| U.S. utility sector analysts are closely watching how companies plan to mitigate rising fuel prices and stagflation. Source: Ron and Patty Thomas/Getty Images |

Concerns about inflation and rising fuel costs are likely to weigh on the U.S. utility sector heading into third-quarter updates.

Utilities and their investors are also keeping a close eye on Washington and any developments related to U.S. President Joe Biden's infrastructure investment and clean energy agenda.

"There could be a fair number of questions regarding the outlook for federal legislation and the energy transition," Glenrock Associates LLC analyst Paul Patterson told S&P Global Market Intelligence. "Continuing questions about the outlook for inflation in general and fuel costs in particular are likely to come up, including their potential impact on the industry and regulatory environment."

Sector analysts are particularly concerned that the emerging risk of stagflation, which describes a period of high inflation and stagnant economic growth, may pressure utilities to increase customer bills and could drive down equity values.

"Although utilities appear cheap on various valuation metrics, in an atmosphere of stagflation we would expect utilities to underperform because of political and regulatory pushback with respect to the effect of a higher bill," Mizuho Securities USA LLC Managing Director Paul Fremont said in an interview. "The most immediate driver of that would be higher fuel and power purchase costs, given commodity prices for gas and coal are up and electricity prices most closely correlate to gas."

Combined with higher construction costs as supply chain crunches drive up prices for materials, he continued, "you've got two big upward pushes" on what customers pay for electricity should stagflation materialize.

Eyes on mitigation

Analysts at KeyBanc Capital Markets agreed in an Oct. 18 note to clients that utilities would not be "clear beneficiaries" of such a macroeconomic shift and must explain to investors how they plan to mitigate one.

"So far, most companies in our coverage universe have not articulated their concerns and positioning in this environment," they wrote. "We expect inflationary and energy cost pressures to attract greater attention during the [third-quarter] reporting season."

Despite the threat of weaker share prices, Scotia Capital (USA) Inc. analyst Andrew Weisel said the firm remains "fundamentally bullish on the group given historically strong growth outlooks with below-average regulatory risks."

"The majority of our recent conversations with investors have included, if not focused on, discussions about the impacts of spiking natural gas prices," Weisel wrote in an Oct. 19 research report, adding that this will be a "key issue" discussed on earnings calls heading into winter heating season, though gas costs shouldn't impact earnings.

Earnings beats/misses

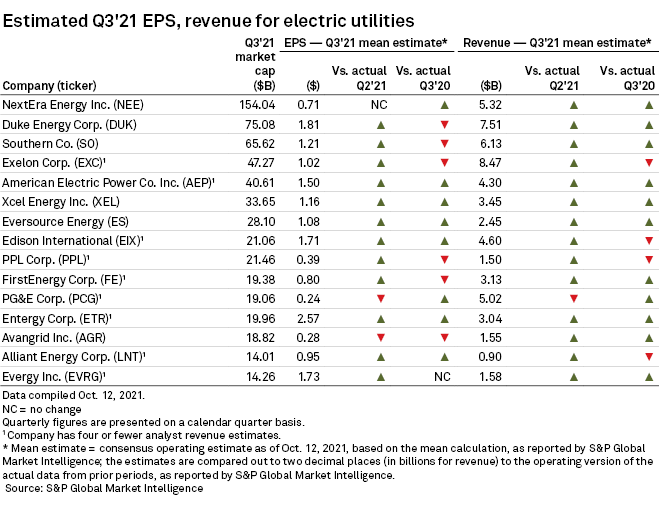

The majority of U.S. investor-owned electric utilities are expected to report positive earnings results for the third quarter of 2021, according to an S&P Global Market Intelligence analysis of S&P Capital IQ consensus estimates.

The mean earnings per share estimates for eight of the top 15 U.S. electric utilities are higher than actual third-quarter 2020 results, the analysis shows. A dozen of the top electric utilities are expected to report quarter-over-quarter gains.

For American Electric Power Co. Inc., Xcel Energy Inc., Edison International, Eversource Energy, Entergy Corp. and Alliant Energy Corp., the mean estimate is higher than actual second-quarter and prior-year results.

Duke Energy Corp., Southern Co., FirstEnergy Corp., Avangrid Inc. and Evergy Inc. are forecast to join AEP, Xcel Energy, Eversource and Entergy in reporting revenue gains versus prior-quarter and third-quarter 2020 results.

NextEra Energy Inc. on Oct. 20 reported a drop in profit for the third quarter as its expenses increased.

The Juno Beach, Fla.-headquartered utility posted net income of $447 million, compared with $1.23 billion in the third quarter of 2020. Adjusted earnings were 75 cents per share compared to a final S&P Capital IQ consensus estimate of 72 cents per share.

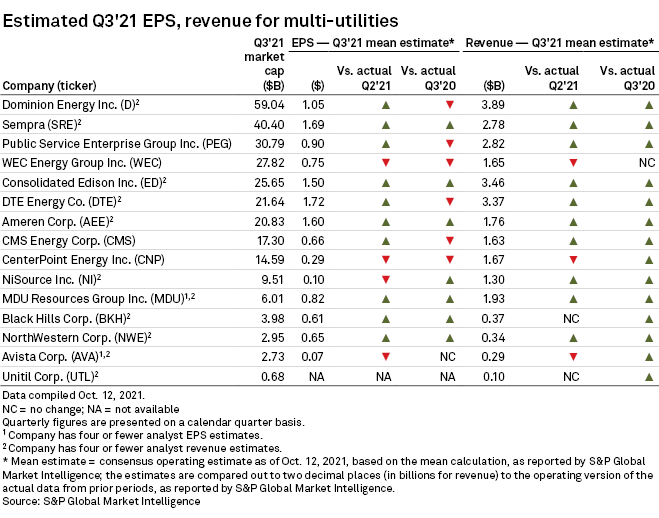

In the multiutilities sector, several companies with large gas and electric businesses could see a boost in third-quarter earnings based on consensus estimates, the analysis shows.

The mean EPS estimates for Sempra, Consolidated Edison Inc., Ameren Corp., MDU Resources Group Inc., Black Hills Corp. and NorthWestern Corp. are higher than actual second-quarter and year-over-year results.

WEC Energy Group Inc. and CenterPoint Energy Inc. are forecast to report lower earnings results compared to the previous quarter and third quarter of 2020.

In addition, the bulk of the top 15 U.S. multiutilities are expected to report an uptick in revenue versus the second quarter of this year and third quarter of 2020. The group includes Dominion Energy Inc., Sempra, Public Service Enterprise Group Inc., Consolidated Edison, DTE Energy Co., Ameren, CMS Energy Corp., NiSource Inc., MDU Resources and NorthWestern.

"At a high level we see [about] 35% of our regulated utility coverage above current consensus estimates," BMO Capital Markets analyst James Thalacker wrote in an Oct. 19 research report, "but similar to 2Q21, the group as a whole is likely to have flattish [quarter-over-quarter] comps given more normal weather and the impacts of asset divestitures including CMS and DTE."

Noteworthy updates

Outside of macroeconomic trends and earnings results, Wall Street is monitoring updates to capital spending, earnings guidance and longer-term financial outlooks.

"In general, the third quarter is the most important quarter of the year given utility load profiles and the potential for weather-related impacts in certain regions of the country," Thalacker wrote. "Furthermore, many companies will update their 2021 guidance with line-of-sight to the end of the year."

BMO Capital Markets, however, does not expect "any material changes" to 2021 full-year guidance with most utilities "tightening their guidance ranges with a bias to the upper end."

Weisel expects many companies to "roll forward" their capex plans with modest increases as companies focus on clean generation opportunities and infrastructure improvements.

"That said, we expect that some might actually reduce 2022 capex forecasts due to affordability concerns and delays to certain solar capacity additions," Weisel wrote.