Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Jul, 2021

By Brian Scheid

Growing fears of the coronavirus delta variant's potential to derail a global economic recovery have triggered a U.S. dollar rally, pushing the greenback to beat out its G-10 currency peers since June.

"Growing risk-off impulses are helping the dollar," said Win Thin, global head of currency strategy at private investment bank Brown Brothers Harriman.

Investors are seeking a haven asset in the dollar on fears that a downturn in stocks, tied to the spread of the COVID-19 variant, could happen and that the Federal Reserve's hawkish turn could roil government bond markets. Strong U.S. data, particularly on rising inflation, is increasing the likelihood of the Fed tapering its $120 billion in monthly bond purchases, Thin said.

The rising risks in stock and bond markets, which typically counter each other, are both bolstering the dollar, Thin said.

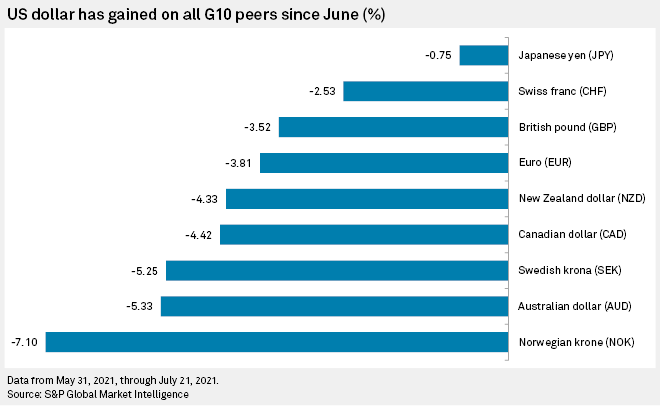

Since the start of June, the dollar has gained ground against all nine of its G-10 peers, led by the Norwegian krone, which has lost 7.1% to the dollar over the past six weeks. The Australian dollar and Swedish krona have lost 5.3% and 5.2%, respectively, to the U.S. dollar over that same time.

In a July 22 note, Derek Halpenny, head of research at MUFG Bank, wrote that the dollar rally is likely to continue as risk aversion in equities continues as the delta variant spreads and fears of upended growth accelerate.

"From a US equity markets perspective, the market is priced for perfection and hence a deeper correction is a risk over the coming weeks and months," Halpenny wrote.

With the S&P 500 less than 1% below its most recent record high, set on July 14, Halpenny sees a high likelihood of a "deeper correction" in the stock market.

"The U.S. dollar would likely benefit if asset prices correct further," Halpenny wrote.

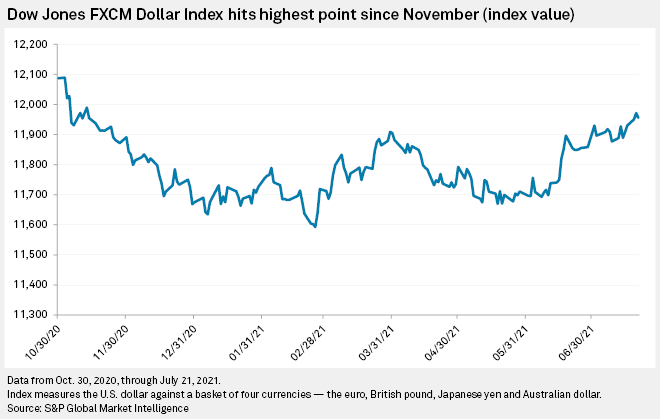

On July 21, the Dow Jones FXCM Dollar Index settled at its highest point since Nov. 12. The index, which measures the US dollar against a basket of four currencies — the euro, British pound, Japanese yen and Australian dollar, has gained about 3.1% since Feb. 24.

Francesco Pesole, a currency strategist with banking and financial services company ING, said the Fed's hawkish shift, which followed its June meeting, has been a major factor driving the dollar's strength over the past six weeks.

"The risk-off environment may signal how some investors are fearing that the Fed may have to go ahead with its tightening plans in 2022-2023 even if the economic recovery is uneven, which raises the risk of a recession," Pesole said.

Still, Pesole said the correction in risk sentiment may have been exaggerated, which could lead to some decline in the dollar's rally.