Personal auto losses for U.S. insurers spiked sharply year over year during the first quarter as the frequency and severity continued to climb for some public companies

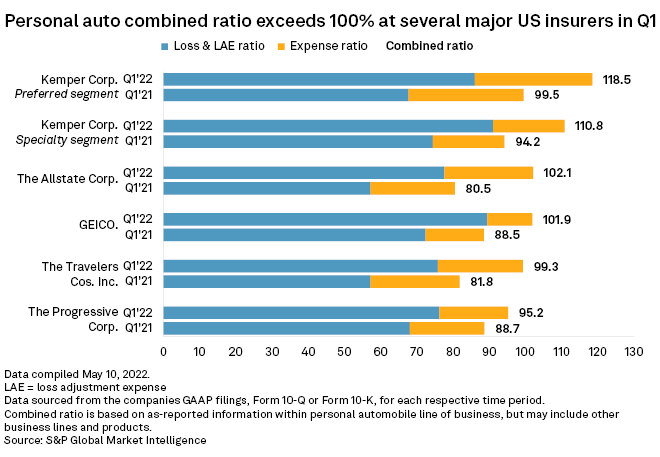

A number of public insurers reported a double-digit point increase in their loss and loss adjustment expense ratios within the private auto line during the first three months of 2022, according to an S&P Global Market Intelligence analysis. Inflationary pressures, coupled with miles driven returning to pre-pandemic levels, have squeezed profitability in the business line.

The Allstate Corp. recorded a year-over-year increase of 20.4 points in its auto loss ratio, the highest among the insurers reviewed in this analysis. The insurer's first-quarter auto combined ratio came in at 102.1%.

Of the five companies within this analysis, The Progressive Corp. was the lone company to not record a double-digit point increase within its loss ratio. The insurer's private auto loss ratio climbed to 76.2% in the first quarter, versus 68.1% in the prior-year period.

The auto combined ratio for Kemper Corp. was the largest during the quarter. The insurer's preferred private auto segment posted a combined ratio of 118.5%, while its specialty, or nonstandard, auto segment logged a combined ratio of 110.8%.

GEICO's auto claims frequency surges

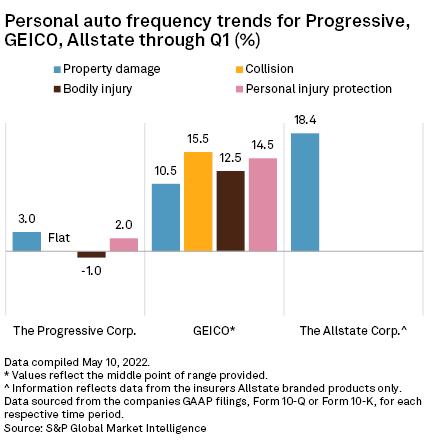

Berkshire Hathaway Inc.'s GEICO reported double-digit year-over-year increases in auto claims frequency across all of its reported coverages. The largest increase, of between 15% and 16%, occurred in collision. Personal injury protection coverage saw claims rise 14% to 15%.

In total, Progressive's auto claim frequency was up 2% year over year during the first quarter of 2022. Claims frequency within auto property damage and personal injury protection were up 3% and 2%, respectively. Collision was flat during the period, while bodily injury decreased by 1%.

Auto claims frequency for Allstate's property damage jumped 18.4% during the first three months of the year.

Collision severity also rises

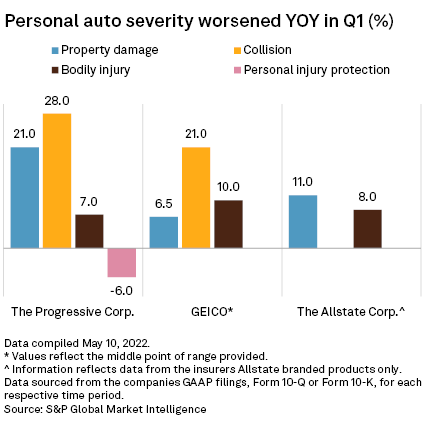

The severity of claims for collision coverage rose sharply at Progressive and GEICO, jumping 28% and 21%, respectively. Claims severity for property damage at Progressive also saw large increases in the first quarter.

The big drivers of severity trends within collision and property damage at Progressive were the cost of replacement parts, car rentals extended by days due to labor shortages at body shops and greater vehicle damage during accidents, according to CEO Tricia Griffith.

Progressive did see a drop of 6% in its personal injury protection claims severity, thanks in part to coverage reform in Michigan.

Claim severity for property damage and bodily injury coverage increased 11% and 8%, respectively, for Allstate during the first three months of 2022.

Rate relief coming in future quarters

Higher losses for insurers mean rising premium rates for policyholders as the largest U.S. private auto insurers have received regulatory approval for some substantial rate increases.

The full impact of rate increases has yet to be felt for Allstate, but the insurer expects to see that happen in the coming quarters.