Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Jul, 2022

By Rica Dela Cruz and Gaby Villaluz

Amid persisting inflationary pressures and market uncertainties, U.S. bank stock returns slipped into negative territory in June after a short stay on the positive side. May's positive returns had broken a monthslong losing streak.

Bank stocks had a negative median month-to-date return of 5.1%, compared to positive 2.4% in May and negative 5.8% in April, according to an S&P Global Market Intelligence analysis.

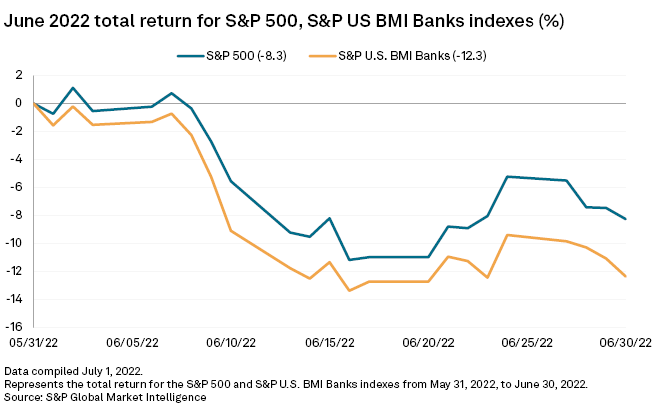

The S&P U.S. BMI Banks index ended June with a negative return of 12.3%, compared to S&P 500's total negative return of 8.3%.

Worst performers

Carver Bancorp Inc. dropped from being the top performer last month to becoming one of the worst-performing stocks in June, posting a negative return of 51.0%. Before the month ended, the New York-based company disclosed it was unable to file its annual report on Form 10-K for the period ended March 31 by the prescribed filing date.

Amid a substantial drop in cryptocurrency valuation, Silvergate Capital Corp., a company catering to the crypto businesses, was the second-worst performer. The La Jolla, Calif.-based bank's shares provided a negative return of 31.8%.

* View index prices at the Index Summary page in S&P Capital IQ Pro.

* Create custom stock market charts using the Chart Builder in S&P Capital IQ Pro.

SVB Financial Group was one of the largest banks on the worst-performer list with a negative return of 19.2%. Wedbush Securities analyst David Chiaverini on June 30 downgraded the Santa Clara, Calif.-based company to "neutral" from "outperform" as he expects its growth to slow in a recessionary environment.

Besides SVB, the banks with over $10 billion in assets on the list were Bank of America Corp. and New York-based Signature Bank, with negative returns of 15.8% and 17.1%, respectively. Bank of America is among the banks facing higher-than-expected increases in their stress capital buffers under the Federal Reserve's stress tests, possibly restricting stock repurchases.

Best performers

Some of May's worst-performing stocks had some of the highest returns in June, such as Elmira, N.Y.-based Chemung Financial Corp. and St. Petersburg, Fla.-based BayFirst Financial Corp. Chemung Financial posted the highest return at 8.7%, while BayFirst Financial had the fourth-highest return at 6.6%.

BancFirst Corp., which grew beyond $10 billion in total assets in the first quarter, ended June with a return of 5.9%. The Oklahoma City-based company was one of the two banks that posted positive returns in 2022 among the 20 most richly valued banks by price-to-estimated 2022 earnings in June and was the only company trading above analysts' one-year price target as of June 16, according to an S&P Global Market Intelligence analysis.

Manitowoc, Wis.-based Bank First Corp. saw a total return of 4.6% in June, the same month it received Fed approval for its proposed merger with Denmark, Wis.-based Denmark Bancshares Inc.