S&P Global Market Intelligence offers our top picks of real estate news stories published throughout the week.

The U.S. net lease investment volume in 2022 stood at $71 billion, down 25% from the record amount the previous year, and accounted for 11% of total commercial real estate investment volume, according to a report from CBRE.

Investment volume in the fourth quarter of 2022 plunged 63% to $12.7 billion, the real estate services and investment firm said in its "U.S. Net Lease | Q4 2022" report.

The industrial and logistics sector was the largest for net lease investments in the fourth quarter of 2022, accounting for 44% of the total, although that was down from 60% a year ago. The shares of net lease investments grew to 32% in office properties and 24% in retail properties year over year.

CBRE expects net-lease investment activity in 2023 to increase due to its less risky nature as inflation eases amid a slowing economy.

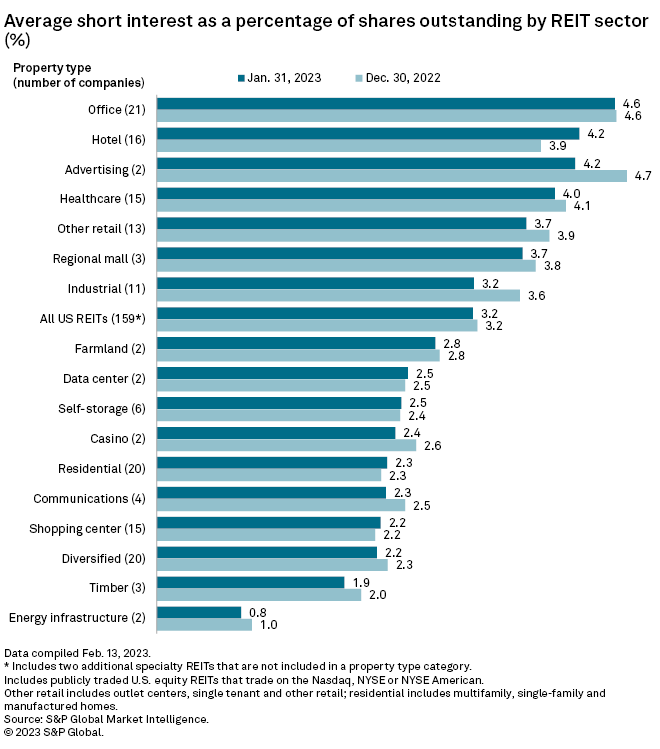

CHART OF THE WEEK: US REIT average short interest falls slightly in January

⮞

⮞

⮞

M&A

* A joint venture between GIC Real Estate Pte. Ltd. and Dream Industrial REIT completed the acquisition of Summit Industrial Income REIT in an all-cash transaction worth C$5.9 billion, including the assumption of certain debt.

* Affiliates of GIC Real Estate and Centerbridge Partners LP agreed to acquire all outstanding shares of Indus Realty Trust Inc. in an all-cash deal valued at roughly $868 million.

Property

* Terreno Realty Corp. is under contract to purchase a 121-acre industrial development site at the Countyline Corporate Park in Hialeah, Fla., for $173.6 million, The Real Deal reported.

* Slate Property Group LLC agreed to purchase 600 Columbus Ave., a 166-unit rental building on the Upper West Side in New York City, for $120 million, according to The Real Deal.

* Standard International Inc. bought the 14-story, 97-key Sixty SoHo hotel at 60 Thompson St. in Lower Manhattan, N.Y., from the Pomeranc family's Sixty Collective for $106.9 million, The Real Deal reported.

Cohen & Steers' total REIT holdings inch higher in Q4'22

Land & Buildings sets crosshair on Six Flags in Q4'22

AEW Capital pares holdings in 25 US REITs, exits 3 in Q4'22