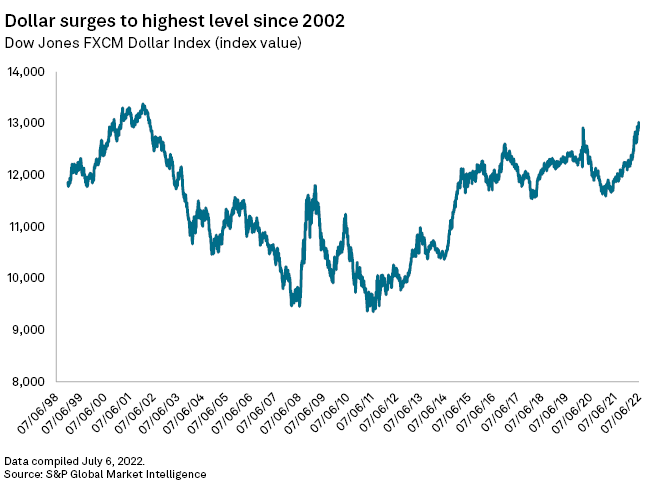

The U.S. dollar is stronger than it has been in 20 years as recession fears and rate hikes from the Federal Reserve have spiked demand for the safe-haven currency.

On July 6, the Dow Jones FXCM Dollar Index reached its highest point since 2002. It has risen 7.1% since the start of the year. The index measures the dollar's value against four currencies: the euro, the British pound, the Japanese yen and the Australian dollar.

The U.S. Dollar Index also hit its 20-year peak. The index measures the dollar's value against six currencies: the euro, Swiss franc, Japanese yen, Canadian dollar, British pound and Swedish krona.

The dollar has gained substantial ground on its G-10 peers this year, and the rally is unlikely to end soon as stocks remain mired in one of the worst stretches in market history.

"I suspect that the [U.S. dollar] strength will not dissipate significantly until the market is happy to buy risky assets again," said Jane Foley, head of foreign exchange strategy at Rabobank. "This may not be until the [Federal Reserve] is prepared to cut rates."

More to come

The dollar tends to strengthen when the Fed hikes rates, drawing more global investors to U.S. government bonds and other dollar-denominated investments that are considered relatively low risk.

In June, the rate-setting Federal Open Market Committee agreed to raise its federal funds rate by 75 basis points, the largest one-time hike since 1994.

According to the minutes of that meeting, released July 6, Fed officials expect additional increases as inflation remains stubbornly high. Fed officials agreed that "an even more restrictive stance could be appropriate if elevated inflation pressures were to persist," according to the minutes, indicating that the central bank does not intend to back off its hawkish monetary policy shift anytime soon.

In addition to Fed rate hike expectations, the dollar is being strengthened by a combination of instability in risk sentiment and expectations that Europe and much of the world will see larger economic slowdowns than the U.S. will, said Francesco Pesole, a foreign exchange strategist with ING.

The Fed's plans to continue to hike rates will likely offer a floor for the dollar this summer, keeping the greenback supported, said Pesole: "We think the dollar should peak over the summer months, and then gradually inch lower into year-end as … markets see the end of the Fed's tightening cycle."

Uncertainty surrounding the looming global economic slowdown means that "the timing of a dollar downtrend is quite uncertain too," Pesole said.

Substantial domestic growth compared to the rest of the world should keep investors buying dollars for the immediate future, said Derek Halpenny, a managing director with MUFG. Even softer data, such as weaker-than-expected job growth or high inflation numbers, is unlikely to derail the dollar's rally, Halpenny said.

"The Fed and other central banks have more policy tightening to do before any pause becomes credible and hence increased signs of recession risks will be primarily bad for equities, financial assets and will lead to tighter financial conditions," Halpenny said.