Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Jul, 2022

By Tyler Hammel and Hassan Javed

Supply chain issues and high energy prices have led to increases in both crop prices and related insurance cover.

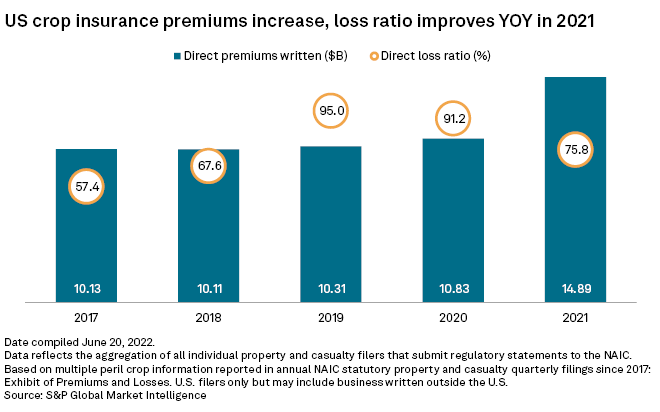

The U.S. crop insurance market saw a 37.5% year-over-year increase in direct premiums written in 2021, as the market grew by about $4 billion amid a continued increase in agricultural commodity prices, according to an analysis by S&P Global Market Intelligence.

Direct premiums written rose to $14.89 billion in 2021 from $10.83 billion in 2020, while the direct loss ratio improved by 15.4 percentage points to 75.8% from 91.2% during the same period.

Most agricultural commodities rose in value, which in turn increased premiums, according to Laurie Langstraat, vice president of public relations for the National Crop Insurance Services, a nonprofit trade association that provides services to various U.S. crop insurers.

"From 2020-2021, most major agricultural commodities experienced double-digit price increases, which drives premiums," Langstraat said. "For these revenue-based policies, the volatility associated with the risk of price change is also a factor in the determination of premiums. Price volatility between 2020-2021 increased significantly."

The price of many major agricultural products rose year over year in June 2022. The war in Ukraine exacerbated the worldwide food situation, as the nation accounts for a significant portion of global wheat production. The S&P GSCI Kansas Wheat index rose 49.1% during the period, while the S&P GSCI Grains index rose 14.3%.

Unlike many forms of insurance in the U.S., crop and agriculture insurance rates are set each winter by the U.S. Department of Agriculture's Risk Management Agency.

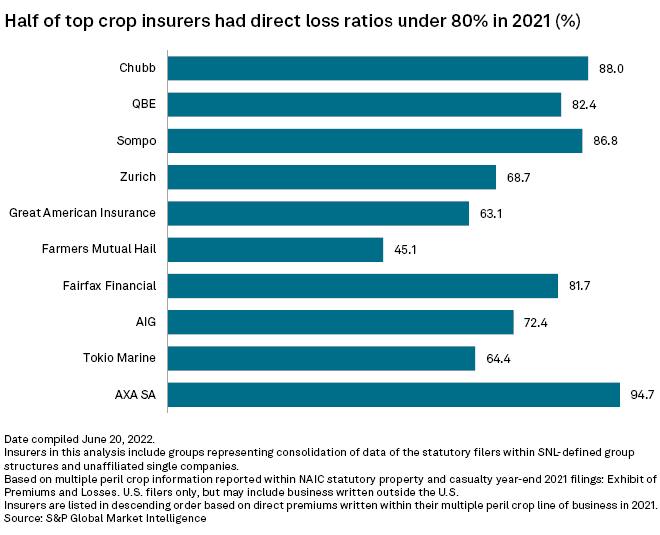

The direct loss ratios for most crop insurers improved during the period, with half of the top 10 U.S. crop insurers reporting direct loss ratios of less than 80% in 2021. Among the top 10, AXA SA logged the highest direct loss ratio at 94.7%, followed by Chubb Ltd. at 88.0% and Sompo International at 86.8%. Farmers Mutual Hail logged the smallest direct loss ratio, totaling 45.1%.

With a 36.6% year-over-year growth in direct premiums written, Chubb maintained its position as the largest U.S. crop insurer. It reported a total of $2.64 billion in direct premiums written in 2021, holding 18% of the market.

* Click here for a model that allows users to view future contracts, historical futures and spot pricing trend, and consensus pricing estimates for Metals, Energy, Agriculture and Industrials commodities.

* Read more about the impact of the war in Ukraine on insurers.

Trailing narrowly behind, QBE Insurance Group Ltd. wrote nearly $2.52 billion in direct premiums in 2021, representing year-over-year growth of 53.9%, the largest percentage premium growth among the top 10 crop insurers. In direct premium growth, QBE was followed by American International Group Inc., which recorded a 50.0% change and $779.7 million in total direct premiums.

QBE also logged the largest increase in market share among the top 10 crop insurers.