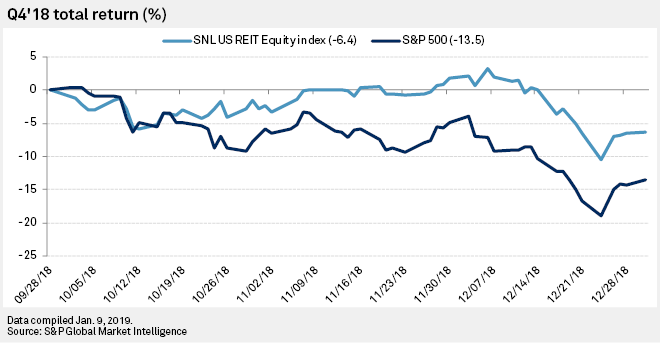

U.S.-based real estate investment trust stocks tumbled during the fourth quarter of 2018, although the drop was not as significant as for the broader market. The SNL U.S. REIT Equity index logged a negative 6.4% total return for the quarter, compared to the negative 13.5% return for the S&P 500.

While the broader SNL U.S. REIT Equity index finished the quarter in the red, three property sectors recorded positive returns during the quarter.

The healthcare sector was the best-performing REIT property type for the quarter, with a 2.8% market-cap-weighted return, while the self-storage and manufactured home sectors generated positive returns of 2.0% and 0.3%, respectively.

The hotel sector was the sole property type to underperform the S&P 500 during the fourth quarter, with a market-cap-weighted total return of negative 20.8%. All publicly traded U.S. hotel REITs logged total returns in the negative double digits for the quarter.

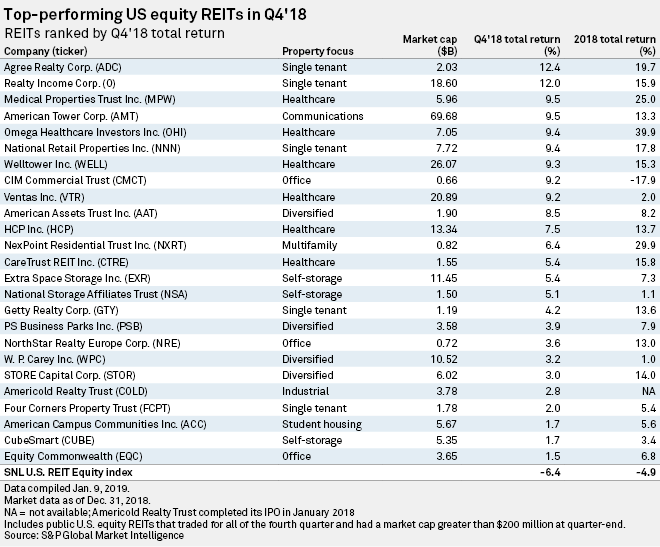

Looking at individual REIT performance during the quarter, two single-tenant retail REIT stocks topped the list with the highest returns.

Agree Realty Corp. ended the quarter with the highest total return among all U.S. REITs with a market capitalization of at least $200 million, at 12.4%. Agree Realty's share price surged 4.8% on Dec. 6, 2018, to an all-time high of $62.39 after the REIT announced a 2.8% increase to its quarterly cash dividend.

Realty Income Corp. took the second spot, logging a total return of 12.0% for the quarter.

Two healthcare REITs, Medical Properties Trust Inc. and Omega Healthcare Investors Inc., as well as communications REIT American Tower Corp. rounded out the top five performing REIT stocks for the quarter.

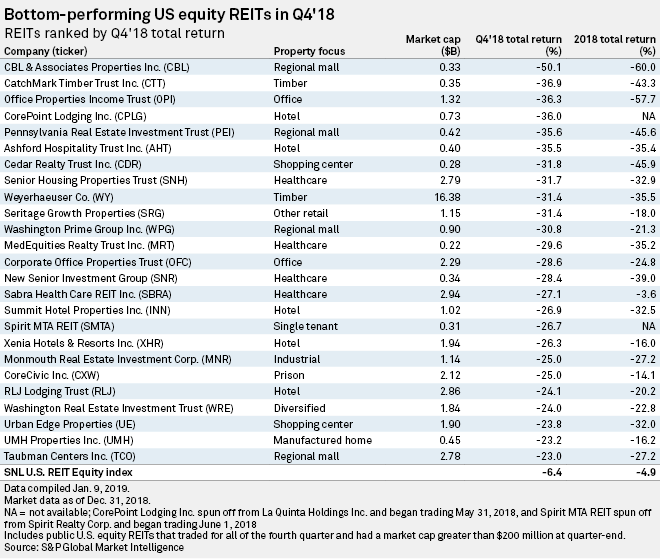

All seven regional mall REITs logged negative returns for the quarter, with those focused on B-class assets falling the furthest.

CBL & Associates Properties Inc. recorded the largest drop of the group, generating a total return of negative 50.1% for the quarter. On Oct. 29, 2018, CBL slashed its common stock dividend for 2019 by 62.5% to an annualized rate of 30 cents per share. In December, Fitch Ratings downgraded the regional mall REIT's long-term issuer default rating to BB- from BB+ with a negative outlook.

Pennsylvania Real Estate Investment Trust and Washington Prime Group Inc., were also among the bottom-performing REIT stocks, with returns of negative 35.6% and 30.8%, respectively, for the quarter.

All four timber REIT stocks logged negative returns in the double-digits during the fourth quarter. Shares for CatchMark Timber Trust Inc. and Weyerhaeuser Co. fell the furthest among the timber REIT peer group, with total returns of negative 36.9% and 31.4%, respectively, for the quarter.

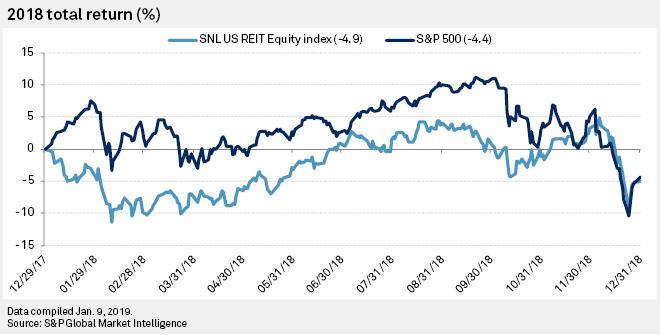

The SNL U.S. REIT Equity index slightly underperformed the S&P 500 when looking at 2018 as a whole, recording a return of negative 4.9% for the year, compared to the S&P 500's negative 4.4% return.

Did you enjoy this analysis? Click here to set email alerts for future real estate Data Dispatch articles. For further analysis, try S&P Global Market Intelligence's Worldwide Real Estate Total Return Analysis. Other templates are also available in the Excel Template Library. |