Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Mar, 2021

| Then-presidential candidate Joe Biden delivers remarks on his campaign's "Build Back Better" energy economic plan on July 14, 2020, in Wilmington, Del. Source: Chip Somodevilla/Getty Images News via Getty Images |

With a new White House and Congress firmly in place, U.S. electric utilities are sharing their ideas on how to pursue President Joe Biden's goal of achieving net-zero carbon dioxide emissions from the power sector by 2035.

Most large utilities are already working to cut carbon emissions, and some with lower-emitting portfolios have welcomed Biden's proposal. But generators have broadly urged caution amid resilience concerns following recent power outages in Texas and as a wave of new natural gas-fired plants is planned to come online.

"Now we have the Biden administration, and the Biden administration wants to see a carbon-neutral electricity system by 2035," former U.S. Energy Secretary Ernest Moniz said at CERAWeek by IHS Markit. "I think even the forward-leaning utility executives kind of swallow hard on that one, but what's interesting is they're working at it."

Such reservations could shape congressional action in the coming months, with Democrats in the U.S. House of Representatives introducing a bill in early March to fulfill Biden's power-sector goal through a federal clean electricity standard, or CES. Democrats are also looking to craft an infrastructure package later this year that could incorporate key pieces of Biden's climate plan, including a potential CES.

"While we share the president's goal of delivering 100% carbon-free electricity to our customers, it is important to achieve this goal in the right way," said Xcel Energy Inc., which has a goal to reduce its carbon emissions 80% by 2030 and be carbon-free by 2050. "Our strategy is subject to the guardrails of affordability and reliability."

Importance of natural gas

Xcel said it can comfortably reduce emissions by 80% using wind and solar energy and other current technologies. But the solutions needed to eliminate carbon entirely "are not available today," the company maintained, meaning it "must employ dispatchable generation using today's technologies, primarily natural gas-fired generation."

Xcel is not alone in projecting continued reliance on gas in the near term. Nearly 33 GW of new U.S. gas-fired generation is slated to come online between 2021 and 2022, according to data compiled by S&P Global Market Intelligence. Another 27 GW is scheduled to enter service between 2023 and 2027, S&P data showed.

Utilities by and large are not ready to pull the plug on gas-fired generation, given the fuel's role in supporting the increasing share of electricity from more intermittent renewable energy sources.

"At this point, we're not taking natural gas off of the agenda because we see it as a resource that allows us to reduce carbon as we close coal plants and allows us to maintain reliability, recognizing at the same time that we're also looking closely at the technologies that are under development," Duke Energy Corp. Chair, President and CEO Lynn Good told S&P Global Market Intelligence. "And when they are at a point to be scaled, we'll of course be anxious to do that."

American Electric Power Co. Inc. also sees natural gas as an important part of its future generation mix.

"We definitely see natural gas as a bridge fuel at a minimum," AEP Executive Vice President and COO Lisa Barton said. "You need to be able to balance the variability of renewables."

"If you really think of a truly electrified economy, the need for reliability is that much more intensified," the COO added.

To get to 100% zero-emissions power, Xcel urged additional funding and support for clean energy research and development and policies that "promote the cost-effective transformation of the electric system."

Rural electric cooperatives also stressed the importance of affordability and reliability in their business models, which could present a challenge depending on the regulatory regime the Biden administration seeks to implement to reach its decarbonization targets.

"Without the technology of an always-available, carbon-free generating source, there are some challenges," said Louis Finkel, senior vice president of government relations for the National Rural Electric Cooperative Association. "It's not one of the challenges that you have to solve. It's all of it. It's a combination of a reasonable and realistic timeline that recognizes the regional disparity and regional access to resources and the need for technological breakthroughs."

Utility optimism

Despite those reservations, Exelon Corp., which generates over 60% of its power from nuclear plants, is "heartened to see the administration set the carbon-free power sector goal by 2035," the company's executive vice president of government and regulatory affairs and public policy, Kathleen Barrón, said during a Feb. 24 earnings call.

In a separate interview, Barrón said Exelon could support a wide range of potential climate policies, including a CES, as long as they maintain existing carbon-free generation. Nuclear power currently makes up 20% of U.S. generation and a substantial portion of its carbon-free electricity. But the U.S. nuclear fleet faces "significant risk," she added, with about 75% of nuclear plants in the Midwest and Northeast having retired, announced premature closure or been saved from early retirement by state policies.

"It's time for the federal policies to catch up and include existing nuclear within the scope of technology that we want to both maintain and add to the system," Barrón said. "Losing 20% of your power supply when all... of that is carbon-free is a major step backward."

At least one California utility welcomed the Biden administration's targets, given their closer alignment to what the state has worked toward for years. The 2035 target presents a challenge for the power sector, but the technology, namely wind and solar generation, is available and continues to become more efficient and economical, said Caroline Choi, senior vice president of corporate affairs for Edison International. Reaching Biden's goal is "absolutely doable," Choi said.

"It will take investment, it will take planning," Choi said. "At the end of the day, all those things are skills that the utilities and other industries have. It's just a matter of will, honestly, and it's a big change."

Duke Energy's Good said the company is "anxious" to work with the Biden administration on its climate and energy goals.

"I think it's clear that the Biden administration cares deeply about climate, as do we," Good told S&P Global Market Intelligence. "I think the administration also understands the magnitude of this change. I'm pleased to see a focus on research and development, for example, recognizing that new technologies are going to be needed in the 2030s and the 2040s to get to net-zero."

Duke Energy, which is targeting a 50% reduction of carbon emissions by 2030 from 2005 levels and net-zero emissions by 2050, has been working on the development of several new technologies from advanced nuclear to long-duration battery storage. "I would point to hydrogen as something we've spent a lot of time on," Good added.

Still, the U.S. will likely need to ramp up the development of new technologies to meet Biden's ambitious plan to achieve a carbon-free power sector by 2035.

"You know, I never count the U.S. out on technology development. ... But I think it's important to recognize that reliability is also something that our customers and communities value," Good said. "I think particularly during this COVID period, it's never been clearer how essential our service is."

AEP's Barton said transmission is another essential component to ensuring grid reliability and enabling the clean energy transition.

"Some of the best wind in the world lies in the Central Plains of the United States and being able to harvest that natural resource requires transmission," Barton said in a Feb. 11 phone interview.

Some utilities, investors remain skeptical

While the industry has made "incredible steps forward," AEP's Barton pointed to challenges with the pace and costs of some decarbonization targets, "particularly if you're looking at a 2035 timeline."

"What concerns the industry as a whole is 2035, and what you're hearing from the industry is a recognition that we need to get it right," she said. "We can't compromise reliability."

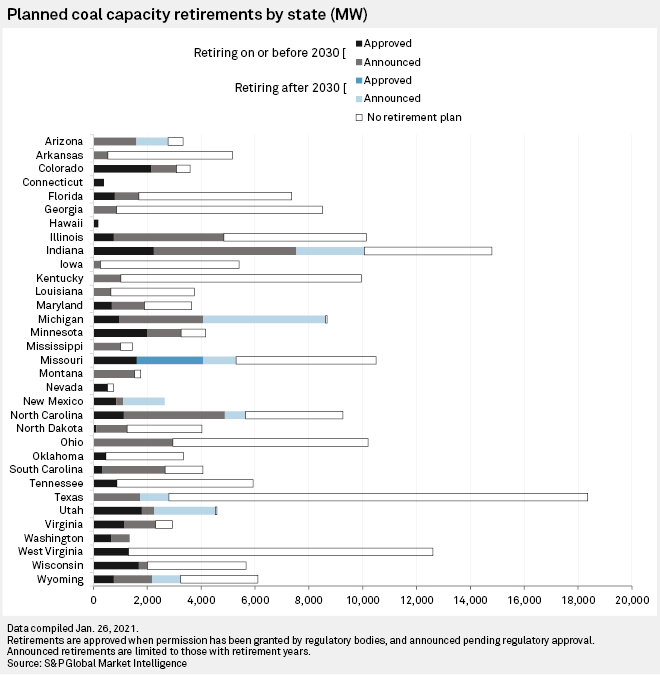

On Feb. 25, AEP accelerated its carbon reduction goals to achieve an 80% reduction in emissions by 2030 and net-zero emissions by 2050 from a 2000 baseline. The company plans to add more than 10,000 MW of wind and solar generation by 2030 while pursuing the retirement of about 5,600 MW of coal-fired generation over the next decade, a 46% reduction in coal capacity from 2020.

"We don't have the technologies today that we need to get to net-zero," Barton said. "So 2035, that becomes even harder."

Wall Street also is skeptical of a carbon-free power sector by 2035.

"I don't think you can do carbon-free by 2035 unless you ramp up new nuclear construction," CreditSights analyst Andrew DeVries said in a phone interview.

"You can certainly kick coal off the grid by 2035 or 2030 if you tighten the screws with the EPA," DeVries said. He added that the challenge is that batteries used to backup renewable capacity are still "incredibly expensive" and cannot yet be deployed universally.

The CreditSights analyst asserted that efforts to reach the Biden administration's policy goals will produce winners and losers in the utility industry from a financial perspective. Biden's push toward full electrification would be "horrendous for gas," DeVries said, but would be a huge financial benefit for electric utilities.

"I think [investor-owned electric utilities] are not just embracing it; they are full-on encouraging it," DeVries said.

IHS Markit is subject to a merger with S&P Global pending regulatory and other customary approvals.