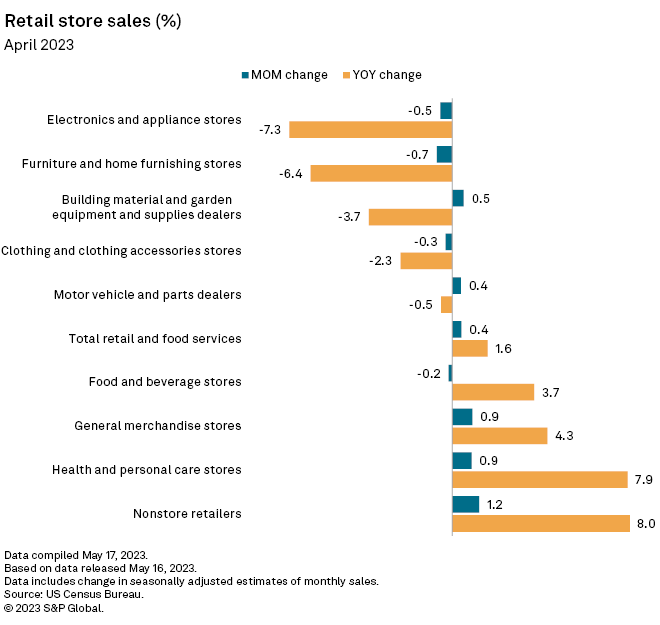

US retail sales returned to monthly growth in April after a two-month downturn, though the bounce back was weaker than economists expected.

Retail and food service sales rose 0.4% month over month in April, following a revised 0.7% drop in March from February, according to US Census Bureau data released May 16. April's increase was less than the consensus estimate of 0.7% growth, according to data compiled by Econoday. While sales grew in April, consumers face sticky inflation, tighter credit standards and a potential labor market slowdown that all threaten to curb spending.

"With storm clouds gathering on the horizon, we think consumer spending will soon run out of steam," Oren Klachkin, lead US economist for Oxford Economics, said in a May 16 note.

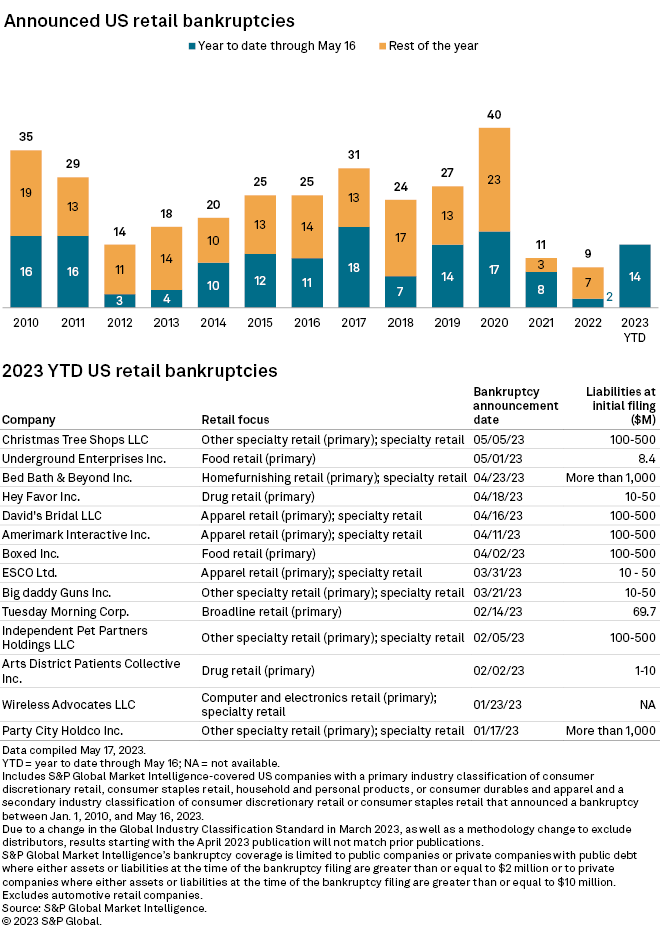

Meanwhile, five companies filed for bankruptcy protection since mid-April through May 16 and the median default risk for retailers rose, according to S&P Global Market Intelligence data.

Retail sales

The advance estimate for US retail and food services sales totaled $686.05 billion in April, up from a revised $683.18 billion in March, according to Census Bureau data. On an annual basis, April sales rose 1.6%.

Miscellaneous store retailers — florists, office and pet supply stores and used item shops — registered the largest monthly gain in sales at 2.4% Nonstore retailers — a category that includes e-commerce and vending machines, among other sales occurring outside a physical store — were second with a 1.2% gain over March.

Sporting goods, hobbies, musical instruments and bookstores registered the largest monthly decline, with sales falling 3.3%. Gas stations and furniture and home furnishing stores followed with declines of 0.8% and 0.7%, respectively.

– Click here to set email alerts for future Data Dispatch articles.

– For more bankruptcy analysis, check out the monthly bankruptcy series.

Bankruptcies

Bed Bath & Beyond Inc. and David's Bridal LLC were among the five new retail bankruptcy filings during the period from April 14 to May 16. Both companies intend to reorganize their operations and seek a buyer.

The tally of 14 retail bankruptcies so far in 2023 is higher than all but three of the prior 11 years, according to Market Intelligence data.

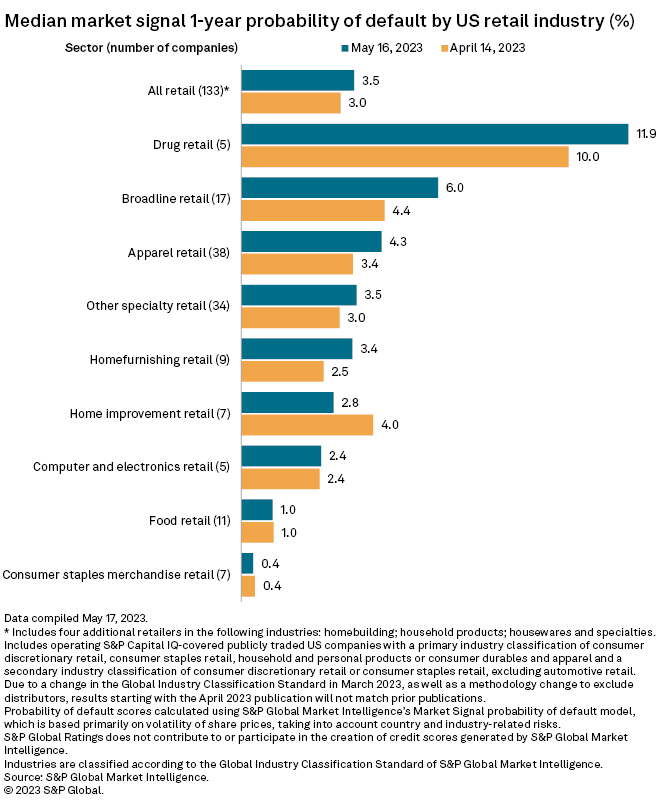

Default risk

Median default risk across retail categories rose to 3.5% as of May 16, up from 3.0% on April 14, according to Market Intelligence's Market Signal Probability of Default model. Rising median default risk among publicly traded drug, broadline, apparel, home furnishing and other specialty retailers influenced the broader rise.

Meanwhile, median default risk fell for home improvement retailers and held steady from a month ago in other categories.

Scores produced by the model represent the odds of default within a year and are based primarily on the volatility of share prices for public companies in the sector, accounting for country- and industry-related risks.