U.S. banks ramped up nonresidential construction lending in the second quarter, even as delinquencies remained elevated amid the COVID-19 pandemic.

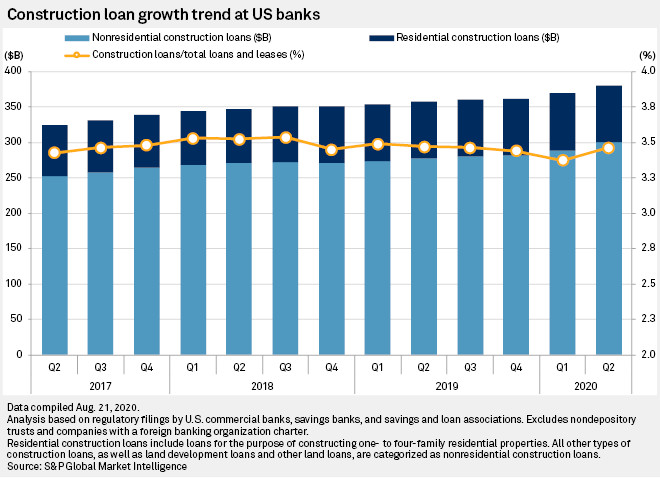

U.S. banks had $380.61 billion in total construction loans on their books in the second quarter, according to regulatory filings, up 2.9% from the first quarter. Banks' construction loans as a percentage of total loans and leases rebounded to 3.46%, after a dip to 3.37% in the first quarter.

Nonresidential construction lending drove the second-quarter gain, rising 4.2% sequentially to $300.35 billion. Residential construction loans, defined as loans originated to build one- to four-family residential properties, fell 1.4% to $80.25 billion.

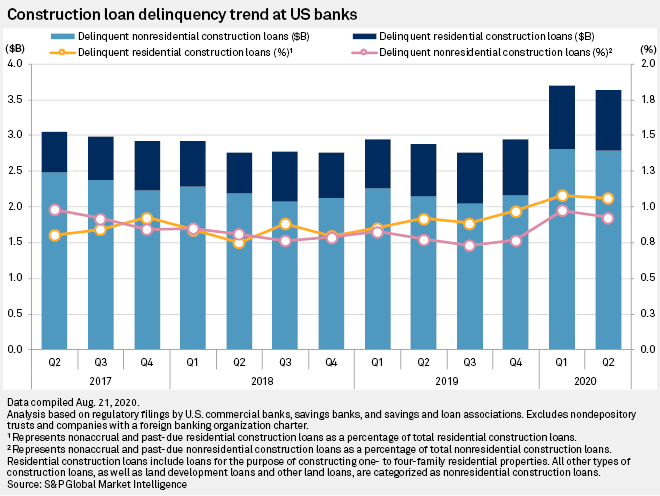

The rebound in loan volume came as delinquencies, for both residential and nonresidential loans, remained well above recent-years levels for the second straight quarter. There were roughly $2.78 billion of nonresidential construction loan delinquencies and roughly $850 million of residential construction loan delinquencies for the quarter, for 1.06% and 0.93% of total loans in each category, respectively.

On both an aggregate and a percentage basis, delinquencies were down slightly from the first quarter, but higher than in any other quarter in 2018 or 2019.

The leading construction lenders in the quarter by volume were Wells Fargo & Co. and U.S. Bancorp, both of which increased their holdings of nonresidential construction loans from the prior quarter. Wells Fargo also reported an increase in residential construction loans for the period, while U.S. Bancorp reported a decrease.

Bank OZK had the greatest exposure to construction loans as a percentage of total loans for the quarter, followed by PacWest Bancorp. PacWest posted a 68.3% increase in the size of its residential construction book in the quarter, to roughly $410 million, while Bank OZK increased the size of its nonresidential construction book by 18.5% to $5.03 billion.

In a July 24 earnings conference call, Bank OZK Chairman and CEO George Gleason II said the bank's ability to grow its real estate specialties group, which originates new construction loans, "has only been enhanced" by the events of the past six months as some competitors have pulled back.

"You've had a long run of real estate construction in markets all across the country," he said. "So there's clearly a need for less of most product types than there was three years ago or five years ago. So the pie has gotten smaller, and COVID-19 certainly has shrunk that pie further."

At the same time, Gleason added, the bank's market share relative to its competitors has increased.

"Our sponsors have always appreciated our sophistication and expertise and ability to execute," he said. "I think that appreciation is higher now. They've always appreciated our enduring up-cycle and down-cycle commitment to the space and the fact that we're always there in the space and active in the space."