Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

6 Sep, 2022

Demand for short-term vacation rentals in the U.S. reached record levels in July, continuing a trend of strong growth and defying the effects of rising inflation.

About 23 million nights were stayed at a U.S. short-term rental in July, up 18.2% year over year and 20.6% higher than the same month in 2019, according to AirDNA LLC, a research and data firm focused on the short-term rental industry.

Average daily rates also grew, up 3.7% year over year to $307, and 26% higher than pre-pandemic levels. Revenue per available room was up 22.6% in July, and 52% higher than the same month in 2019.

Hotels lag short-term rentals in recovery

During the pandemic, there was a sharp shift away from hotels to short-term rental properties, AirDNA Vice President of Research Jamie Lane said in an interview. While urban short-term rental properties were largely taken off the market by owners, leisure travel demand led to a large spike of new supply in areas with nearby mountains or beaches.

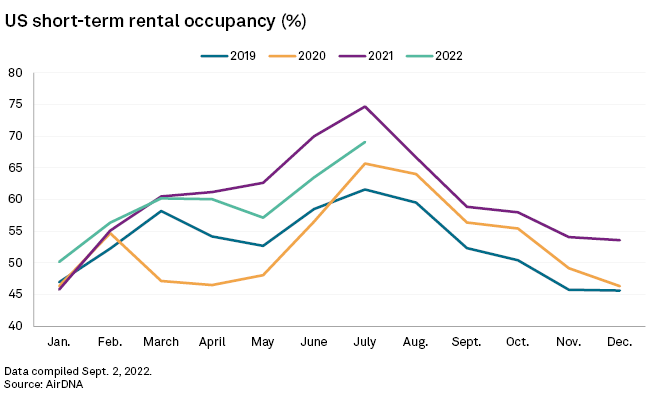

July occupancy was down 7.5% year over year to 69.1% but not for lack of demand. As of July, there has been a 25.5% year-over-year increase in available short-term rental nights that have come on to the market, AirDNA data showed.

Prolific short-term vacation rental platform Airbnb Inc. reported 103.7 million nights and experiences booked during the second quarter, the company's highest quarterly number ever and 24% higher than the same quarter in 2019.

While the short-term rental market was able to grow significantly in a year to accommodate demand, Lane said the hotel industry has less flexibility, growing supply by only 2% or 3% a year. As of April 2021, short-term rentals had recovered to pre-pandemic levels, but hotels are still not quite there.

"If hotels could pick up and move to non-urban areas, I'm sure they would have. But because they have fixed assets, they're waiting for demand to come back to the cities, waiting for business travel to fully recover, and for groups and meetings to sort of come back in earnest," Lane said.

Still, pent-up travel demand has helped hotel recovery in 2022. U.S. hotels reported an ADR of $159.08 in July, up by 17.5% from June 2019, according to STR. RevPAR averaged $110.73, 11.2% higher than June 2019, and hotel occupancy was 69.6%, down 5.4% from June 2019 levels, STR found.

Inflation not slowing bookings

Although inflation has begun to weigh on consumer spending, there has not been any discernable slowdown in the number of bookings or stays for short-term rentals, Lane said. In July, the number of future nights booked was up about 19% year over year.

The industry, however, is not completely immune. Lane said that some weakness is starting to appear in both the pricing power and occupancy of luxury and upscale short-term rentals.

"When there is typically weakness in the economy, generally we don't see trips immediately begin to start being canceled, but people start to trade down in quality," Lane said.

The other important trend to note is that while the number of American leisure travelers to Europe has soared over the summer, averaging only 11% below pre-pandemic levels, European leisure travel to the U.S. remains much lower, at 40% below pre-pandemic levels.

"A lot of that, we attribute to the strength of the dollar [and] how much more expensive it is for travel to the U.S.," Lane said.

Short-term rental market share growing

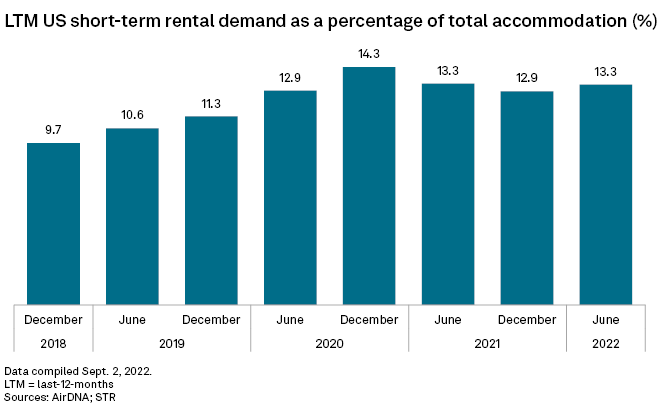

Short-term rentals have been gaining accommodation market share over the years, but the pandemic helped to accelerate that trend. In December 2018, short-term rentals accounted for 9.7% of total U.S. accommodation demand. As of June, that figure has jumped to 13.3%, AirDNA data showed.

Lane said short-term rentals will continue to take market share, with an expected increase of 1% over the next year. However, new supply is anticipated to slow, reflecting high interest rates and the elevated cost of purchasing homes.

For hotel operators, the biggest concern should be the growing number of people who have tried short-term rentals for the first time over the last few years, Lane said. In a typical year, about 25% of travelers who stayed in a short-term rental were trying it for the first time. During 2020 and 2021, that percentage soared past 40%.

"If that ends up being much stickier ... we could see the share of demand [for] staying in short-term rentals increase even more," Lane said.