U.S. companies are so far unfazed by inflation and rising borrowing costs as they enter 2022 well positioned to repay their debts.

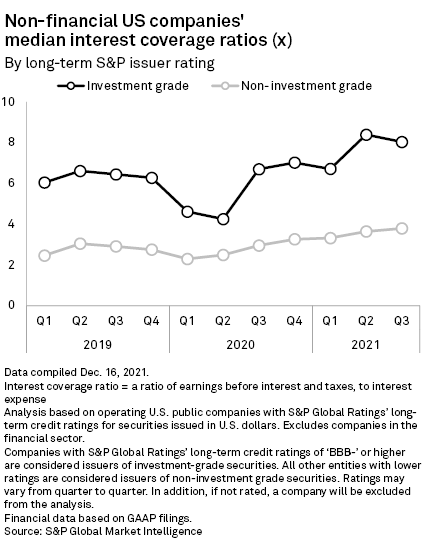

The median interest coverage ratio — a measure of a company's ability to repay its debts calculated by dividing earnings before interest and taxes by the cost of its debt-interest payments — for companies (excluding financials) rated investment-grade by S&P Global Ratings was 8.0 in the third quarter of 2021.

While this was down from 8.4 in the second quarter of 2021, the ratio remains higher than the pre-pandemic level of 6.0, according to data published by S&P Global Market Intelligence.

|

The small quarter-over-quarter reduction is the first since the second quarter of 2020, when companies were left reeling by COVID-19. There were declines in the median ratios in the consumer discretionary, materials and healthcare sectors, though all remain higher than their pre-pandemic levels. Sectors that traditionally operate with lower interest coverage ratios, such as utilities, energy and communication services, all registered increases in the third quarter of 2021.

Business has benefitted from cheap borrowing and a resurgence in earnings during the sharp recovery of the U.S. economy. But that could change as inflation eats into profit margins while the cost of debt increases as the Federal Reserve tightens monetary policy and corporate bond yields rise.

"It's so important to monitor borrowing costs," Gregg Lemos-Stein, global head of analytics and research at S&P Global Ratings, said in an interview. "Extraordinarily cheap borrowing costs are what have on the one hand prevented defaults but also [enabled] the increase in debt that we have seen."

Wave of defaults avoided

The Fed created favorable credit conditions for companies as COVID-19 hit, cutting interest rates to zero and buying trillions of dollars of bonds, allowing companies to borrow extensively and refinance debt at ever lower rates.

Improved credit conditions in the last 18 months emboldened companies to return capital to shareholders with record expenditure on share buybacks as well as M&A.

Lower-rated companies shared in the improvement in corporate health. The median ratio for non-investment-grade-rated companies rose to 3.8 in the third quarter of 2021 from 3.6 in the second quarter, the sixth-consecutive quarterly rise.

As a result, the wave of defaults that could have come with the dramatic recession never materialized. In fact, the U.S. trailing-12-month speculative-grade corporate default rate dipped to 2.4% in September 2021, from 6.7% at the beginning of the year, according to S&P Global Ratings.

|

Rising borrowing costs

But the landscape is changing. Bond yields are rising following the Fed's decision to taper its purchases of bonds. The expected increase in interest rates in 2022 should also increase borrowing costs.

Corporate bond yields have followed a similar pattern with the yield on the S&P U.S. high-yield corporate bond index rising to 4.57% as of Jan. 7 from 4.22% on Jan. 1.

Yet this level is still lower than the November 2020 peak of 4.7%, suggesting investors are not yet panicking about the Fed withdrawing its supportive role for businesses.

"High yield bonds continue to provide an attractive relative yield, with generally improving corporate fundamentals and a lowering default rate," Anthony Karaminas, head of fixed income and multi-asset at SEI, said in an email.

The question is whether corporate bond yields will remain low as strong inflation may force the Fed to raise rates more quickly than expected and investors demand higher returns to hold corporate debt.

"It will always be hard to foresee in advance because we're not talking about central bank rates, we're talking about corporate borrowing and that's not just set by the banks, there's market confidence," Lemos-Stein said. "That can move more suddenly and much more substantially."

The other question is whether earnings will hold up. Rising costs are not too much of a concern for companies that are able to grow their profits, but inflation and rising wages will pressurize margins.

"There is plenty of evidence that the inflationary pressures building in the global economy are now deep-seated and present in virtually every area of the global economy," said Chris Hiorns, fund manager at EdenTree Investment Management.

The U.S. Bureau of Labor Statistics reported in December 2021 that the consumer price index, the market's preferred inflation metric, rose 6.8% from November 2020 to November 2021, the steepest jump in nearly 40 years.

Companies have so far been able to pass on costs to customers, Lemos-Stein said. "Can that continue? Absolutely not."