Significant uncertainty remained in the U.S. LNG industry over how an initial trade agreement between the U.S. and China might restore the LNG trade relationship between the two superpowers, even though it seemed to be a positive development.

On the one hand, the "phase one" trade agreement signed Jan. 15 could result in some U.S. LNG cargoes flowing toward the world's fastest-growing market and allow coveted Chinese buyers to reengage with U.S. LNG projects again while avoiding a further escalation of tariffs.

But experts also described the near-term effects of the pact as limited for U.S. LNG and unlikely to spur a rush of commercial agreements supporting the buildout of additional American LNG export infrastructure.

Key obstacles remained in the way of a huge ramp in U.S. LNG purchases by China, despite China's commitment under the deal to aggressive targets for energy purchases over the next two years, market observers said. China's 25% retaliatory tariff on U.S. LNG has stayed in place. There are market constraints. And there is a limited amount of U.S. LNG available to help China meet its goals for energy imports from the U.S.

"At the end of the day, it is not like this is a big breakthrough for U.S. LNG exports or exporters or project developers," said Nikos Tsafos, a senior fellow with the energy and national security program at the Center for Strategic and International Studies.

A real breakthrough would depend on "a comprehensive deal, removal of tariffs, and some indication that the Chinese would be willing to make a long-term bet on the United States," Tsafos said. "After you started the trade war, you then need to convince the Chinese that you are a reliable long-term supplier on whom they have to base their energy security."

No U.S. LNG has been delivered to China since March 2019, and long-term contracting between Chinese buyers and U.S. LNG developers has stalled. But there was some optimism in the U.S. industry.

"It's better today than it was," said Charlie Riedl, executive director of the trade group Center for Liquefied Natural Gas, summarizing the views of the group's members after the deal. "But to quantify that from a metric standpoint is probably too difficult to do."

Two LNG company CEOs who attended a Jan. 15 signing ceremony at the White House for the deal, Jack Fusco of Cheniere Energy Inc. and Meg Gentle of the export-hopeful Tellurian Inc., praised the agreement as a move in the right direction.

The day before the deal was signed, Cheniere's and Tellurian's stock closed at $63.97 and $7.13, respectively. By the end of the day on Jan. 17, their stocks were up by more than 3% and nearly 22%, respectively.

China is expected to become the biggest importer of the commodity within a decade, making the country a critical market despite the fact that U.S. LNG cargoes went elsewhere for much of 2019. U.S. LNG developers have long sought Chinese buyers for long-term deals that the developers can use to secure financing for their projects.

"The real bogey for the U.S. on the LNG side is if the trade deal somehow led to new contracts with LNG developers," said veteran energy analyst Katie Bays, co-founder of research and consulting firm Sandhill Strategy, who was skeptical that the deal would provide such a catalyst. "In terms of getting China to 'yes' on a future contract with a U.S. company, there is no way that those volumes could be used to satisfy 2020 and 2021 goals anyway, because the projects take years to build."

"It just isn't a good fit to presume that the phase one deal is a big win for LNG," Bays said.

Significant questions also remained about what will happen following the two years covered by the deal. But there was also skepticism about whether China would meet its massive commitment to buy energy products in the interim and how much U.S. LNG it could import to achieve that goal.

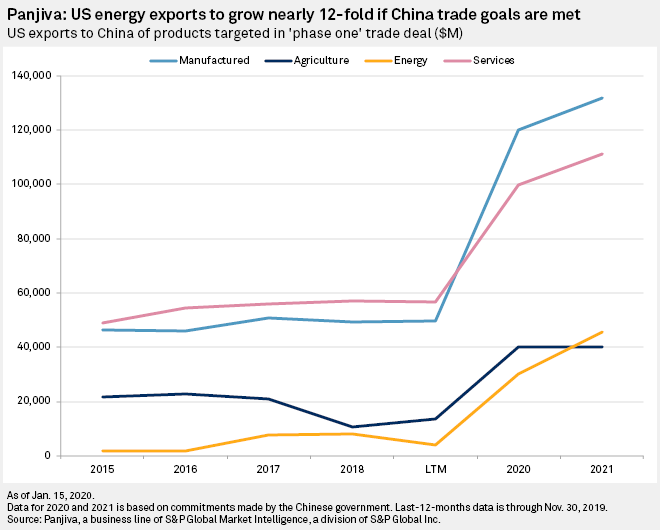

China pledged to step up its purchases of U.S. crude oil, LNG, refined products and coal by $52.4 billion across the next two years compared to what China bought in 2017. China committed to increase its purchases by $18.5 billion in 2020 over 2017 levels. For 2021, this would rise to $33.9 billion more than the 2017 levels.

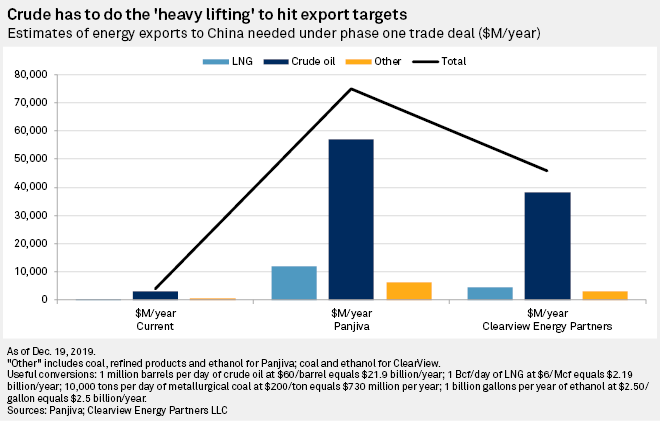

Details on specific product purchases under the deal were not released. But analysts expected U.S. crude would have to make up the bulk of the exports.

"U.S. LNG is just nowhere near being able to take a big share of that," Jason Feer, head of business intelligence at oil and gas ship broker Poten & Partners, said in an interview. "There is just not the volume."

To cover 25% of the 2020 increase in energy purchases over status quo levels, which works out to about $5.56 billion, China would have to buy about 2.5 Bcf/d worth of U.S. LNG at a $6/Mcf price, analysts with energy consulting firm ClearView Energy Partners LLC said, a level that the analysts described as "staggering."

U.S. LNG export capacity exceeds roughly 7 Bcf/d. The capacity is expected to rise to around 9 Bcf/d by the end of 2020 once new liquefaction units that are under construction at existing sites come online. But most of that LNG is sold under long-term contract commitments.

Cheniere is the only major U.S. LNG exporter that has a direct long-term supply agreement with a Chinese buyer, Petrochina Company Ltd., which has elected to divert LNG cargoes. But that deal, combined with volumes from portfolio suppliers that have contracted supply into China and U.S. off-take, means China can access around 3 million tonnes per annum of U.S. LNG on existing contracts, Feer said.

Moreover, most of China's LNG imports are also under long-term contracts, meaning a big increase in imports of U.S. LNG could conflict with contracts with other suppliers. The Chinese government will have options if it wants to demonstrate its commitment to the trade agreement by importing U.S. LNG. It could buy a lot of spot cargoes, sign short-term deals, source volume from traders or swap cargoes with another buyer, Feer said. "But even a doubling of their current contract volumes from the U.S. only gets you to a couple of billion dollars — maybe."