Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Aug, 2021

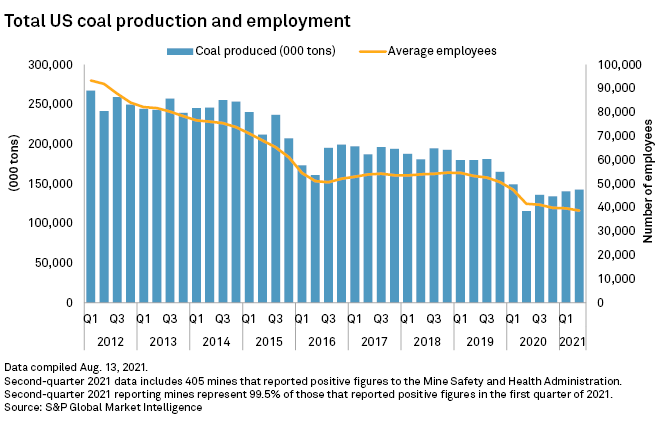

U.S. coal production bounced back in the first half of 2021 from early pandemic lows set in the first half of 2020, but average quarterly employment in the sector has not similarly recovered.

Total U.S. coal output dipped substantially in early 2020 as reduced demand drove down energy consumption during widespread quarantining efforts. Production has steadily increased since the second quarter of 2020, though it has yet to climb back to the level reported in the first quarter of 2020. Meanwhile, average quarterly employment in the coal sector has steadily declined after a sharp drop in the second quarter of 2020.

While coal production has bounced back in 2021, it will likely fall modestly in 2022 against a backdrop of waning domestic demand, according to Benjamin Nelson, global lead analyst for coal at Moody's Investors Service. In the meantime, employment is unlikely to increase as more efficient mines continue to operate and others close down, Nelson said. While that could lower costs, it may also create policy risk for the sector in the long term.

"As we think over a longer horizon, this is an industry with diminishing economic significance and diminishing employment," Nelson said. "We think that creates longer-term policy risks, less support for the industry, or concern about what the industry does to take care of legacy sites and so forth."

The U.S. coal industry is looking to advances in technology that could reduce emissions intensity to enable a path forward for the country's thermal coal sector, according to Conor Bernstein, senior communications director with the National Mining Association. The group has also highlighted concerns about grid reliability as more coal plants are retired.

"Integrating more and more variable power — and doing it at the speed some are proposing — is immensely challenging," Bernstein said. "We think the existing coal fleet — the balance, optionality and fuel security it provides — is a critical backstop to grid reliability as we navigate the energy transition."

Hallador Energy Co. has seen "huge price increases" with its coal sales, President and CEO Brent Bilsland said on an Aug. 10 earnings call. The Illinois Basin coal miner wants to hire more people but is wary of materially affecting labor costs and implementing a permanent change in cost infrastructure, the executive added.

"We are hiring people, which is challenging," Bilsland said, noting that more people are starting to interview for jobs as federal deadlines for unemployment approach.

Alliance Resource Partners LP Chairman, President and CEO Joseph Craft also recently flagged challenges coal producers are facing in hiring and suggested it would help if utilities could start locking in longer-term contracts for coal purchases.

"From a labor perspective, our key issue is just trying to ensure to our employees and any prospective employees that they've got a future in the coal industry for the next 20 years," Craft said during a July 26 earnings call.

U.S. producers reported 283.1 million tons of coal production in the first half of 2021, according to U.S. Mine Safety and Health Administration data analyzed by Market Intelligence. The U.S. Energy Information Administration recently estimated in its latest "Short-Term Energy Outlook" released in August that production would reach 607 million tons for the full year.

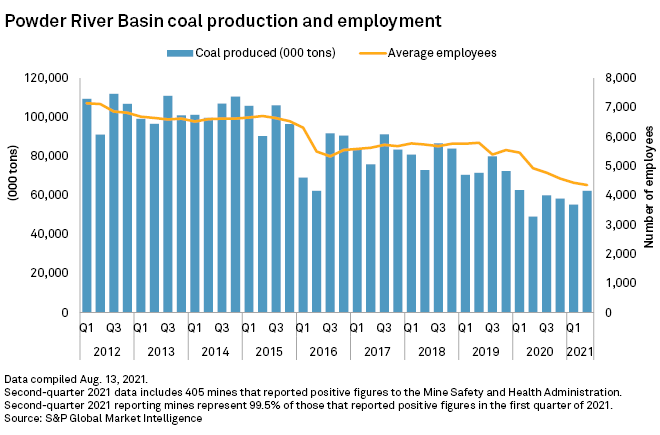

Producers in the Powder River Basin, the largest coal mining region in the U.S., mined 62.3 million tons of coal in the second quarter. Regional output increased 26.6% compared to the second quarter of 2020 but was roughly in line with the total for the first quarter of 2020.

Average employment numbers in the Powder River Basin remained low, decreasing 20.2% in the second quarter compared to the first quarter of 2020. The discrepancy is possible partly because coal producers in the Powder River Basin have access to larger seams of thermal coal that are generally mined with far fewer employee hours per ton compared to Eastern U.S. operations.

Peabody Energy Corp., the largest producer of coal in the Powder River Basin, expects the strong sales seen in the second quarter to continue through the second half of the year, according to President and CEO James Grech.

Arch Resources Inc., another large producer in the basin, shared plans to wind down operations in the region in favor of focusing on Eastern U.S. metallurgical coal operations.

While coal-fired power plant retirements continue to whittle away at the potential customer base for U.S. coal, some producers reported that utilities have been more ready to buy in recent quarters due to an increase in demand.

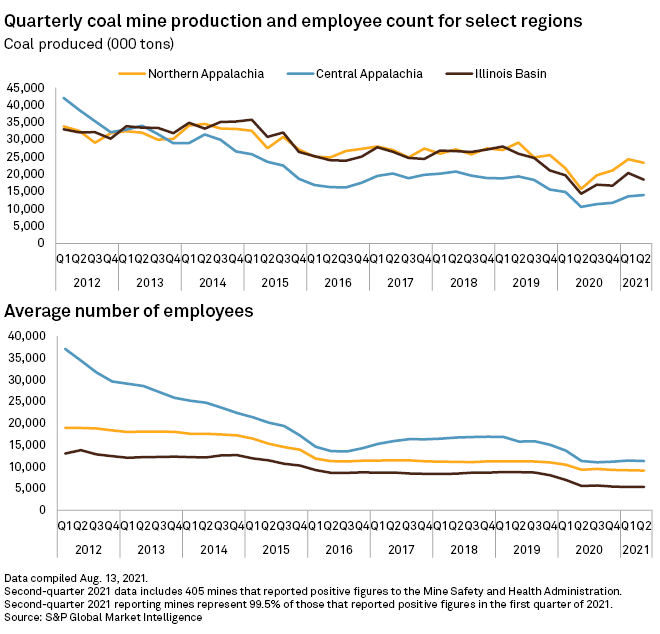

American producers have been finding more customers abroad, particularly in the Eastern U.S. as the global market adjusts to an ongoing trade dispute between Australia and China.

U.S. coal exports totaled 20.6 million tonnes in the second quarter, up 52.5% from 13.5 million tonnes in the year-ago period, according to a recent Market Intelligence analysis of industry data.

Progress on a federal infrastructure bill could be a further boon to U.S. coal producers that mine metallurgical coal used in the steelmaking industry. Much of the coal that meets those specifications comes from Central Appalachia. Production in the Central Appalachian region has fallen in the past several years but has been steadily climbing in more recent quarters. A boom in infrastructure spending would likely create substantial demand for new steel.

"American met [coal] mines are ready to help meet that demand, and we're working to ensure there's recognition that those mines and the thousands of miners they employ are a key piece of reshoring the nation's industrial base and providing the American-made materials needed to rebuild and reinvest," Bernstein said.