The U.S. pension risk transfer market saw an influx of deals during the last three months of 2020 after a sluggish middle of the year due to the COVID-19 pandemic.

Single premium buyout sales were $13.68 billion during the fourth quarter of 2020, compared to $11.33 billion during the first nine months of year, according to survey data collected by LIMRA. It was the highest quarterly total since the last quarter of 2012 when General Motors Co. and Verizon Communications Inc. transferred pension obligations to Prudential Financial Inc. in deals totaling roughly $26 billion and $7.5 billion, respectively.

On a year-over-year basis, single premium buyout sales fell to $25.01 billion in 2020 from $27.99 billion, according to the industry research group.

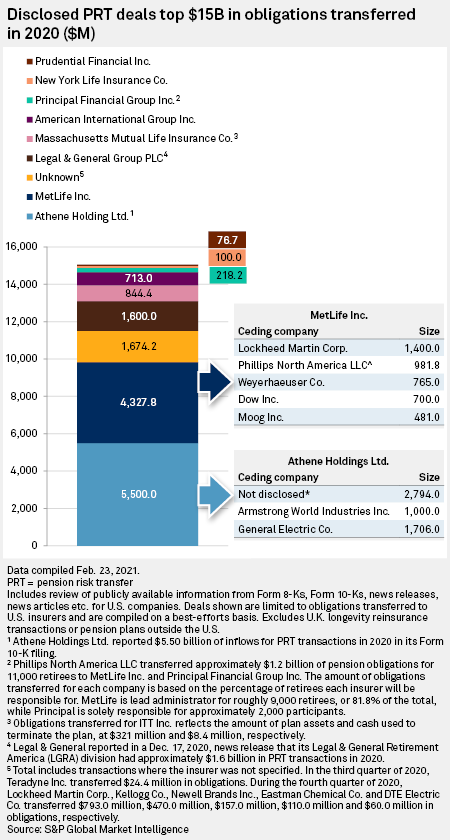

A review of public documents by S&P Global Market Intelligence found that U.S. companies disclosed approximately $15.1 billion in pension obligations transferred to life insurance companies operating in the domestic market. The figure is derived on a best-effort basis analysis and excludes several longevity reinsurance transactions with U.K. insurers as well as U.S. companies transferring offshore pension programs.

|

Lockheed Martin Corp. completed its third pension risk transfer, or PRT, transaction in as many years. In December 2020, Lockheed announced its purchase of two group annuity contracts totaling $2.2 billion. MetLife Inc. agreed to assume roughly $1.4 billion in obligations covering 13,500 retirees, while the second contract worth $793 million involving 2,500 retirees went to an undisclosed insurance company.

MetLife was also part of a $1.2 billion PRT transaction signed in the fourth quarter of 2020 with Philips North America LLC. MetLife will be the lead administrator providing monthly benefits for approximately 9,000 retirees, while Principal Financial Group Inc. will be solely responsible for roughly 2,000 deferred participants.

Athene Holding Ltd. completed two transactions over $1 billion in 2020. In February of that year, Armstrong World Industries Inc. transferred 10,000 retirees to the insurer in a deal worth $1.0 billion. General Electric Co. moved 70,000 retirees and beneficiaries to Athene in December, which totaled roughly $1.7 billion in obligations. Athene had $5.5 billion of PRT inflows during that year.

In 2020, Legal & General Group PLC's U.S. companies completed 17 PRT deals exceeding $1.6 billion pension obligations transferred to the insurer. The group completed its largest U.S transaction to date, independent of reinsurance, when Trinity Industries Inc. terminated its plan for 7,500 participants in a deal valued at $355 million.

Massachusetts Mutual Life Insurance Co. completed at least three PRT deals totaling almost $850 million in liabilities. MassMutual's disclosed deals with ITT Inc., Unisys Corp. and the New York Times Co. worth $329.4 million, $280 million and $235 million, respectively.

U.K. longevity reinsurance transactions

MetLife completed its first longevity reinsurance transaction in the U.K. in June 2020 with Pension Insurance Corp. PLC. Longevity reinsurance is used by U.K. pension schemes and annuity writers to hedge against the risk of annuitants living longer than expected. Under the terms of the agreement, MetLife will provide reinsurance on the longevity risk for roughly £280 million of pension liabilities.

MetLife signed at least four other longevity reinsurance deals with U.K. insurers. Three of them were with Rothesay Life PLC, which provides reinsurance on approximately $5.32 billion of total pension liabilities on an aggregate basis. The other was a reinsurance deal on $2 billion of pension liabilities with Legal & General Assurance Society Ltd.

In July, Prudential Financial announced that it closed $1.7 billion in longevity reinsurance transaction during the first half of 2020.