Legislation in Congress to curb alleged anti-competitive trade practices by China has divided the U.S. solar industry, with domestic solar manufacturers cheering the bill's trade provisions but power project developers expressing concern about their potential cost impacts.

The U.S. House of Representatives passed the America COMPETES Act on Feb. 4, which seeks to help the U.S. compete against China on technology and innovation. The bill includes provisions designed to crack down on imports from countries or companies seeking to avoid antidumping and countervailing duties, or AD/CVD.

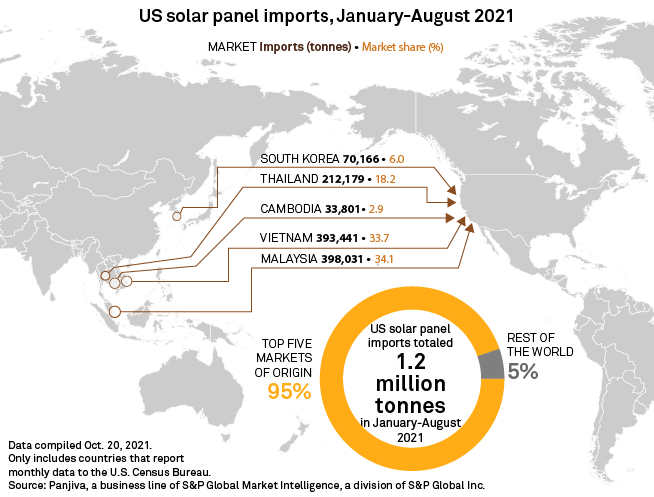

In particular, the proposals respond to concerns that China, a dominant global supplier of solar power components, is transshipping exports through other countries or shifting production to Thailand, Vietnam, Malaysia and Cambodia to circumvent AD/CVD restrictions.

Such actions are undermining efforts to build a domestic solar supply chain as the Biden administration and utilities seek to decarbonize power generation, U.S. manufacturers said. Southeast Asian countries supply most U.S. solar panel imports, with few entering the country directly from China.

To address circumvention concerns, the America COMPETES Act would require the U.S. Commerce Department to begin a circumvention inquiry whenever an interested party files a petition.

The bill would also require the Commerce Department to begin an inquiry within 30 days of a party filing a request and make a preliminary determination within 90 days of starting the investigation. A final decision would be due within 120 days of Commerce publishing its initial determination.

Under current rules, Commerce must determine within 30 days whether to begin a circumvention request. If initiated, Commerce is required to issue its final determination within 300 days or, if extended, within 365 days.

The America COMPETES Act would also allow Commerce to simultaneously launch a circumvention inquiry while issuing a preliminary determination if the alleged trade abuse is similar to that in a prior final determination. Furthermore, the bill would codify Commerce's ability to issue both companywide and countrywide circumvention findings.

Bill targets 'whack-a-mole problem'

U.S. solar manufacturers have cheered the America COMPETES Act's circumvention provisions.

The proposed law "would address the whack-a-mole problem ... where Commerce has already found circumvention and then the pattern is repeated by other companies and importers," said Timothy Brightbill, an attorney at Wiley Rein LLP who has represented domestic solar equipment-makers in favor of trade cases against China.

The America COMPETES Act's circumvention language mirrors a bipartisan proposal from U.S. Sens. Sherrod Brown, D-Ohio, and Rob Portman, R-Ohio. A companion bill was introduced in the House by U.S. Reps. Terri Sewell, D-Ala., and Bill Johnson, R-Ohio.

U.S. solar manufacturers support the bill and want it to be included in the Senate's version of the America COMPETES Act, dubbed the United States Innovation and Competition Act. The House and Senate plan to work out differences between their respective bills through a conference committee.

The circumvention proposals "would streamline trade relief, minimize uncertainty, and help ensure that U.S. manufacturers are able to compete on a level playing field," a group of domestic solar manufacturers said in a Jan. 25 letter to House and Senate leaders.

The letter was signed by representatives of Suniva Inc., First Solar Inc., Q Cells, Auxin Solar LLC and Heliene USA Inc.

Brightbill said the proposed circumvention safeguards could target "a significant percentage" of solar imports from Southeast Asian countries. But Brightbill and other proponents of the legislation stressed that the bill would merely help enforce existing trade laws.

"These are important provisions to strengthen and codify circumvention inquiries, but they are not a radical overhaul of how Commerce currently investigates circumvention," Brightbill said.

Solar installers not happy

Despite those assurances, U.S. solar energy installers are worried about the circumvention language, particularly after the White House recently chose to extend Section 201 tariffs on certain imported solar cells and panels.

The bill would limit the secretary of commerce's discretion on whether to initiate a circumvention investigation, said John Smirnow, vice president of market strategy and general counsel for the Solar Energy Industries Association, or SEIA. That policy change will allow more single-company petitions for AD/CVD relief that could have a "devastating impact" on domestic solar energy deployment, Smirnow said in an interview.

For example, Auxin Solar filed a circumvention petition in early February accusing Chinese makers of crystalline silicon solar cells and panels of assembling products in Malaysia, Thailand, Vietnam and Cambodia from components made in China to avoid paying AD/CVD.

"These countries represent about 80% of total [solar cell and panel] imports to the U.S. and nearly 70% of total panels installed in the U.S.," Smirnow said. If Commerce agrees to begin the investigation that Auxin requested, it could immediately result in duties of 50% to 250% on solar products sold in the U.S., Smirnow added.

Smirnow also criticized assertions from U.S. manufacturers that solar cell production in Southeast Asian countries relying on China-sourced inputs is a minor processing step that is not exempt from AD/CVD laws. If the America COMPETES Act limits Commerce's ability to reject investigation petitions, Smirnow warned that more challenges could be filed.

"If you remove the discretion from the secretary to initiate that, we're just going to see abuse of U.S. trade laws through that new provision," Smirnow said.

Rather than enact such reforms, Congress should give consumer groups such as SEIA "interested party standing" in AD/CVD proceedings, Smirnow said.

"They should allow for an organization like SEIA to have the same rights and obligations as an importer or a domestic producer has in these proceedings," Smirnow said. "We're definitely having conversations with [lawmakers on Capitol Hill] where we are raising our concerns about the circumvention provision."