U.S. banks have billions of dollars in cross-border exposure to the countries suffering the most from the coronavirus outbreak. However, those assets are a tiny fraction of the banks' overall balance sheets.

So far, the countries with the most confirmed reports of the virus are China, South Korea and Italy. According to a Feb. 27 report from the World Health Organization, China has had more than 78,000 cases, followed by some 1,700 cases in South Korea and 400 cases in Italy. No other country has reported more than 200 cases.

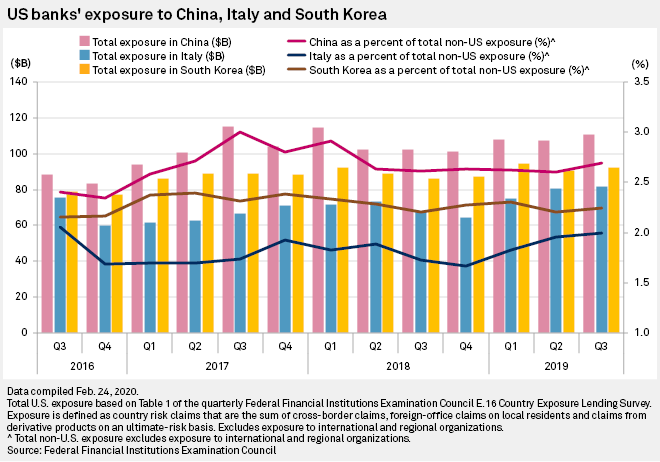

Only banks with cross-border exposures that exceed 1% of total assets or 20% of total capital have to specify exposures to any particular country. Across the entire industry, U.S. banks have more than $110 billion of cross-border exposure to China as of Sept. 30, 2019. However, with the banking industry reporting nearly $23 trillion of total assets as of 2019 year-end, that cross-border exposure to China amounts to less than 0.5% of total assets.

|

Citigroup Inc. tends to have the most significant global footprint among U.S. banks, and it is no different for the three countries hardest hit by the coronavirus. The bank had $29.49 billion of cross-border exposure to China, $42.19 billion to South Korea and $24.16 billion to Italy, as of Sept. 30, 2019. Combined, those cross-border exposures amounted to less than 5% of the bank's total assets.

At Credit Suisse's financial services conference on Feb. 28, a Citigroup executive did not mention the coronavirus outbreak but did speak about the bank's global footprint and the opportunities it provides. Credit Suisse analyst Susan Roth Katzke noted that the company has banking licenses in 98 countries, something that provides a competitive advantage over new entrants into the increasingly competitive treasury business space. Naveed Sultan, global head of treasury and trade solutions, said the bank's well-established, extensive global network provides a competitive advantage.

"We have a unique opportunity because of these assets we have built to make that transition into becoming the financial platform to global commerce," Sultan said, according to a transcript.

Among banks that need to disclose the information, Goldman Sachs Group Inc. had the second-largest exposure to China with $14.20 billion, as of Sept. 30, 2019.