|

A miner prepares to be transported to the longwall face at Consol Energy Inc.'s Enlow Fork coal mine in November 2018. |

The U.S. coal sector is seeing little hope of improvement in the next few years, after a long list of bankruptcies, power plant closures, layoffs and other troubles marred the industry's timeline over the last decade.

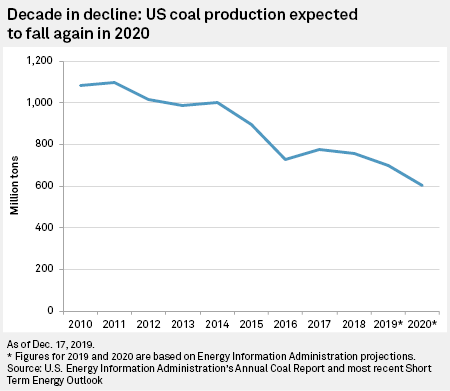

Federal records show U.S. coal producers mined 1.09 billion tons of coal in 2010, a figure the U.S. Energy Information Administration expects to drop by more than one-third to 697 million tons in 2019. Given that the energy sector typically makes decisions on decadeslong timelines, the drop in coal production was dramatic as utilities migrated en masse to natural gas generation and, increasingly, renewable energy sources.

Seaport Global Securities LLC analyst Mark Levin wrote Dec. 3 that through the end of September, U.S. utility coal demand was annualizing to just 559 million tons, compared to 637 million tons of demand in 2018. If that plays out, U.S. utility coal demand would fall 12%, the highest annual decline since 2015 when it declined 13%.

|

"I think a decade ago, a lot of people would have had a hard time seeing [the shift away from coal] happening so quickly, even though the forces causing that were well underway a decade ago," said Robert Godby, an economist at the University of Wyoming.

Lazard Ltd. recently estimated that the mean levelized cost of energy for crystalline solar and wind generation in the U.S. in 2019 was about $40/MWh and $41/MWh, respectively. That compares to about $56/MWh for gas and $109/MWh for coal.

"During the Obama administration, older and smaller plants made up the bulk of the coal retirements," said Hannah Kolus, a research analyst with Rhodium Group LLC's energy and climate team. "But today larger and younger plants are more and more vulnerable. These coal plants are facing increasing economic pressure from cheap, natural gas and the decreasing cost of renewables like solar and wind."

The beginning of the decade saw much of the U.S. economy still recovering from the 2008 recession. Initially, the economy's turnaround drove a 4.5% increase in coal production in 2010.

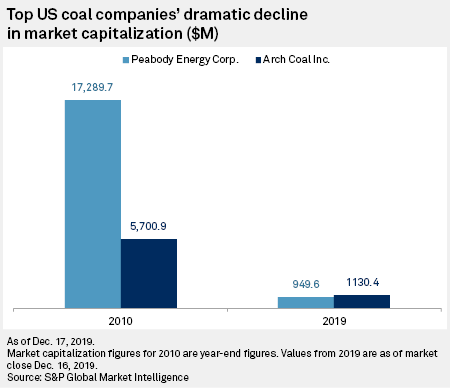

Peabody Energy Corp., the largest coal miner based in the U.S., was hopeful in 2010 about long-term prospects for coal primarily due to an expected boom in Chinese demand. The company repeatedly touted a coming "supercycle" for coal demand. However, it was just a few years away from a bankruptcy reorganization driven by reduced coal demand, weakened export opportunities and significant debt accumulated to expand into global metallurgical coal markets.

"I believe we are in the early stages of a long-term supercycle for coal. And Peabody, with its unmatched asset base, market positions and growth projects, is uniquely positioned to capitalize on this sustained trend," Gregory Boyce, then chairman and CEO of Peabody, said in June 2010.

Peabody boasted a market capitalization of $17.29 billion in 2010, falling to $949.6 million as of Dec. 16.

|

Coal generation supplied about 45% of the nation's power in 2010. The U.S. Energy Information Administration's latest short-term energy outlook estimated coal's share of U.S. electricity generation nearly halving since the beginning of the decade, ending 2019 at an average of 25% and falling to 22% in 2020.

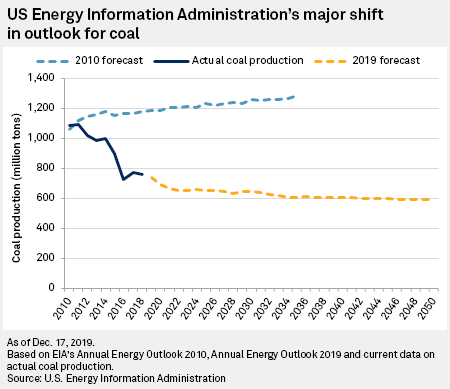

Coal companies, however, were not alone in their belief that the fuel would continue to dominate the domestic energy landscape. In 2012, for example, the EIA projected that coal's share of the U.S. generation mix would drop to 39%, but not until 2035.

Failing to predict a coming boom in cheap natural gas in the U.S., the EIA projected in 2006 that rising natural gas prices would tilt utilities toward coal-fired power and drive the construction of 155 GW of new coal-fired capacity from 2015 to 2030. Meeting that prediction called for an extensive build-out of coal generation, considering the generation capabilities of the largest coal plants in the U.S. today total between 3.0 GW and just over 3.5 GW.

Instead of a coal construction boom in the country, the U.S. Environmental Protection Agency began enforcing new rules restricting power plant emissions of mercury, a regulatory move that contributed to 2015 setting a high watermark for annual coal power plant retirements that was rivaled, but not quite beat, in 2018. With the help of a flood of cheap natural gas unlocked from shale formations across the U.S., utilities began to move away from coal. Except for a small coal plant for a university in Alaska, no new coal plants have been built in the U.S. since 2015.

Dropping demand devastated coal companies as the industry struggled to optimize production to reduced customer needs while still servicing large debt loads assumed to expand production. Over 50 coal companies filed for bankruptcy in the past decade, including some of the largest producers. Much of the coal mined in the U.S. now comes from mines owned or previously owned by a company that filed for bankruptcy reorganization.

Along the way, the sector significantly trimmed its workforce. Bankruptcy courts allowed companies to dispose of numerous debts and liabilities, including billions in worker pension and retirement obligations. Facing pressure from investors increasingly focused on environmental issues as well as the risk of stranded assets, a slew of insurance companies, banks and other institutions are rolling out policies to exclude or reduce coal holdings.

|

Murray Energy Corp. founder and CEO Robert Murray decried the notion of a "bankruptcy sewer" in which coal companies went into bankruptcy and discharged debt. He said this practice drove other companies toward the brink as they struggled to compete. Murray Energy itself recently became one of the larger coal mining companies to file for a Chapter 11 bankruptcy reorganization.

Murray was an early and vocal supporter of President Donald Trump's campaign. While Murray cautioned that Trump would likely not revive the industry, he insisted the president could avoid further destruction. Despite the administration's promise to put coal miners back to work and numerous related policy attempts, market forces, activist action and the looming prospect of potential policies aimed at reducing carbon dioxide emissions to stave off climate change continued to drive coal plant retirements.

Planned coal power plant retirements doubled from 2017 to 2018. This reduction occurred despite the administration touting the "end of war on coal," a nod to a phrase the coal industry coined to describe regulatory actions taken by the Obama administration.

While market forces have been a primary driver of coal's decline, the sector also lost several battles to environmental activists fighting the industry. The Sierra Club's Beyond Coal campaign, backed by a war chest featuring prominent donations from the likes of presidential prospect Michael Bloomberg, further pressured coal. The organization used a combination of tactics against the industry, including a public relations battle, an avalanche of lawsuits and continuous advocacy against coal across various levels of government.

"We have seen our reliance on coal plummet over the past decade. There were wild, dire predictions that would cause the lights to go off and our electricity prices to go up. The reality is that the lights have stayed on, and electricity prices have stayed low," said Mary Anne Hitt, director of the Beyond Coal Campaign.

Hitt said efforts by groups such as the Sierra Club to hold coal accountable for air and water pollution played a pivotal role in driving the shift away from the fuel.

"There's still a lot more coal out there. I think it will continue to require advocacy to retire those plants," Hitt said.

While a rise in demand from international markets propped up coal demand in the early months of the Trump administration despite falling domestic demand, those opportunities contracted significantly in 2019. Dim prospects in those markets led many to return to a dire outlook on the future of U.S. coal companies.

Moody's Investors Service recently projected that coal's share of U.S. electricity generation could fall to as little as 11% by 2030, based on scheduled and likely coal retirements alone.

"The destruction of that demand will be too significant for the coal industry to replace just through greater participation in other markets, such as industrial or home-heating uses, or by increased exports, whose profitability over the cycle depends on relatively high prices because of the high costs of delivering some U.S.-produced coal to distant growth markets," Benjamin Nelson, a senior credit officer and lead coal analyst with Moody's, said in July.

While much of the "low hanging fruit" when it comes to coal plant retirements occurred in the latter part of the decade, larger and more efficient plants are already in the crosshairs for potential retirement even without a firm U.S. climate policy in place, Godby said.

"I think people feel that there's more pressure than ever to do something about climate and to implement some sort of climate strategy," Godby said. "I think those pressures are even stronger than they were a decade ago. So looking forward, I think much of what happens really depends on if that occurs, when, and in what way."