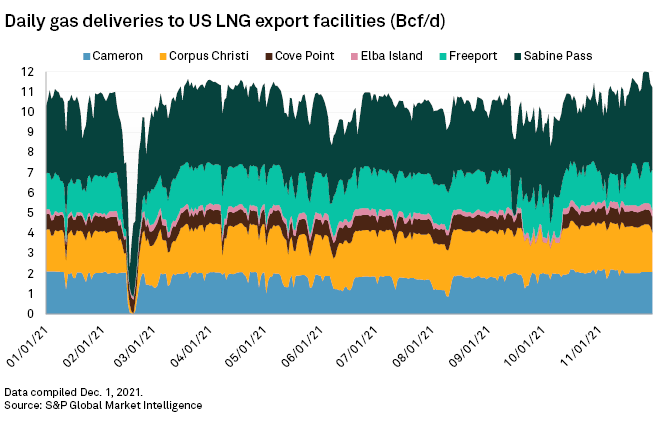

Natural gas deliveries to U.S. LNG export terminals surged to record levels in the waning days of November, topping 12 Bcf/d as strong global gas demand continued to incentivize operators to run their facilities at full bore.

Total feedgas deliveries to the six major operating U.S. LNG export facilities hit about 12.1 Bcf/d on Nov. 26 and remained near that level for about two days before dropping to about 11.2 Bcf/d on Nov. 30, according to S&P Global Market Intelligence pipeline flow data. This last number compared to about 10.9 Bcf/d on Nov. 30, 2020, as sector activity rebounded from the impacts of the pandemic.

Average flows for November 2021 exceeded 11 Bcf/d.

Part of the uptick in activity was because of commissioning work on a sixth liquefaction train at Cheniere Energy Inc.'s flagship Sabine Pass LNG terminal in Louisiana. The company said the train produced its first LNG on Nov. 23. But high global gas prices were a key driver.

The European benchmark Dutch Title Transfer Facility day-ahead contract reached an all-time high of $39.51/MMBtu on Oct. 5, while the S&P Global Platts Japan Korea Marker spot Asian LNG price hit a record high of $56.33/MMBtu on Oct. 6. Prices have fallen since then, but they remain several times higher than prices in the U.S. and continue to encourage U.S. LNG exports. Spot LNG prices have also not suffered in the same way as prices for other commodities over concerns about the emerging omicron variant of the coronavirus, as buyers seek winter gas supplies.

In the U.S., robust LNG exports in recent months attracted criticism from an industrial manufacturers trade group long-opposed to LNG exports. The group mounted a renewed effort to convince the U.S. Department of Energy to limit exports to avoid winter price spikes and supply shortages. The leading U.S. LNG trade group argued that curbing exports could upend gas markets and undermine billions of dollars worth of infrastructure investments.

Some government officials have joined in the criticism of U.S. energy companies over higher domestic gas prices this winter, including Sen. Elizabeth Warren, D-Mass. The senator sent a Nov. 23 letter to 11 natural gas producers asking why they are keeping production low and exporting record amounts of gas. Warren expressed concern that domestic prices were "being driven by energy companies' corporate greed and profiteering."

Appalachian oil and gas trade groups, including the Marcellus Shale Coalition, fired back with a Nov. 30 letter that said the lawmaker's "recent attempts to use the U.S. energy industry as a scapegoat for rising energy prices is a deeply misguided, headline-grabbing ploy." The groups said gas price swings are "influenced by a variety of factors, including political and regulatory environments," and they pointed to increased production from the Marcellus and Utica shale provinces as evidence that markets work.

The White House so far has not suggested it would move to reduce U.S. LNG exports.

LNG exports have contributed to higher domestic prices, but U.S. gas producers have also shown a reluctance to boost output in response to the price signals, largely complying with investors' demands. Permitting activity in Pennsylvania has suggested that some large producers may be breaking with the pack to chase higher winter prices. Average natural gas prices also dropped in November to less than the $5/MMBtu benchmark in all regions of the U.S.

Prices at hubs in every region were down sharply in Dec. 1 trading as mild weather underwhelmed U.S. gas markets, according to Platts.

LNG exports, meanwhile, could continue rising into 2022. In addition to the sixth train at Sabine Pass, Venture Global LNG's Calcasieu Pass LNG export facility is also undergoing commissioning in Louisiana. The developer has said its facility, which will have an export capacity of about 10 million tonnes per year, could begin producing LNG by the end of 2021. Goldman Sachs commodity analysts recently raised their full-year 2022 projection for U.S. LNG exports by 5 Mt to a total of 82 Mt for the year.

S&P Global Market Intelligence and S&P Global Platts are owned by S&P Global Inc.