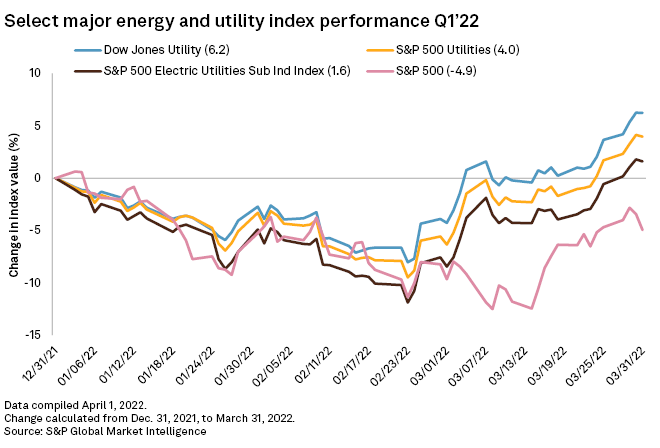

Electric and multi-utility stocks capped the first quarter of 2022 with modest gains, outperforming the broader S&P 500 market, which closed the period in the red.

Markets saw a massive shift in mid-January brought on by inflation concerns, and they took a dive in February after Russia invaded Ukraine.

At the end of March, the S&P 500 Utilities Index had risen 4% year-to-date, the Dow Jones Utility Index climbed 6.2% and the S&P 500 Electric Utilities Sub Ind Index was up 1.6%. The S&P 500 Index logged a negative return of 4.9%.

Among utilities covered by S&P Global Market Intelligence, Sempra took the lead with a 27.1% share price gain, closing the first quarter at $168.12. The company proposed design changes to the expansion of its Cameron LNG export terminal that would lower the overall production capacity and postpone the timeline for commercially sanctioning the project to 2023.

NiSource Inc. recorded a share price increase of 15.2% to $31.80. NiSource President and CEO Lloyd Yates said management will consider asset divestments and purchases as part of a strategic review of the Midwest and mid-Atlantic multi-utility's business.

Consolidated Edison Inc., which logged an increase of 11% to end the quarter at $94.68, confirmed that it will "explore strategic alternatives" for its unregulated Con Edison Clean Energy Businesses Inc. subsidiary.

American Electric Power Co. Inc., Pinnacle West Capital Corp. and DTE Energy Co. joined the list of top-performing utility stocks, all recording double-digit gains.

Meanwhile, Exelon Corp. shed 17.5% during the quarter, as it completed the separation from its Constellation Energy business in early February. Exelon's management previously said the company's transformation into a pure-play transmission and distribution utility could significantly boost its equity valuation, with opportunities to invest in electric vehicle infrastructure and grid resiliency.

NRG Energy Inc.'s share price dipped 11% in the first quarter to $38.36. On Feb. 24, the independent power producer announced a lower financial impact from the arctic freeze at $380 million, compared to the expected range of $500 million to $700 million.

NextEra Energy Inc. logged a 9.3% share price decrease to $84.71.

The Juno Beach, Fla.-headquartered utility shed about $18.5 billion of market capitalization over two days in January as Wall Street signaled it was surprised by the announcement that John Ketchum will replace Jim Robo as president and CEO of the company.

Otter Tail Corp., Avangrid Inc. and PPL Corp. also recorded share price declines in the first quarter.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.