Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Nov, 2022

By Sophia Furber and Xylex Mangulabnan

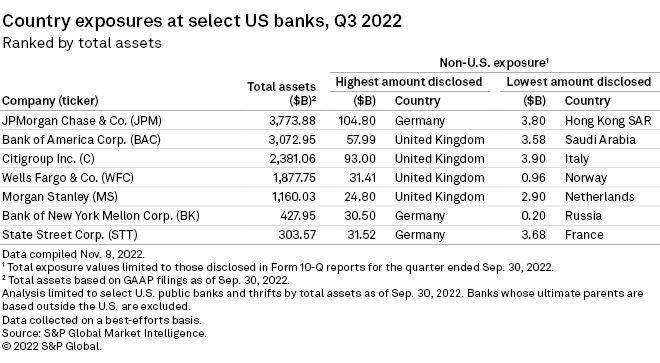

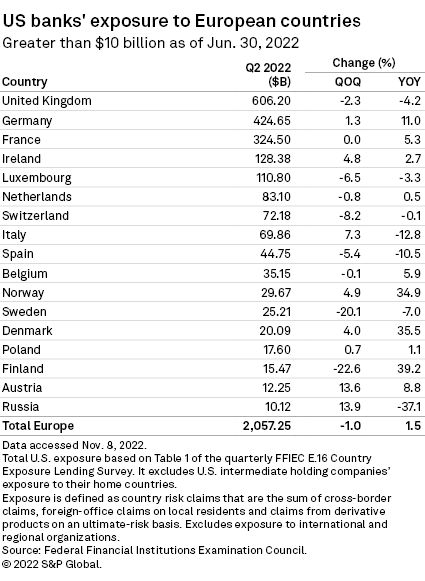

U.S. banks continue to increase their footprint in the French and German markets, with exposures rising by 5.3% and 11.0%, respectively, in the year to June 30, 2022, but they are pulling back from the U.K., Italy and Spain.

Lenders based in the U.S. had $324.50 billion worth of exposures to France and $424.65 billion to Germany during the period, data from the Federal Financial Institutions Examination Council shows.

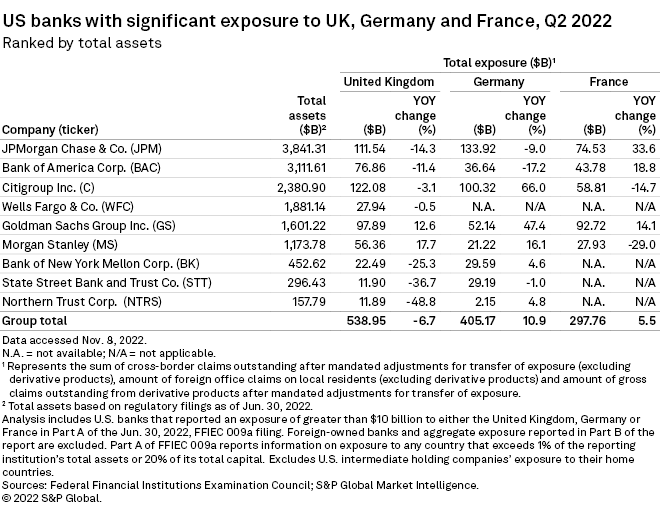

JPMorgan Chase & Co. recorded the largest growth in percentage terms in its exposures to the French market during the period, rising 33.6% to $74.53 billion. The bank, which has had a presence in Paris for more than 150 years, opened a new trading hub in Paris in June 2021 and said it planned to increase head count in the city to 800 by the end of 2022.

French President Emmanuel Macron, who inaugurated JPMorgan's new premises, has been eager to promote Paris as an alternative to London as a European base for global banks following Brexit. The U.K. formally left the EU in January 2020.

Bank of America Corp. also expanded its French business in the year to June-end, growing 18.8% to $43.78 billion, as did The Goldman Sachs Group Inc., growing 14.1% to $92.72 billion.

However, the pace at which U.S. banks are expanding into the French market has slowed compared with the previous year, when exposures increased 47% to $308.1 billion in the 12 months to June-end 2021.

U.S. banks have also bolstered their presence in Germany, with exposures growing 11% to $424.65 billion in the year to June-end. Citigroup recorded the biggest increase in its German exposures in percentage terms, rising 66% over the year to $100.32 billion, followed by Goldman Sachs, rising 47.4% to $52.14 billion.

A Citigroup Inc. senior executive said in August that the bank is expanding its German business, with a focus on midsized and digital firms in the fields of healthcare, mobility and industry, according to reports in the German media.

The U.K. remains the largest European market for U.S. banks, with exposures totaling $606.20 billion at June-end 2022. Yet this represents a contraction of 4.2% year on year, and its share of U.S. banks' total exposure to European markets is on the decline, at 29.47% as of June-end, compared with 31.22% at the same point in 2021 and 31.85% in 2020.

Citigroup Inc., which has the largest presence in the U.K. market among the U.S. banks, reduced its exposures to the country by 3.1% to $122.08 billion, while JPMorgan, which has the second-largest presence out of the U.S. banks in the U.K., reduced its exposures by 14.3% year on year to $111.54 billion.

The pullback from the U.K. was not universal among U.S. banks, with Goldman Sachs increasing its U.K. exposures by 12.6% to $97.89 billion and Morgan Stanley by 17.7% to $56.36 billion.

Despite the aggregate decrease in U.K. exposures, JPMorgan CEO and Chairman Jamie Dimon said in September that the bank is looking to grow its retail bank, Chase, which launched in the U.K. in January 2021. According to media reports, Chase has gained 1 million customers and a deposit base of $10.8 billion since its launch.

The U.K. is not the only market that U.S. banks appear to be retrenching from. Exposures in southern Europe also decreased, falling by 12.8% to $69.86 billion in Italy and 10.5% to $44.75 billion in Spain.