Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Mar, 2023

U.S. shoppers spent slightly less than economists predicted in February.

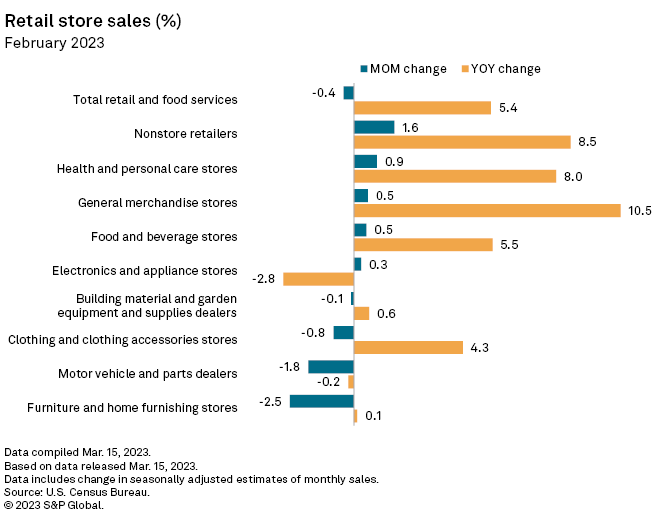

Retail and food services sales dropped 0.4% month over month, according to seasonally adjusted data released March 15 by the U.S. Census Bureau. Economists' estimates compiled by Econoday called for a 0.3% drop.

"Retail sales took a step back in February but not enough to signal a major deterioration in consumers' willingness to spend," Oren Klachkin, lead U.S. economist for Oxford Economics, said in a March 15 note. "Momentum may stay upbeat in the very near term, but we expect consumer spending to weaken later this year as income gains soften, excess savings run dry, borrowing costs rise, and inflation stays elevated."

Retail sales

U.S. retail and food services sales totaled $697.88 billion in February, down 0.4% from the revised $700.68 billion in sales the month prior. On an annual basis, sales rose 5.4%.

Sales for nonstore retailers — a category that includes e-commerce, door-to-door sales and vending machines — grew 1.6% to $112.72 billion, the largest month-over-month increase of any retail category. Sales at health and personal care stores followed, up 0.9% month over month to $34.80 billion.

Furniture and home furnishing stores registered the biggest drop in sales, down 2.5% month over month to $12.05 billion.

* Click here to set email alerts for future Data Dispatch articles.

* For more bankruptcy analysis, check out the monthly Bankruptcy series.

Default risk

Default risks remained relatively unchanged for the retail sector overall compared to the month prior, according to S&P Global Market Intelligence's Market Signal Probability of Default model.

The median probability of default score for all publicly traded U.S. retailers grew only slightly, hitting 3.12% on March 14 from 3.08% a month earlier.

Internet and direct marketing retailers continued to score the highest risk of default at 9.6% on a median basis, up from 7.6% a month earlier.

Scores produced by the model represent the odds of default within a year and are based primarily on the volatility of share prices for public companies in the sector, accounting for country- and industry-related risks.

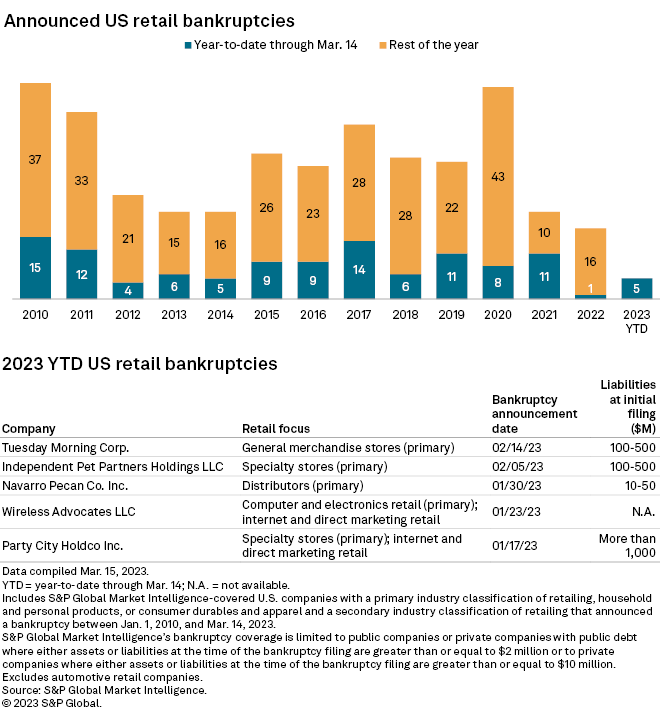

Bankruptcies

There were no new retail bankruptcies in the past month, according to Market Intelligence data.

Total retail bankruptcy filings year to date sit at five as of March 14, compared to only one over the same time period the year prior.

Party City Holdco Inc.'s Chapter 11 filing on Jan. 17 marked the largest retail bankruptcy thus far, listing both assets and liabilities at more than $1 billion.

Another prominent retail filing was Tuesday Morning Corp., which listed assets and liabilities each in the range between $100 million and $500 million. This marked Tuesday Morning's second bankruptcy filing in recent years, after reorganizing and emerging from its prior filing in 2020 during the COVID-19 pandemic.