Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Oct, 2022

By Priyanka Boghani and Umer Khan

Regulatory and geopolitical uncertainty is likely to weigh on the appetite of large U.S.-based institutional investors to increase holdings in Chinese technology, media and telecommunication companies listed on U.S. exchanges, market experts said.

The U.S. Public Company Accounting Oversight Board, or PCAOB, which inspects and investigates public accounting firms around the world, recently struck a deal with the China Securities Regulatory Commission and China's Ministry of Finance to allow the auditing of registered public accounting firms headquartered in mainland China and Hong Kong. The deal came after a 2020 law that said companies audited by such accounting firms could not trade on U.S. exchanges if the PCAOB could not evaluate the accounting firms' work.

Though the immediate risk of Chinese companies being forced to delist from U.S. exchanges has passed, U.S. investors remain skittish about the threat of heightened regulatory scrutiny of Chinese investments.

"While the landmark deal is a critical step for U.S. investors in Chinese TMT companies, U.S. institutional investors will continue to exercise caution when it comes to regulatory matters — whether it is a U.S.-listed company or an HK-listed company," said Yang Ge, partner at DLA Piper.

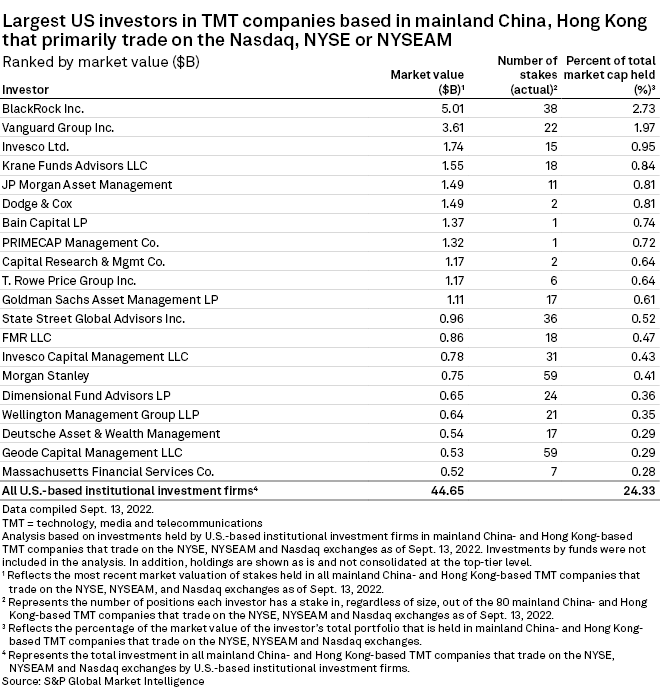

BlackRock Inc. is the top U.S. institutional investor in U.S.-listed Chinese technology, media and telecom, or TMT, companies by market value. It holds about $5.01 billion in aggregate from 38 stakes in U.S.-listed TMT companies based in mainland China and Hong Kong, according to data compiled by S&P Global Market Intelligence. That represents 2.73% of BlackRock's total investments.

Vanguard Group Inc. ranks second, with $3.61 billion in market value from 22 stakes in U.S.-listed Chinese TMT companies. Vanguard elected not to launch a Vanguard China Select Stock fund earlier this year, abandoning a plan announced in November 2021. About 1.97% of the total market cap represented by Vanguard's total holdings is from U.S.-listed TMT companies based in mainland China and Hong Kong.

Invesco Ltd. was the third largest U.S. investor in U.S.-listed Chinese TMT companies, holding $1.74 billion in market value from 15 company stakes. That represents about 0.95% of the market cap of Invesco's total portfolio holdings.

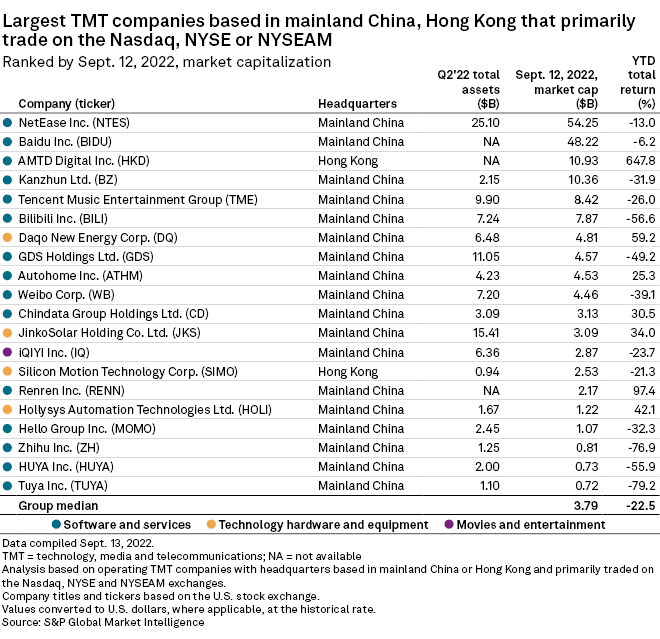

BlackRock and Invesco are the top institutional holders of gaming company NetEase Inc., the largest Chinese TMT company that primarily trades in the U.S.

BlackRock is also the top institutional holder in search engine operator Baidu Inc., the second-largest company in China that primarily trades in the U.S. Vanguard is the second-biggest institutional holder of Baidu's U.S.-listed stock.

U.S. investors will want to evaluate the results of the first audit of Chinese accounting firms to assess potential risks to investments in Chinese TMT companies, said Justin Tang, head of Asian research at investment firm United First Partners, Singapore.

"Investors will not want just lip service. They will flock to where there is growth so if this deal works out as scripted, then their conviction will be strengthened," Tang said.

China's government has sent a team of regulatory officials to Hong Kong to help with the U.S. audit watchdog's onsite inspections, according to a Sept. 22 Reuters report. After the deal was announced in August, the U.S. sent its officials to Hong Kong to inspect China-based accounting firms that audit New York-listed companies in early September. U.S. regulators are looking into the operations of U.S.-listed Alibaba Group Holding Ltd. and JD.com Inc., among others, according to an Aug. 31 Reuters report.

The U.S. accounting oversight board behind the audits is required to make a reassessment of the agreement with China's regulators by the end of 2022.

In the current regulatory environment, a company with a secondary or dual primary listing in Hong Kong may attract more institutional investors, according to David Yu, a professor of finance at New York University Shanghai.

"If Chinese TMT companies opt for a dual listing in Hong Kong, they are likely to get a better valuation in Hong Kong, which may appeal to U.S. investors," said Yu.

Market experts recently told Market Intelligence that Chinese TMT companies are likely to seek a secondary or dual primary listing in Hong Kong to hedge risk and reach more investors.