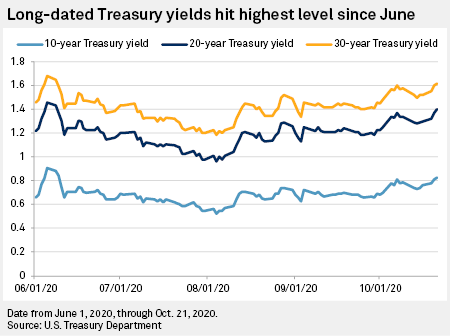

The potential of a Joe Biden victory along with a Democratic Senate majority is driving long-dated U.S. Treasury yields to highs not seen since early June, with investors expecting higher inflation as the likelihood of elevated government spending grows.

"The main factor is undoubtedly what we like to call the 'Biden reflation trade,'" said Antoine Bouvet, a senior rates strategist with ING. "In short, the market is pricing a greater growth and inflation prospect in the U.S. due to more pro-growth fiscal policy in case of a Democrat sweep at next month's election."

On Oct. 22, the 10-year Treasury yield settled at 0.87%, up 5 basis points from Oct. 21 and the highest level since June 8. The 20-year and 30-year yields settled at 1.43% and 1.67%, respectively, up 3 and 5 basis points from Oct. 21. It was the highest yield for the 20-year since June 8 and the highest for the 30-year since June 5.

The difference between 2-year and 10-year note yields was 0.71 percentage point on Oct. 22, the most since February 2018. That compares with 0.55 percentage point a month ago and 0.18 percentage point a year ago.

With the Federal Reserve committed to keeping rates low and a pledge to raise them only once inflation has risen durably above the 2% target, the long end of the yield curve is facing more upward pressure than the short end.

"The market is starting to price that they might be able to achieve this inflation goal going forward," said Patrick Leary, chief market strategist and senior trader at Incapital.

Leary agreed that the recent climb in long Treasury yields signals that the market is pricing in the higher likelihood of a "blue wave," with Democratic nominee Joe Biden winning the presidency and Democrats controlling Congress. They now control the House but need to gain at least three Senate seats for control of the upper chamber.

"If this happens, there will be even more spending and more borrowing," Leary said. "More supply should mean lower prices and higher yields, all things equal."

De facto yield-curve control

But accommodative Fed policy during the pandemic, including additional purchases by the central bank of longer-term securities, is likely to keep government bond yields from climbing much from current levels, Leary said.

"While we don't know the level it would take to get them to do this, the market knows that there is a level that would cause them to act, and as such they are achieving de facto yield curve control," Leary said. "I feel comfortable saying that 10-year yields would be comfortably above 1% if the prospects of Fed purchases were not waiting in the wings."