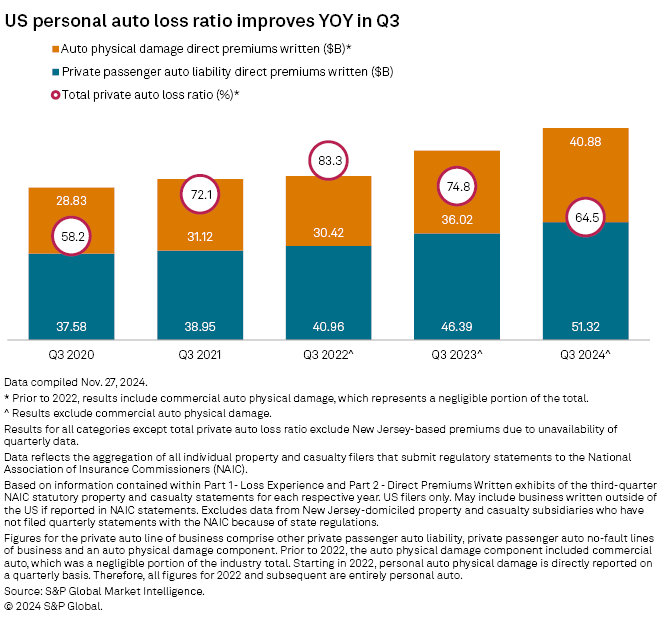

The profitability surge for private auto insurers in the US continued in the third quarter of 2024 as premiums reached record levels.

Insurers recorded direct premiums written (DPW) of $92.2 billion during the quarter, the highest third-quarter total since 2001, according to an S&P Global Market Intelligence analysis. This marks a $9.78 billion increase from $82.42 billion in 2023.

The private auto sector recorded $267.51 billion in direct premiums earned in the first three quarters of 2024, S&P Global Market Intelligence data shows.

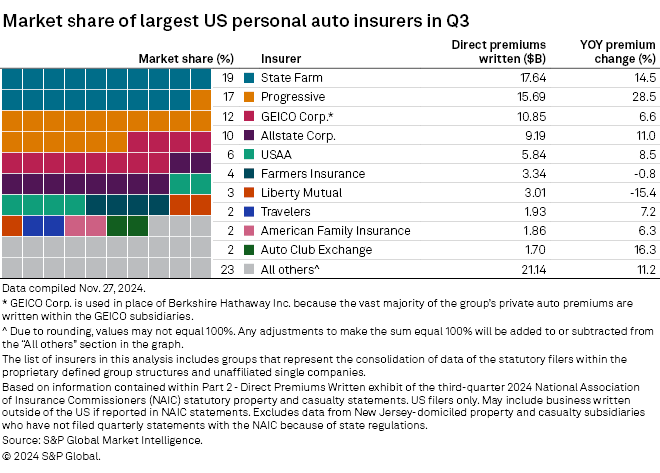

State Farm Mutual Automobile Insurance Co. remained the market leader as it booked year-over-year premium growth of 14.5%. The Bloomington, Illinois-based carrier's DPW increased to $17.64 billion in the quarter, representing a 19.1% market share, a 0.4-percentage-point increase from 18.7% a year ago.

The Progressive Corp., despite fallout from Hurricane Helene, saw its market share rise 2.2 percentage points to 17% from 14.8% a year ago while its DPW soared 28.5% to $15.69 billion from $12.21 billion. The Mayfield, Ohio-based carrier and State Farm were the only companies in the top 10 with market shares increases from 2023.

Berkshire Hathaway Inc.'s GEICO Corp. saw its market share decrease to 11.8% from 12.4% as its DPW rose 6.6% to $10.85 billion from $10.18 billion.

The Allstate Corp.'s market share remained at 10% despite an 11% rise in DPW to $9.19 billion, from $8.27 billion a year ago.

United Services Automobile Association was fifth in the analysis as its DPW increased 8.5% to $5.84 billion from $5.38 billion. However, its market share dropped to 6.3%, from 6.5% in 2023.

Progressive turned in record growth in the quarter, adding 1.6 million policies in force and pushing the total added in the first three quarters of 2024 to 4.2 million. The company ended the quarter with a 14% year-over-year increase to 33.9 million policies.

CEO Tricia Griffith said during an earnings call that Progressive is "in a good position headed into 2025."

"While there will undoubtedly be challenges, I'm already looking forward to what I anticipate will be a great fourth quarter and a strong 2025," Griffith said.

Solid growth in premiums

Premium growth continued for eight of the top 10 insurers in the analysis, four of which had double-digit percentage-point DPW increases. Progressive led the market with a 28.5% rise. Following Progressive was Auto Club Exchange Group with a 16.3% increase, growing to $1.7 billion from $1.46 billion a year ago. State Farm came next with a 14.5% increase, while Allstate saw an 11% rise.

The Travelers Cos. Inc. was up 7.2% while American Family Insurance Group improved 6.3%.

Liberty Mutual Holding Co. Inc., one of two companies in the analysis with decreases in DPW, saw its premiums decline 15.4% compared to last year, falling to $3.01 billion from $3.56 billion. Farmers Insurance Group of Cos. was down 0.8% to $3.34 billion from $3.37 billion.

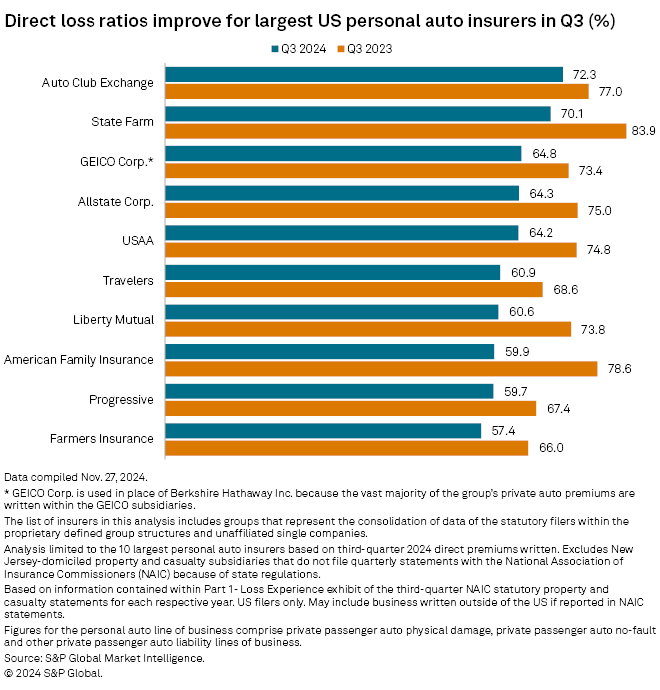

Ratios continue to retreat

The loss ratio for the sector fell 10.25 percentage points to 64.52% from 74.77% in 2023. It was the lowest industry loss ratio since the third quarter of 2020 when the ratio was 58.21% during the COVID-19 pandemic.

All insurers in the top 10 saw year-over-year improvement in their loss ratios, with five posting declines of 10 or more percentage points.

American Family had the steepest drop, down 18.7 percentage points to 59.9% from 78.6%, followed by State Farm, down 13.8 points to 70.1% from 83.9%, and Liberty Mutual, down 13.2 points to 60.6% from 73.8%.

Farmers came in with the lowest loss ratio in the top 10 at 57.4%, with Progressive and American Family at 59.7% and 59.9%, respectively. Auto Club Exchange, at 72.3%, and State Farm, at 70.1, had the highest.