As more U.S. shoppers return to stores this spring, e-commerce-driven services like curbside pickup that provided a lifeline during the early days of the pandemic could become a weight to the margins of major retailers.

Over the last year, a pandemic-induced e-commerce boom benefited brick-and-mortar retailers like Walmart Inc., Target Corp. and Costco Wholesale Corp., and their investments in omnichannel capabilities allowed them to capitalize on online demand. Consumer-related stimulus spending also helped lift same-store sales growth, which includes both digital and in-store transactions. But a slowdown in e-commerce is expected as COVID-19 case counts wane in many parts of the U.S., and higher labor and delivery costs could start making those online services less profitable, retail analysts said.

Last-mile delivery costs for online goods are notoriously expensive and time-consuming for the retailers, said Garrett Nelson, senior equity research analyst at CFRA. And workers who fulfill online orders for curbside pickup are often paid higher wages than most other store workers, Nelson added.

Also problematic are lingering COVID-19 related expenses that could eat into sales margins, along with rising commodity, freight and fuel costs, Nelson said. Major consumer products companies such as The Coca-Cola Co. and The Procter & Gamble Co. have recently announced price increases, which will likely be passed on to a more value-oriented shopper looking to spend less, Nelson said.

"We're seeing cost pressures that we haven't seen in a long time," Nelson said. "Comps are very difficult as we pass the one-year anniversary of the pandemic."

Companies will be working to offset increasing costs as consumers who previously spent more online during the pandemic become less concerned with safety and convenience.

"Eventually, they are going to start scrutinizing what they are paying for some of these delivery services or choosing a retailer that's closer by that has curbside," said Doug Hermanson, principal economist for Kantar.

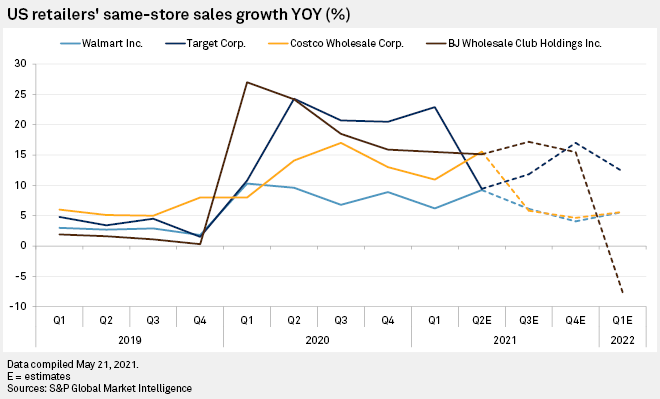

Costco and Walmart Inc. saw year-over-year increases in comparable same-store sales in 2020 with average quarterly increases of 13.0% and 8.9%, respectively, as online shopping during the pandemic helped boost profits. BJ's Wholesale Club Holdings Inc., a unit of Walmart, posted an average quarterly increase in same-store sales of 21.4% in 2020, followed close behind by Target, which saw an average quarterly increase of 19.1% throughout 2020.

According to S&P Capital IQ, analysts expect Walmart and Costco to see same-store sales growth shrink back down to below 5% in the second half of 2021. Meanwhile, analysts forecast Target to bounce back from an immediate dip to single-digit territory at 9.4% in the second quarter of 2021 to 17% at the end of 2021.

Michael Baker, managing director with D.A. Davidson who covers Walmart, said comparing this year's growth to last year will be tough, but companies could offset slowing e-commerce sales with improvements in-store traffic.

Both Walmart and Target reported a strong return to in-store shopping and a dip in digital sales in their most recent quarterly results. Walmart expects U.S. comparable sales to grow in the low single-digits during the second quarter, excluding fuel, while Target expects mid-to-high single-digit growth in comparable sales during the second quarter.

CFRA's Nelson said Walmart and Costco could see more of an impact on the bottom line because they are more tied to the grocery category, which was boosted by online shopping trends but is expected to decline as consumers increasingly eat away from home.

Target, however, is more favorably positioned because food and beverage only account for about 20% of its total net sales, and the company has more exposure to higher-margin general merchandise categories. Target has also become more proactive with minimum wage increases to $15 per hour, potentially making retention less of an issue, Nelson said.