US banks' net gains from loan sales fell for the first time since in a year as elevated interest rates continued to depress market pricing.

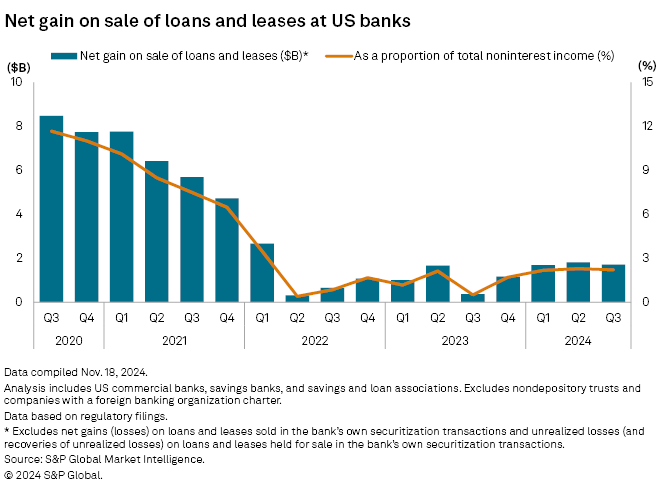

In the third quarter, US banks reported $1.70 billion in net gains on sales of loans and leases, according to S&P Global Market Intelligence data. That was down from $1.80 billion in the prior quarter, but still well above $365.4 million in the prior-year period. Net gains from selling loans accounted for 2.2% of banks' total noninterest income in the third quarter, versus 2.3% a quarter ago and 0.5% a year earlier.

Market pricing on loans for sale remains more challenging in some lending segments than others, such as commercial real estate (CRE), said Raymond James Head of Whole Loan Trading John Toohig. On top of rates being higher than they were when many CRE loans were originated, a slowdown in originations has made it difficult to ascertain their loan-to-value ratios.

"That credit mark is a little bit more difficult to ascertain these days," Toohig said in an interview. "It's probably a little bit wider, specifically in commercial real estate, than it historically has been."

Biggest losses

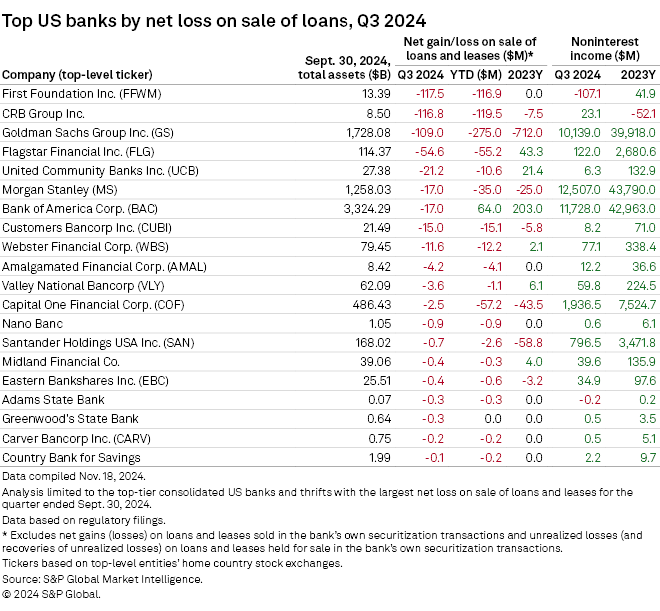

Some of the biggest losses on loan sales in the banking industry were related to CRE loans.

"We've seen a couple of very large discounted trades in the multifamily sector," D.A. Davidson Senior Vice President of Whole Loan Sales Bryan Perlmutter said in an interview. "Commercial real estate office and nonowner-occupied projects have been fairly difficult."

First Foundation Inc., for example, posted a net loss of $117.5 million from selling loans in the third quarter, the largest loss among US banks. The net loss resulted from the company moving $1.9 billion of multifamily loans to available-for-sale status from held for investment, CEO Scott Kavanaugh said during the company's third-quarter earnings presentation. The move is part of an effort to reduce the company's exposure to low-yielding fixed-rate loans its exposure to CRE, executives said on the call.

The $54.6 million net loss on loan sales at Flagstar Financial Inc., the fourth-largest among banks in the analysis, was also CRE-related, as the company closed the sale of its mortgage warehouse portfolio in July. Valley National Bancorp's $3.6 million loss came as the company moved $800 million of its CRE loans to held for sale during the third quarter.

Biggest gains

On the other hand, market rates in consumer lending, especially residential mortgage, have held up "exceedingly well," Toohig said.

"Spreads have even recently kind of tightened on mortgages," Toohig said. "Of all loan assets, I think residential mortgage has been the winner."

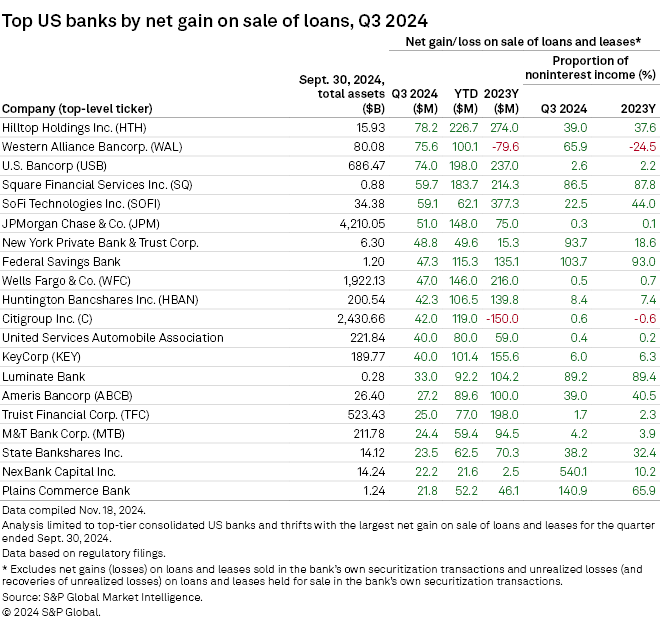

Hilltop Holdings Inc. and Western Alliance Bancorp. booked the two largest net gains on loan sales among US banks, at $78.2 million and $75.6 million, respectively, even as the gain on sale margins for both companies' mortgage lending businesses declined during the quarter. The gain-on-sale margin for Hilltop's mortgage lending subsidiary PrimeLending fell 4 basis points to 224 basis points, according to a company slide deck. Western Alliance reported a 6-basis-point decline in the gain-on-sale margin of its mortgage business during the third quarter, according to a company slide deck.

Determining the level of demand necessary to expand Western Alliance's gain on sale margin in its mortgage business has been "a struggle," President and CEO Kenneth Vecchione said during the company's third-quarter earnings presentation.

"If you know there are a couple of the rate cuts coming at you, would you go out today and buy a home?" Vecchione said. "People love their mortgage rate, they hate their home. ... We're trying to see if people want to find a new home and just rent their mortgage rate, and then refi as they go forward."

Ameris Bancorp, which reported the 15th-largest gain on loan sales for the quarter, also reported a reduced gain-on-sale margin in its mortgage business to 2.17% from 2.45%, CFO Nicole Stokes said during a third-quarter earnings presentation.

Bullish on 2025

Despite the industry's decline in net gains on loan sales in the third quarter, loan sales are expected to increase in the coming quarters. With concerns about the existential risk to banks after the failure of Silicon Valley Bank in 2023 now in the rearview mirror, Winnick said there will be more loan sales going forward.

"I think a lot of banks got out of transactional lending last year and I think a lot of them are regretting it," Winnick said. "There are many banks that are behind their loan origination goals that are more open to purchasing portfolios."

Additionally, the incoming Trump administration will likely be more favorable to M&A, and marking loans to market will likely become a "hotter topic" as a result, Toohig said. Now that there is a clearer idea of which direction the regulatory regime is headed, there is likely to be a "flurry" of deals, he added.

"We're definitely having more of those conversations," Toohig said. "The industry is kind of pent-up and ready to go."