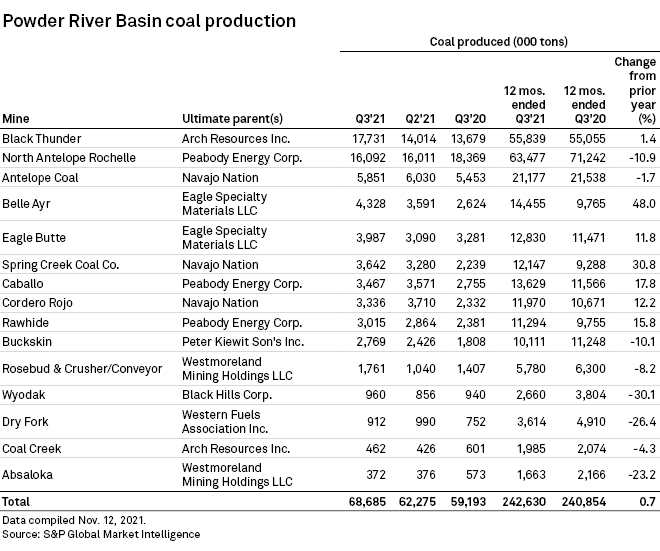

Nation's largest coal basin leads surge

|

Peabody Energy Corp. President and CEO James Grech said on an Oct. 28 earnings call that utilities consumed 30% more Powder River Basin coal in the first nine months of 2021 compared to the prior year. The executive noted that high forward natural gas prices and strong coal export demand were supporting higher coal prices.

The largest coal miner by volume in the basin, Peabody is trending toward the upper end of its annual guidance.

"We currently have some uncommitted tons for 2022," Grech said. "However, given current demand exceeds supply, we are only selling those uncommitted tons under multiyear contracts."

St. Louis-based Peabody is one of many U.S. coal miners that reported nearly sold out or completely sold out coal volumes through 2022. Despite higher coal prices, investment in new supply remains scant as many companies in the sector continue to have limited access to capital and face the prospect of a long-term secular decline in coal use.

Peabody's largest mine, North Antelope Rochelle, produced 16.1 million tons of coal in the third quarter, up just slightly from 16.0 million tons produced in the prior quarter and down from 18.4 million tons produced in the year-ago period.

Meanwhile, Arch Resources Inc. drastically ramped up production at its Black Thunder mine, mining 17.7 million tons of coal in the third quarter, an increase of 26.5% over the prior quarter. The production growth was enough to vault Black Thunder's production total over that of the North Antelope Rochelle mine — long the top producing coal mine in the U.S. — for the first time since the third quarter of 2015.

Still, Arch executives have long-term plans to wind down production at the mine and its other thermal coal operations as the company shifts its focus to metallurgical coal operations in the Eastern U.S.

Arch is first focusing on closing its smaller Coal Creek mine and reclaiming the operation. The company recently announced that it would contribute at least $15 million in the fourth quarter and $30 million in 2022 toward a sinking fund for closing mines that produce thermal coal used in electricity generation.

"Given the strong committed book of thermal business we now have in place for 2022 and beyond, we should be in an excellent position to continue to build this fund during future periods in a smart and systematic manner using cash generated from our thermal assets," Arch President and CEO Paul Lang said on an Oct. 26 call.

In the third quarter, the Black Thunder mine produced more than a quarter of the total coal produced in the Powder River Basin.

Eagle Specialty Materials LLC also substantially increased production to 8.3 million tons at its two mines in the basin, up from 6.7 million tons in the prior quarter and 5.9 million tons in the year-ago period. Eagle Specialty acquired the mines after completing a bonding deal with its previous owners related to surety bonds for eventual mine reclamation.

The Navajo Nation's Navajo Transitional Energy Co. LLC, another relative newcomer to the basin, mined 12.8 million tons of coal in the third quarter. That is down slightly from the prior quarter, but a substantial increase from the 10.0 million tons of coal produced by the same three former Cloud Peak Energy Inc. thermal coal mines in the same quarter of 2020.

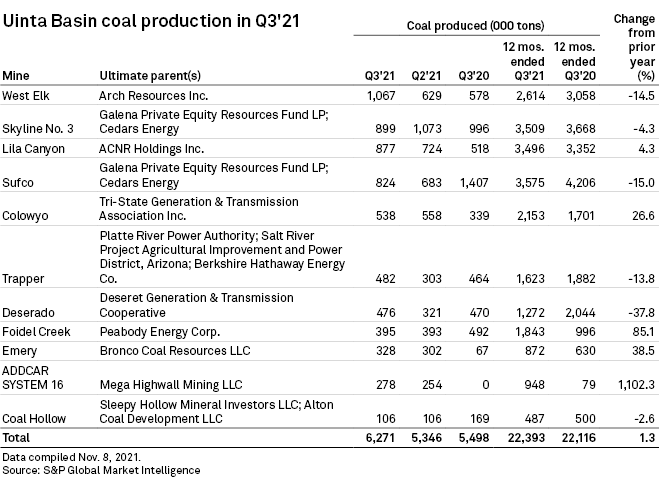

Uinta Basin is also on the rise

|

Despite plans to pivot away from thermal coal, the recent uptick in prices also allowed an Arch mine to claim the mantle of top producer in the much smaller Uinta Basin.

Producers, located in Colorado and Utah, generally sell coal to be used for electricity generation. They mined 6.3 million tons of coal in the third quarter, an increase of 17.2% from the prior quarter. The increase was largely driven by an uptick at Arch's West Elk mine.

Peabody's Foidel Creek mine, the only other mine operated by a publicly-traded company in the basin, mined about 394,545 tons of coal in the third quarter, roughly in line with the prior quarter but down from 491,874 tons produced in the prior-year quarter.