Five tanker ships hauling U.S. LNG in March offered a rare bright spot for exporters staring down a brutal summer for the global gas market.

The cargoes set out to be the first U.S. LNG deliveries to China in more than a year, made possible by tariff exemptions that followed an agreement between the two countries that was designed to help resolve an ongoing trade war.

The renewal of LNG exports to China, the world's fastest-growing market for LNG, could have softened the blow dealt to U.S. exporters by an oversupplied global gas market and low gas prices and blunted a wave of curtailed shipments expected in the months ahead. China fell behind in its commitments under the January trade agreement in the first quarter as the coronavirus roiled its economy, but U.S. exporters hoped that the country could pick up the slack in its energy purchases.

But deteriorating market conditions and another flare-up of geopolitical tensions between China and the U.S. — President Donald Trump has threatened new tariffs amid frustration with China over the coronavirus outbreak — have dimmed the prospects of an increase in U.S. LNG shipments to China.

"You are so far off meeting the [trade agreement's] phase one commitments," said Nikos Tsafos, a senior fellow with the energy security and climate change program at the Center for Strategic and International Studies. "Could I imagine that everything else being equal, you choose a U.S. cargo if you are a Chinese company to show that you are making some token progress toward this goal? Sure. Is this going to be really material, or is this going to be enough to offset everything else that is pushing things down? Probably not."

Following the initial trade agreement in January, China said in February that it would grant exemptions to a 25% tariff on LNG that remains in place. The first of the U.S. LNG cargoes arrived in China on April 20 after departing from the Freeport LNG Development LP terminal in Texas. Other March shipments have since arrived in China. And at least three additional tankers carrying U.S. LNG departed for China in April, according to S&P Global Platts' cFlow vessel-tracking software.

The shipments coincided with a gradual uptick in economic activity in China, which was hit hard by the coronavirus. But poor shipping economics make U.S. LNG uncompetitive in Asia compared to supplies from places such as the Middle East.

Spot gas prices in Europe, Asia and the U.S. have all fallen to around the same $2/MMBtu levels, increasing pressure on buyers to defer or cancel shipments. Shut-ins of U.S. LNG cargoes are expected to spike in June and persist for months.

Low oil and gas prices also mean that any purchases China does make do not go as far in meeting the goals of the phase-one agreement. As part of the deal, China agreed to more than double its imports of a basket of 548 U.S. products that would amount to an extra $200 billion in purchases through 2020 and 2021 compared to 2017 levels.

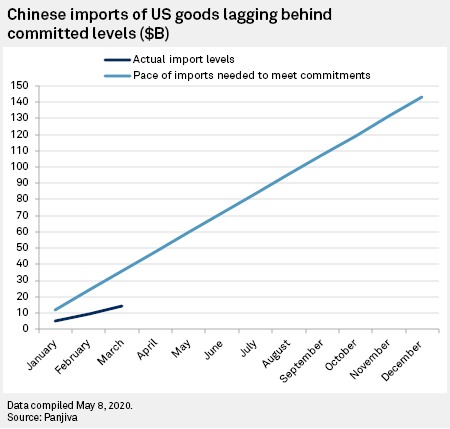

China would need to buy $11.93 billion of these goods every month to meet that target, but its total purchases amounted to only $5.24 billion in March, according to recent data from Panjiva, a business line of S&P Global Market Intelligence that provides news and analysis about global supply chains. Over the entire first quarter, China came up $21.2 billion short.

China nonetheless increased purchases of energy products, which are a category in which China could make significant headway toward its goals. Such products, which include LNG, oil, refined petroleum products and coal, should account for $52.4 billion worth of China's targeted purchases over 2017 levels across the next two years, although product-specific details about the goals were not released. For 2020, the target is $18.5 billion over what China bought in 2017.

Transportation of energy products in March increased nearly 76.9% from the same month of 2019, largely because of a massive spike in refined oil product shipments and the first shipments of LNG, according to Panjiva. But the collapse of commodity prices resulted in a dollar value of $356 million, well below the monthly rate needed to meet trade targets.

The total value of the U.S. LNG shipments to China in March was about $58.7 million.

By volume, U.S. LNG bound for China represented a significant amount of the 244.4 Bcf shipped during March, a total that nearly matched a previous high reached in January despite the coronavirus weighing on the world economy, according to an S&P Global Market Intelligence analysis of recent LNG export figures released by the U.S. Department of Energy.

But the 17.7 Bcf of LNG that left for China was less than shipments to other key export markets, including South Korea, Spain, France, the United Kingdom and Japan. The main destinations for U.S. LNG during the month were in Europe and Central Asia, accounting for about 47% of all U.S. shipments.

Europe has been a key outlet for the glutted global gas market, but market observers have warned that storage in Europe, already at high levels, could fill up later in the year, triggering a sharp increase in U.S. cargo cancellations if other markets cannot absorb the LNG.

It is not yet clear how much LNG China can absorb, and there is a potential for further outbreaks of the virus.

Even at the time the initial trade deal was signed, experts were skeptical that China would meet its massive commitment to buy energy products and about how much U.S. LNG it could import, pointing to market constraints that have only become more severe and to the limited amount of U.S. LNG available to China.

Much of the U.S. LNG volumes are tied to long-term trade deals between producers and off-takers. The only U.S. LNG producer that has a direct long-term supply agreement with a Chinese counterparty is Cheniere Energy Inc. It has two contracts with PetroChina Co. Ltd. for a combined 1.2 million tonnes per annum. Only a small portion of this is in effect, with the remainder starting in 2023.

The total value of all U.S. LNG exports per month during the first quarter averaged about $1.22 billion, according to Panjiva. But with China's total LNG imports averaging about $3.3 billion per month in the past year, scaling up from the $58.7 million worth it took from the U.S. in March should be possible, Panjiva found.

One possible solution to help China meet the trade targets could be a mutual understanding that commitments to long-term supply agreements with U.S. LNG developers will count toward the $52.4 billion goal, according to an April policy brief put forth by Kenneth Medlock and Steven Miles, researcher from Rice University's Baker Institute Center for Energy Studies. This could help developers of new LNG projects, which face market headwinds in securing the commercial deals that most of them need to obtain financing.

Industry groups LNG Allies and the American Exploration & Production Council recently pitched this proposal to the White House.

But other researchers see China as having little appetite for long-term supply deals with the U.S.

"China is not apt to make itself dependent on U.S. gas imports for a 15-25-year period, especially when it may have concerns about the Trump administration's position on trade from one week to the next, let alone what future administrations may do over two decades," said Erin Blanton, a senior research scholar at Columbia University's Center on Global Energy Policy. Blanton made the observation in an analysis of the global LNG market.

Analysts at independent research firm ClearView Energy Partners described the U.S.-China trade agreement as "in peril of collapse — eventually, if not imminently." The analysts pointed to the stark shortfalls in China's energy purchases and market volatility driven by the coronavirus pandemic that could lead Trump to abandon the deal and scapegoat China for failing to contain the virus.

"President Trump may see a greater political premium in blaming China for the coronavirus than in saving the deal," ClearView Managing Director Kevin Book said during a May 19 webinar.

S&P Global Platts and S&P Global Market Intelligence are owned by S&P Global Inc.

Panjiva is a business line of S&P Global Market Intelligence, a division of S&P Global Inc.