As many nations near the anniversary of social restrictions aimed at slowing the spread of COVID-19, hopes for economic recovery have been closely tied to the rollout of a growing number of approved vaccines.

But a reliance on regions pulling out of the pandemic together, as well as countries' varying vaccination efforts, means estimates for when this recovery will occur range from as early as the second quarter to the end of the year.

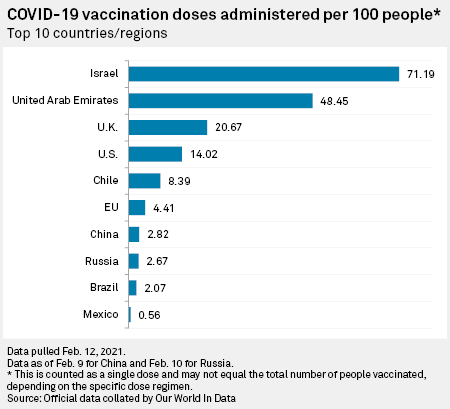

While Israel currently leads the way in vaccinations, followed by the United Arab Emirates, the U.K. and the U.S., HSBC Global Research analysts tracking global reopening efforts warned that predicting when the global economy will return to some semblance of normalcy is difficult due to the varying approaches, new emerging strains of the virus and rising case numbers. The company sees conditions becoming "more normal again at some point in 2021, resulting in higher GDP growth."

The reward for winning this race, economists said, could be a strengthening of a country's currency, a relatively higher bounce in GDP and, potentially, larger gains in the labor market and consumer spending than will be seen in nations slower to vaccinate their populations.

"Right now, every country that is able to is in a full-on sprint to get people vaccinated," Claudia Sahm, a former U.S. Federal Reserve economist, told S&P Global Market Intelligence.

Vaccinations, Sahm added, are key for the U.S. to move beyond the economic impacts of the coronavirus pandemic, which has strained all corners of the domestic and global economy.

"Economies that are able to get 'back to normal' relatively quickly should gain market share and a leg up on the competition," said Matt Weller, global head of market research at GAIN Capital.

S&P Global Ratings said it believes that continued improvements in vaccination rates, along with some further key positive developments — specifically the approval of additional vaccines such as Johnson & Johnson's candidate — could enable the U.S. to achieve herd immunity, which it estimates as a 70% vaccination rate, or about 230 million individuals immunized, by near midyear.

"However, it remains difficult," the rating agency added in its Feb. 11 report.

Aggressive interventions

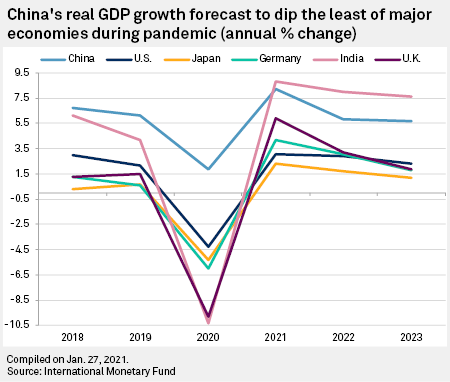

While not a vaccination effort, China's aggressive interventions to limit the virus's spread last year helped push up its GDP growth at a higher rate than other, major developed economies, Weller pointed out.

"A similar dynamic could be at play in the first half of this year for countries that are able to distribute vaccines effectively," Weller said. "With more virulent mutations of COVID-19 spreading rapidly across the globe, the pace of vaccinations will be the most important storyline to watch through the first half of the year."

|

The first Western country to approve a coronavirus vaccine, the U.K. has since made an important start to its ambitious vaccination program, said David Salisbury, chair of the World Health Organization's Global Commission for Certification of Polio Eradication. However, he thinks the government is correct to resist attempts to tie a specific vaccination target to when the country can emerge from lockdown.

"The focus, probably rightly, right now is getting as much vaccine into the risk groups, and we have not had insight into what they're going to do after that," Salisbury told S&P Global Market Intelligence.

"We've heard about the 'sunny uplands' of Easter. We've heard about life going back to normal — I think those are optimistic. But it depends on where you make your cut: what is an acceptable level of ongoing disease?"

Both the U.K.'s and U.S.' relative successes in securing vaccines have exceeded efforts throughout much of the EU, said James Knightley, ING's chief international economist, with a slow start potentially pushing a full reopening of Europe's economy to the fourth quarter. By comparison, a successful effort in the U.S. and U.K. could lead to a full reopening as soon as the second quarter of this year, Knightley said.

However, Marta Wieczorek, coordinating spokesperson for economic and financial affairs, jobs and social rights at the European Commission, said good news on the vaccine front had boosted expectations of a faster recovery across the EU.

"If vaccines are made available to all Europeans over the course of 2021, we could see a swifter-than-expected return of GDP to its pre-pandemic levels," Wieczorek told S&P Global Market Intelligence. "Higher demand would boost consumption and bring forward private investment, in turn significantly lifting recovery prospects for the EU."

Even a successful vaccination program, however, could result in uneven economic effects, said Michael Hewson, chief market analyst at CMC Markets. Restaurants and bars, for example, might quickly recover, but a vaccinated population in a single country might do little to help airlines and rest of the travel industry rebound.

"Even if someone is vaccinated and able to travel, they may well not want to if the country they are traveling to isn't fully reopen in terms of its economy, due to being behind in their own vaccine program," Hewson said.

|

'A COVID-19 world'

Oren Klachkin, lead economist with Oxford Economics, agreed that the economic effects of vaccinations will likely be slow to fully take root. "I'd note that no nation is an island — travel is one of the main vectors through which the virus and its mutations are spread — and so it's not until most regions achieve herd immunity will the global economy get fully back up on its feet," Klachkin said.

An uneven economic recovery will likely worsen financial disparities between developed and developing countries as nations with earlier access to vaccines reopen faster, said former Federal Reserve economist Sahm.

"That's going to push the haves and the have-nots on an international scale in very different directions," she said. It could also disrupt trading relationships as flows between the U.S. and India, for example, could be hindered.

As the pandemic wears on, the business community and citizens seem to be adapting to the ebb and flow of lockdowns, which to HSBC suggests at least further restrictions may mean lesser damage to the global economy.

"The better news from Europe is that the lockdowns in the second wave in late 2020 were much less damaging for growth than the first as companies and households adapted to living in a COVID-19 world," HSBC added.