U.S. banks that have a direct-to-consumer digital brand are leading the competition to attract consumer deposits with higher rates, but it remains to be seen how sticky these deposits will be and how the digital banks use them to improve net interest margins.

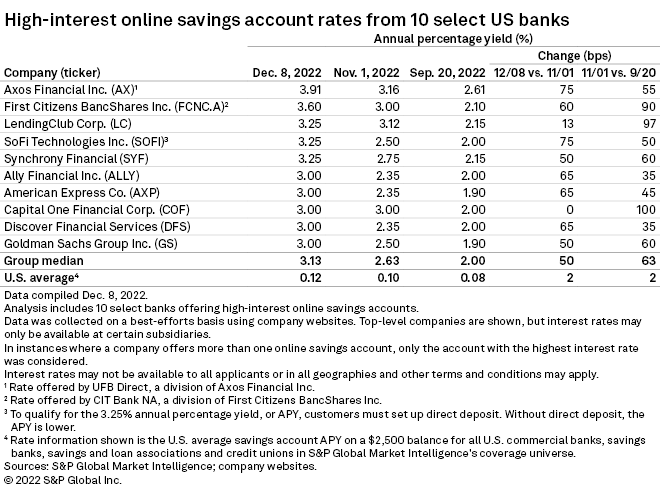

Among 10 select digital banks, the annual percentage yield of their high-yield savings products have all reached or exceeded 3.00%, compared to the national average of 0.12%, according to data compiled by S&P Global Market Intelligence.

The high savings yields have occurred alongside a fast-rising federal funds rate. On Nov. 2, the Federal Open Market Committee raised interest rates by 75 basis points for the fourth time in 2022. Since then, the group of banks has bumped up APY by a median of 50 basis points.

As a result of the high-yield offerings, some of the digital banks have reported strong deposit growth, contrary to the broad trend of deposit outflows in the industry. Digital banks' desire and capability to compete for higher APY remain strong with further Fed tightening to come, industry experts said. The FOMC is expected to hike rates by another 50 basis points following its Dec. 13-14 meeting.

As most of the digital banks are going through their first major rate-hike cycle, winning incremental deposits is only the first step to test out the economics of their business models.

"Where I'm focused is who is generating good core customers that are going to stay engaged with the platform over multiple cycles," said Michael Perito, managing director on the U.S. regional bank equity research team at Keefe Bruyette & Woods Inc. "I would argue that many digital franchises haven't yet really been able to prove that in a significant way."

Digitally raised FDIC-insured deposit accounts still represent a fairly small piece of the overall market share in the U.S., growing to more than 6% in 2021 from less than 1% in 2012, according to a KBW report in October. But the growth potential is promising, as wealth transfers to the digital-savvy, younger generations.

"I think the question is — what are they doing to distinguish themselves to their end users?" said David Sandler, co-head of financial services investment banking at Piper Sandler. "If all you got is a great advertising campaign and the highest rate and you're competing with the broader market on the asset side with the same products and services, I don't know how you're distinguishing yourself other than cutting into margin."

Efforts to distinguish

Perito pointed to Live Oak Bancshares Inc. as one of the digital banks that have proven the ability to put the high-cost deposits to work. Even with a higher deposit beta, the branchless bank maintained the net interest margin at over 3.50% thanks to the niche of assets with higher yields from loans backed by the Small Business Administration, Perito noted.

Live Oak's third-quarter net interest margin was 3.84%. Depositors at Live Oak currently can yield 3.10% in APY on savings, according to its website.

SoFi Technologies Inc.and LendingClub Corp. largely deploy their deposits to fund personal loans which yield double-digit returns, Perito said. To add prime loan books, LendingClub announced plans on Dec. 2 to acquire a $1.05 billion loan portfolio from MUFG Union Bank NA, which recently completed a sale of its core regional banking franchise to U.S. Bancorp. The loans have a current outstanding FICO score of 729. The deal is set to grow LendingClub's loan volume by over 20%. Its total loans held for investment stood at $4.41 billion as of Sept. 30.

In another example, Axos Financial Inc. has built a source of deposits with relatively lower cost from custody services for registered investment advisers, Perito noted.

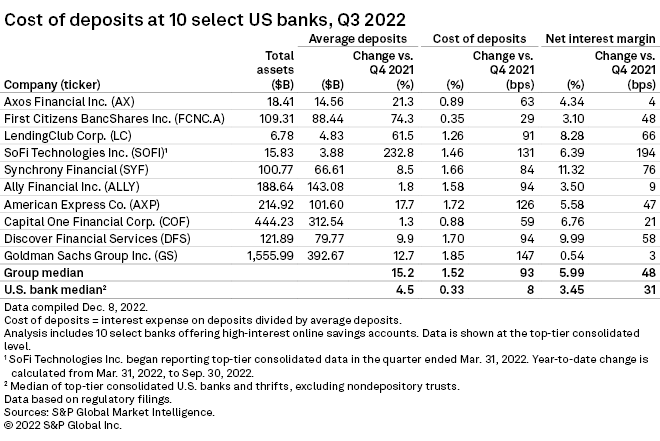

"Historically, advisers and broker-dealers have not viewed cash sweeps as an asset class and have not actively looked to maximize the return on that cash. However, given the Fed's aggressive tightening, some advisers are starting to evaluate higher-yielding cash alternatives," Axos President and CEO Gregory Garrabrants said during the company's most-recent earnings call in October. In the quarter, Axos' net interest margin remained at 4.34%, compared to the industry median at 3.45%.

So far in this cycle, digital banks are showing competitive net interest margins, with the group median standing at 5.99% in the third quarter.

APY competition set to continue

Although higher APY increases the cost of deposits, these deposits still appear attractive compared to other funding sources. The cost of capital in the securitization market for consumer unsecured loans has been rapidly rising over the past year, Sandler noted.

SoFi has not yet reached the ceiling of what it can offer in APY, CFO Christopher Lapointe said at a conference Nov. 30. The cost of retail deposits is still lower by 200 to 300 basis points than that of other funding sources, the CFO noted.

"Those rate-payers are going to keep pushing the envelope," Sandler said.

When it comes to competing for higher rates, digital banks typically catch up quickly with competitors. They are eager to have their APY stay on top of the curation lists on aggregation websites such as Bankrate.com, Perito noted, since those are "the most bang for their buck" to reach interested consumers.

Consumers also often look for a meaningful boost in rates in order to switch banks, so the APY would need to be competitive enough to move the needle, and the digital banks have managed to do so, said Adam Stockton, head of retail deposits at Curinos.

"Many traditional banks have not been very competitive from a rate perspective. They're going to need to start to get more competitive to make sure that they don't lose too much in terms of deposits and customers," Stockton said.

Few other deposit drivers

Despite the heated competition, higher APY is still an effective tool for banks to grow deposits. The group of select digital banks grew average deposits by a median of 15.2% in the third quarter compared to the fourth quarter of 2021. Most of them outperformed the industry mean of 4.5%, with the exceptions being Ally Financial Inc. and Capital One Financial Corp.

In search for deposit growth, many banks have entered novel, technology-oriented verticals in recent years. They opted to take on more risks in niches with fewer peers and provided banking services to entities or their end consumers in the cannabis, cryptocurrency and fintech segments. But currently, the market turmoil in cryptocurrency is being passed on to banks active in digital assets, while cannabis banking and fintech-bank partnerships carry high regulatory risks. The slowdown in fintech venture capital investments has also prompted some banks to decelerate the onboarding of new fintech startups.

With respect to banking-as-a-service, "the idea of competing for high cost-efficient deposits is a much less compelling strategy and therefore with the reduction of capital seeking that industry and with the difficulty of earning a margin without significant risk on those deposits, I think you're going to see a lot less deposit flow there," Sandler said.

In addition, banks historically use M&A to bring new deposits, but the deal flow slowed down in 2022 with longer closure timelines.

"I think there's still some time before M&A becomes more active," Perito said. "That really leaves these banks with one less tool in the kit."