|

| U.S. investors had the highest volume of investments in Asia-Pacific financial technology firms compared with any other country. Source: Pixabay |

U.S. investors,

Venture capitalists are likely to continue to invest in

Banking tech investments on the rise

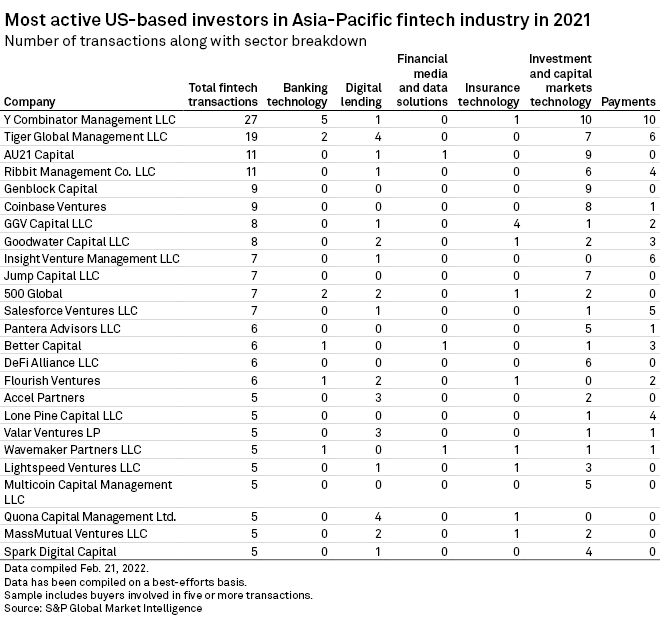

Global investors were most active in backing fintech companies specializing in investment and capital markets technology such as blockchain, internet of things and artificial intelligence, funding 254 deals in 2021 compared with 99 the year prior.

Several mature fintech firms were active

There is also growing interest in

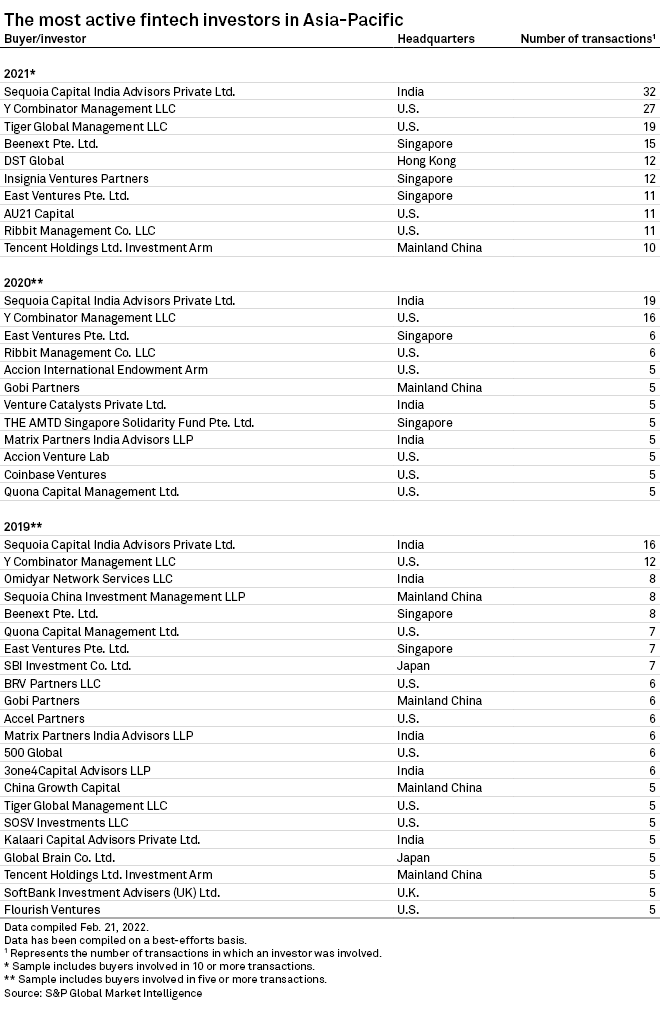

Examples of these transactions include American technology startup accelerator Y Combinator's investments in India's blockchain company, NextBillion Technology Pvt. Ltd. and Indonesia's online broking platform, PT Ajaib Sekuritas Asia. The U.S.-based investment firm was involved in 27 fintech transactions in the Asia-Pacific region in 2021.

Payment platforms in focus

Payments was the second-most popular category for U.S. investors, as 167 companies received funding in 2021. Warren Buffett-owned investment powerhouse Berkshire Hathaway Inc. invested in Alibaba Group Holding Ltd. and SoftBank Corp.-backed One97 Communications Ltd., or Paytm, which became India's biggest ever IPO when it raised $2.47 billion in November 2021.

India's payment companies were a big focus for some U.S. investors. For example, Y Combinator and U.S.-based investment firm Tiger Global Management LLC both backed Razorpay Software Pvt. Ltd. in 2021 while Tiger Global funded Resilient Innovations Pvt. Ltd. which operates as BharatPe, and PhonePe Pvt. Ltd. The country's payment landscape has become increasingly competitive, with local industry giant Reliance Industries Ltd., Alphabet Inc.'s Google Pay and Facebook-owner Meta Platforms Inc. all vying for a share of the burgeoning market.

In particular, the buy-now, pay-later space in the region was hot, with notable transactions including Block Inc.'s $26.90 billion purchase of Australia's Afterpay Ltd. and PayPal Holdings Inc.'s $2.73 billion acquisition of Japan's Paidy Inc. in 2021.

Active India-based investors

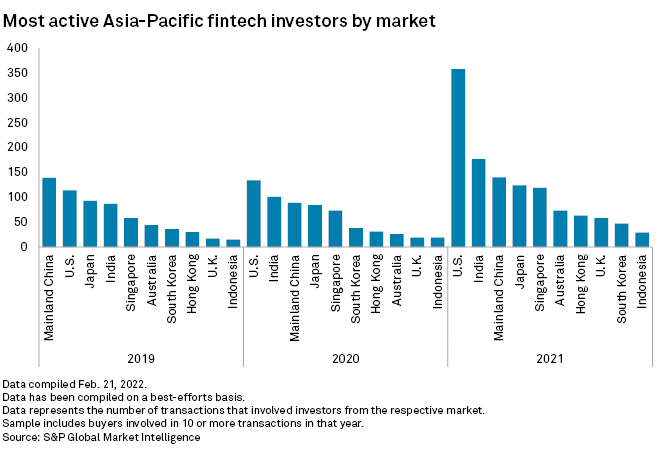

India-based investors were a distant second in providing funding to fintechs in Asia-Pacific after the U.S. in 2021.

The Indian venture capital arm of Sequoia Capital Operations, Sequoia Capital India Advisors Pvt. Ltd., contributed to the funding of Razorpay and Resilient Innovations as well as India-based cryptocurrency exchange aggregator Bitcipher Labs LLP and Australia's funds transfer platform Airwallex Pty. Ltd.

India also attracted the most funding in the region, with $5.94 billion raised across 236 deals in 2021, up from $1.5 billion across 118 deals in 2020.

Celeste Goh contributed to the article.